We hear from two US companies which are stakeholders in both the present and future of energy storage, in this fourth and final instalment of our interview series looking back at 2021 and ahead to this year and beyond.

Energy-Storage.news wrote about both Key Capture Energy and Form Energy several times throughout last year. Key Capture Energy (KCE), because the developer, owner and operator of energy storage assets completed or announced some interesting and significant projects last year in key territories of New York and Texas.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

CEO Jeff Bishop is an insightful and often candid speaker on the US market, describing his company as akin to an energy storage independent power producer (IPP), seeking out early opportunities in largely untapped regional markets.

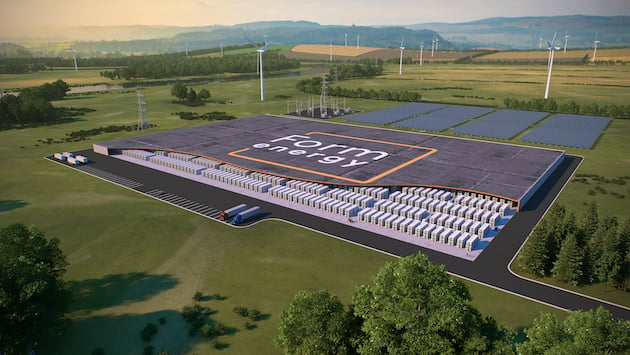

Form Energy meanwhile is a startup that exemplifies much of the promise and expectation around the emergence of long-duration energy storage. Long-duration was certainly one of the major talking points of 2021 and that interest is only expected to intensify as the need grows.

There are many different types of advanced long-duration energy storage technology at various stages of commercialisation. Form Energy’s was touted as one of the potential breakthrough technologies even before anyone outside the company knew what it was: a type of battery chemistry based on iron and air or, in other words, rust.

Promising that its battery can cost-effectively provide up to 150 hours of storage, Form Energy has raised investment dollars and interest alike. As with KCE’s Jeff Bishop, Form CEO and co-founder Mateo Jaramillo is an insightful speaker on the industry, with forthright views.

Key Capture Energy

Jeff Bishop, CEO and co-founder

What did the energy storage business in 2021 mean for your company and how did it compare with previous years?

The energy storage industry is growing up – and Key Capture Energy is a reflection of the industry’s trajectory.

When we started developing utility-scale energy storage projects in 2016 in New York, New England and Texas – my team and I were trying to figure out what exactly the market was. From learning by doing with 10-20 MW size projects in 2019/2020, we were able to scale up and start constructing 50-100 MW size projects in 2021.

2021 was a major year for Key Capture Energy, as we continued to grow out our team and our expertise, and we brought in SK E&S as our new owner.

How are the business models for energy storage evolving?

Energy storage has moved from being a single revenue product like frequency regulation to providing optimisation opportunities across all wholesale market revenues; whether day ahead or real-time, non-spin to energy arbitrage, 10-minute reserves to frequency regulation.

Optimising wholesale market revenue requires a full understanding of the regulatory, commercial and technical limitations and opportunities.

We’ve built up our team on market operations, and now have algorithms that update our bids in Texas’ ERCOT market every five minutes.

Each market is different when it comes to participation rules, and across the US the industry is still tasked with identifying opportunities in new markets and finding ways to innovate in the existing space.

What are some of the technology or industry trends you have observed: which of those are the most exciting and conversely are any of them fads that you think will be gone within the longer term?

The software side is really exciting and will continue to be the major trend to watch in the years to come.

From machine learning to artificial intelligence (AI), we have been part of the software growth for market optimisation; already we find our algorithms bidding into the wholesale market that are not overly intuitive, but when we start to dig into the rationale it is really the most optimal outcome for the electric grid and for our projects.

While there is still a lot of room for industry growth on market optimisation, there are other data analytics improvements that is primed for growth.

What will 2022 bring for your company and for the wider energy storage industry?

As 2022 evolves, there is an increased likelihood that congressional action will tilt the market favourably to incentivise the building of green technology and infrastructure such as energy storage. At the state level, we are continuing to see more energy storage targets and rewriting of rules that allow for full participation of energy storage projects.

Internally we expect to see nothing but exponential growth – innovation of products and increased megawatts in operation.

Which regional markets or market opportunities are the most promising for your energy storage business today and why?

We are finding more areas that make economic sense, all across the US, today. The work has been done over the last 20 years to bring down the cost curve of storage to the point that markets that seemed out of reach even a few years ago, are going to be cost competitive tomorrow.

One area that we’re really excited by is thermal to storage. In 2021, we announced a partnership with (independent power producer) Talen Energy to install a 20MW battery storage project adjacent to their H.A. Wagner coal plant in Baltimore.

