Energy-Storage.news has heard from the founder and CEO of start-up Lumenion that the company’s technology, now being trialled in Germany by Vattenfall, can store energy in steel structures for up to 48 hours.

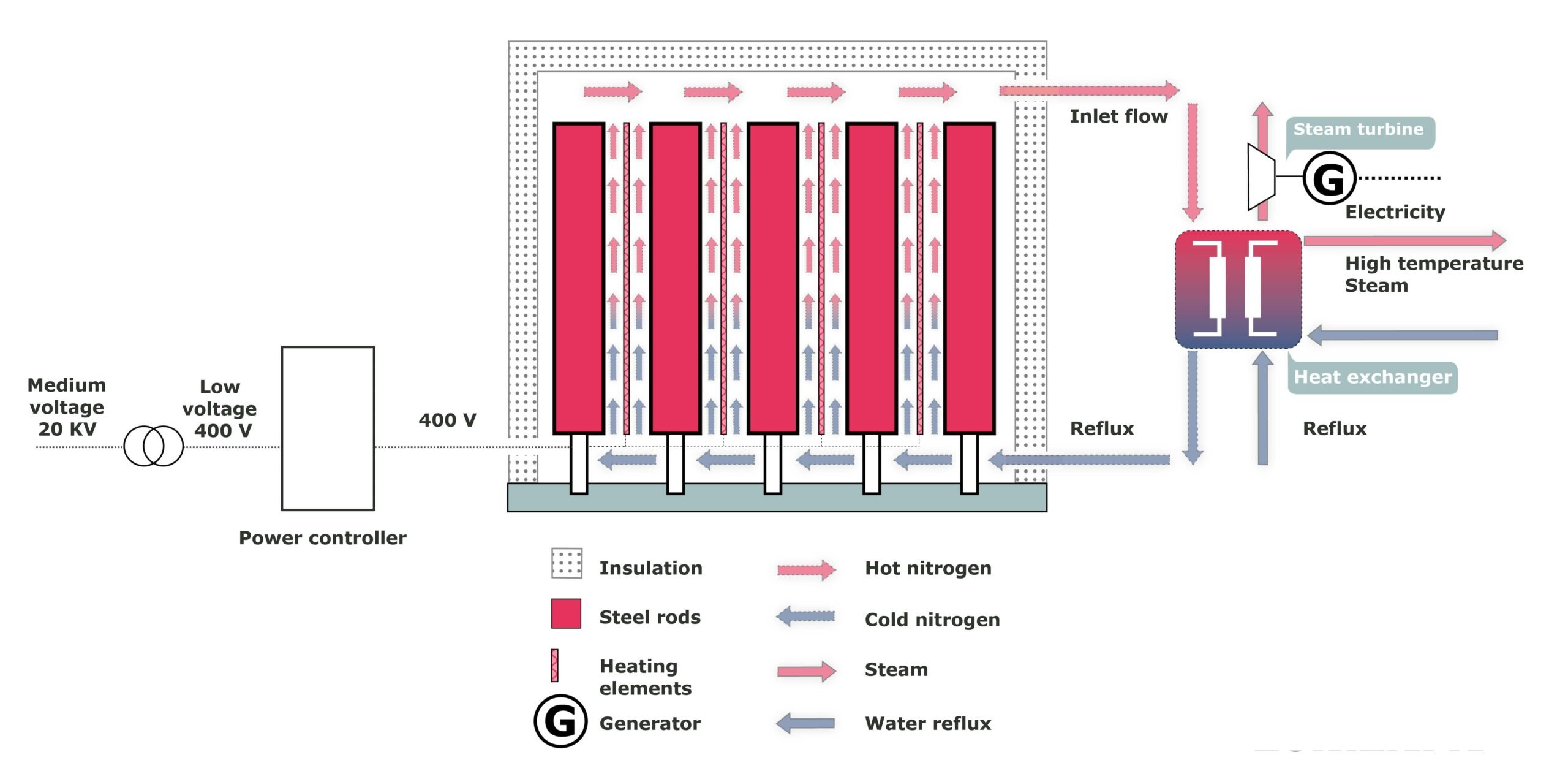

At the end of October, Lumenion announced that a 2.4MWh steel-based thermal energy storage system will go into operation in Berlin through Vattenfall Energy Solutions and Gewobag, a municipal housing company. The company claims it can provide low-cost energy storage on combined heat & power (CHP) principles, using steel as the medium. The steel modules store energy thermally at up to 650 degrees Celsius and the system is then capable on conversion of outputting around two parts heat to one part electricity.

The system will absorb power generated by local renewables plants, wind and solar, and store it at a claimed cost of less than €0.02 per kWh. While it could output all of the stored energy as heat, it can also be converted back into power and heat using steam engines.

CEO Alexander Voigt told Energy-Storage.news that Lumenion is producing a ‘bulk storage’ technology, developed with a “view to economically shift large amounts of renewable energy – and to integrate it effectively into our energy system. Voigt said it is “much simpler – and thus also cheaper than batteries.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“Which is why we see it as a compliment to – rather than a replacement of – batteries,” he said.

“Steel storage is well suited for providing the ‘heavy lifting’, i.e. to quickly absorb large amounts of renewable energy when the production peaks occur, to store those peaks for two cents per kWh or less, and then provide the energy continuously for many hours or even days. Batteries, on the other hand, provide the precision round the edges – frequency regulation, voltage control, black start capability and the rest.”

Younicos founder spies need for longer-term ‘bulk storage’

The company claims the low-cost is possible because of the abundance of the materials used. It relies on no rare earth metals and as Voigt put it, Tesla may have a Gigafactory for lithium-ion batteries but there are already plenty of vast steel production facilities in the world.

Voigt, who was among the founders of Younicos (now owned by Aggreko and focusing on mobile commercial and industrial storage solutions) and solar companies Solon and QCells, said Lumenion is targeting a still-emerging segment of the storage market not served by batteries.

Voigt said storage for up to 48 hours will be necessary to capture peaks in solar and wind production. However, he believes batteries are unlikely to become an economical way to serve this need because this “implies having just one full cycle every two days,” while the best value from batteries is generally found through putting them to as much use as possible within acceptable limits for degradation, often cycling them up to 1,000 times in a year.

Other methods or media for providing longer duration storage than 8-10 hours (currently the upper limit achievable with some flow batteries), are being trialled or put into use, with many others claiming low-cost and scalability for their technology including EnergyNest, which stores energy in steel and concrete ‘thermal battery modules’ and Highview Power, which has developed liquid air energy storage (LAES).

Previously at European industry and trade shows, the focus for longer duration or even seasonal storage has been mostly on power-to-gas or hydrogen, although there has also been increasing industry and policy interest in sector coupling between power, heat and transportation – which could offer more opportunities for the likes of Lumenion. Meanwhile, in the US, energy secretary Rick Perry has launched a competitive initiative to fund the development of systems which can store energy for up to 100 hours.

Lumenion’s Alexander Voigt claims the steel storage technology can scale “very quickly”. There is a 450kWh demonstrator at HTW, University of Applied Science in Berlin, while talks are underway with a large organic farm in northern Germany for a 40MWh system, capturing wind energy that would be otherwise curtailed and replacing gas plants in the process. There are also early stage talks to build projects of several hundred megawatt-hours each, in “high wind areas”, that Voigt said could be completed as early as 2021.

This article has been amended from its original form to reflect that Highview Power’s technology is based around liquid, not compressed, air.