The market share of vertically integrated battery cell and BESS companies has fallen since 2023, market intelligence firm Rho Motion said.

The firm’s research shows that the battery energy storage system (BESS) market share of lithium-ion OEMs like CATL and BYD peaked in 2023 at over 40% and has now fallen to under 30% in the first half of 2025.

‘This was largely due to the LFP cell price surge in 2022, which gave cell players the advantage of being able to produce systems at lower costs, since cells made up the largest cost component of ESS systems,’ the firm said.

Price falls and an expansion of the battery industry has brought in more players and broadened the range of options available to BESS producers, allowing them to compete more with vertically integrated players, Rho Motion said.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

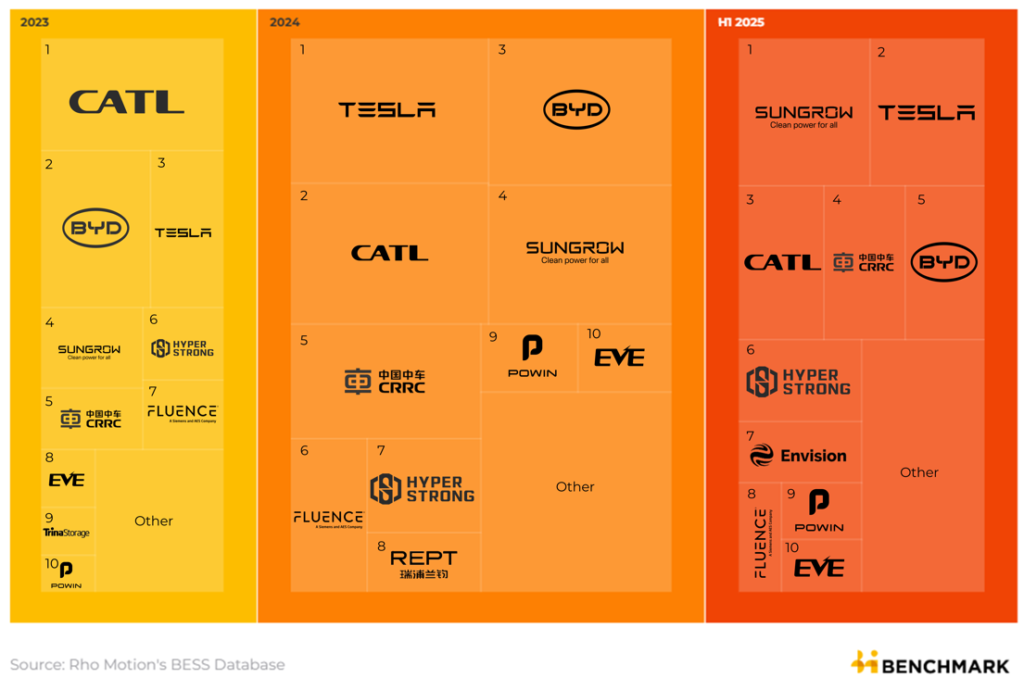

The market overall is becoming less consolidated, although remains top-heavy. The infographic above shows companies’ market share in 2023, 2024 and H1 2025. CATL’s went from 20% in 2023 to 14% in H1 2025 while BYD’s went from 17% to 9%.

The biggest examples of this shift to BESS manufacturers that do not manufacture cells are Sungrow, CRRC and Hyperstrong, whose combined market share went from 20% in 2023 to 30% in H1 2025.

Sungrow has grown to be the largest player with a 14% market share in the most recent period, while Tesla has kept a roughly consistent market share over the three periods, going from 11% to 14% to 12%.

The UK is a great example of this shift, with many of the very early projects in 2018-2022 supplied by BYD and CATL, but their names typically featuring less heavily than Sungrow, Hithium and Envision and Canadian Solar for newer ones.

Note that Rho Motion’s research only looks at the BESS supplier, regardless of whether a system integrator sits in between the supplier and the buyer. Other companies’ research typically categorises projects by the system integrator or final seller, meaning CATL ranks lowly or does not appear at all in their reports.

Rho Motion’s report also noted that system integration ability is proving more important, echoing what we heard from system integrator Prevalon in an interview earlier this year for ESN Premium.

A similar trend of (relatively) newer BESS-specialised cell suppliers taking market share from the established OEMs is also being seen on the cell supply side, Rho Motion said. In H1 2025, Hithium and Eve Energy joined CATL in the top three, overtaking BYD.

Rho Motion is part of upstream specialist Benchmark Mineral Intelligence.