With more coal retirements on the horizon, we will continue to see a need for projects like this that provide capacity that has historically been provided to the US electric grid by coal, natural gas and nuclear.

COP26 brought climate change into mainstream headlines and the international policy agenda: how best can the energy transition happen more quickly to meet climate goals?

In order to meet our climate goals there must be increased consistency between policies at the state, regional, federal and international level.

We need all people to see the climate challenge as one that ascends political affiliation, conflict, or bias.

There must be standard climate goals at the federal level that sets a good precedence for the creation of climate goals at the state and local level.

We can accelerate cutting greenhouse gas (GHG) emissions through the assimilation of battery storage into the power grid, augmented with advanced artificial intelligence.

Our new owner, the SK Group, recently announced an ambitious goal to reduce GHG emissions by approximately 100 million tons by 2030; this is the equivalent to roughly 3.3% of the US GHG emission reduction target. Going forward, energy storage and electric vehicles are a big component of that.

Form Energy

Mateo Jaramillo, CEO and co-founder

What did the energy storage business in 2021 mean for your company and how did it compare with previous years?

We went public with the iron-air chemistry of our multi-day energy storage technology, a hugely significant milestone for the company.

We set out about four years ago to develop the kind of battery that could enable a fully renewable and reliable electric grid.

A few years later, after a lot of hard work and some fantastic developments in the lab, we found ourselves in 2021 with a technology solution that has a very clear path to get into the market, which is moving very quickly to decarbonise the electricity sector.

How are the business models for energy storage evolving?

There is an increasing focus on clean, firm power. While solar, wind, and lithium-ion batteries will meet a good part of future electricity demand, clean, firm resources provide significant cost savings and reliability benefits over a renewables and lithium-ion only approach.

How to go about providing that clean, firm power and procuring it is starting to come into focus, and we expect this will continue to be the case. We believe that there will need to be cost effective solutions to complement lithium-ion and provide storage over a period of multiple days.

What are some of the technology or industry trends you have observed: which of those are the most exciting and conversely are any of them fads that you think will be gone within the longer term?

It’s been great to both observe and participate in the increasingly collaborative nature of the energy storage industry over this past year.

We were excited to be a part of the launch of the Long Duration Energy Storage Council (LDES Council) in November, a 24-member company organisation made up of companies developing and commercialising a wide range of LDES technologies, end users, and capital providers. The Council was primarily formed to provide fact-based guidance to governments, grid operators and major electricity users on the deployment of LDES while also offering the opportunity for industry leaders to convene and collaboratively quantify the value of this important, nascent industry.

Have there been any major challenges the industry has faced this year and faces going forwards, and how do you think they can be solved?

As I mentioned, I believe one of the biggest challenges currently facing the industry is figuring out how to offer clean, firm power and the reliability needed to make zero-carbon grids a reality.

In practice, all resources are subject to availability conditions.

As we learned from the storms in Texas last February that brought down roughly one-third of the state’s “firm” thermal generation, no technology class is perfect. Firm resources must be able to consistently meet a given demand under a wide variety of weather conditions. Recent work has clarified that, for storage to be truly firm, it will need to reach dramatically lower costs and longer durations than today’s commercial technologies, which is ultimately the focus of our efforts at Form.

What will 2022 bring for your company and for the wider energy storage industry?

In 2022, our focus will be on preparing for commercialisation. Our first announced project is with Minnesota-based utility Great River Energy, a 1MW grid-scale battery system that we expect to go online in 2023.

Early on, we had an indication that our multi-day energy storage technology had great potential. Now we must prove the bankability of the asset itself, proving that it is durable and meets the needs of utilities in real-world operating conditions.

Which regional markets or market opportunities are the most promising for your energy storage business today and why?

As far as countries, our first and primary focus is on the US market. While ambitious, the Biden Administration’s climate policy goals show that there has never been a better time for visionary infrastructure, innovation, and decarbonisation plans to meet the challenges of climate change.

Diving even deeper, we are looking towards states like California and New York, which are leading the path with aggressive energy storage goals and decarbonisation and grid modernisation efforts.

COP26 brought climate change into mainstream headlines and the international policy agenda: how best can the energy transition happen more quickly to meet climate goals?

One thing that we see as key to accelerating the energy transition is ensuring that electric utilities, regulators, and grid operators have the best possible analytical tools available for future grid planning.

Unfortunately, many of the models in wide use today are ill-equipped to cost effectively guide the transition to a low-to-zero-carbon grid because they were not designed to account for the variability of renewable energy resources.

To reach climate goals more quickly, we need grid planners to examine existing modelling practices, compare these practices against new modelling capabilities, and transition to adopting new modelling approaches that have certain minimum capabilities like co-optimisation across diverse weather and system conditions.