In a recently published interview with Energy-Storage.news Premium, CEO and President of Prevalon Energy, Thomas Cornell, spoke about the global consequences of the budget reconciliation bill and tariffs.

One concern mentioned by Cornell is that Chinese manufacturers are dumping products that would have formerly gone to US companies.

Cornell explained, “Some markets are just emerging now to allow batteries to participate in grid-scale. This year is a big year, especially in some countries in Latin America. Brazil is having their first capacity auction, which is allowing batteries to participate. Argentina is following behind that.”

“Because of what the US has done, the Chinese market was number one, the US was right behind it at number two, and then the rest of the world was way down. Now that all this Chinese supply chain can’t come into the US, it’s going into these other markets, which are getting flooded. We’re worried it’s going to be a race to the bottom with people dumping products,” he said.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

There are multiple factors leading to this potential “race to the bottom.”

According to Wood Mackenzie’s report, ‘All aboard the tariff coaster: implications for the US power industry,’ tariffs on imports will primarily impact battery storage more than solar PV or wind sectors.

This is because the battery energy storage system (BESS) market depends heavily on imports from China, with “nearly all” battery cells for US utility-scale projects in 2024 originating there.

Depending on the extent of possible tariff increases, the cost of utility-scale BESS could increase by 12% to 50% across three modelled tariff scenarios.

In July, the US Department of Commerce imposed anti-dumping (AD) tariffs on active anode material (AAM) product imports from China at a rate of 93.5%, bringing the total tariff on these imports to 160%.

The tariff covers AAM included in finished batteries but excludes finished BESS products.

Market intelligence firm Rho Motion noted at the time that US BESS manufacturers and system integrators will be impacted if they import batteries from China. However, Chinese BESS manufacturers shipping finished products will not be affected.

To use Brazil and its capacity auction as an example, solar energy company RatedPower recently noted, “Demand for BESS components rose 89% from 2023 to 2024, and projections suggest the sector could reach a market value of BRL22.5 billion (US$3.79 billion) by 2030.”

The upcoming battery auction is expected to draw as much as US$450 million in private investment, which is the estimated cost for developers to install 300MW of storage capacity.

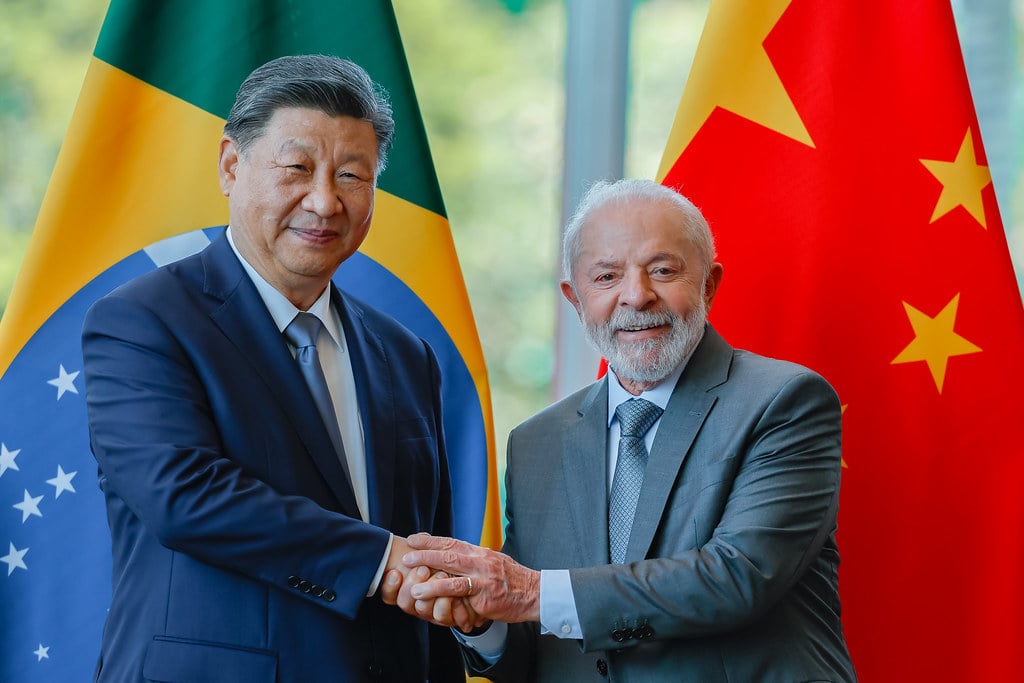

Brazil arguably has a much stronger relationship with China than with the US. President Luiz Inácio Lula da Silva recently said, “Tariff blackmail is being normalised as a tool for conquering markets and interfering in domestic issues,” during a meeting of Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the UAE (BRICS) leaders.

Donald Trump announced an additional 40% tariff on most imports from Brazil, in addition to the 10% baseline tariff the US had previously imposed, bringing the total tariff rate to 50%. Multiple sources, including Reuters, cite Trump’s dissatisfaction with the Brazilian government’s treatment of former President Jair Bolsonaro as a motivating factor for the increase.

In August, China’s President Xi Jinping told Lula, according to the Rio Times, that China was prepared to enhance cooperation and bolster the Global South.

Beijing is working to secure long-term influence in sectors like food, energy, transport, and technology, which will shape Brazil’s economic future.

In July, the Brazilian government, via the mines and energy ministry, signed a letter of intent with Chinese state-owned company CGN Energy. This agreement aims to promote technical and scientific cooperation on energy transition, sustainability, and the peaceful and sustainable utilisation of nuclear mineral resources in Brazil, as reported by BNamericas.

CGN Energy is also looking to implement an energy storage system and solar thermal generation project in the country.

Other companies with facilities in the country include BYD, Deye, Dyness, FoxESS, Huawei, UCB Power, and SolaX Power, among others.

US tariffs and additional measures intended to spur American BESS manufacturing may have the consequence of also strengthening the trade bonds between the affected countries.

The full consequences of having such an abundance of BESS material available in countries like Brazil are yet to be seen, but as Cornell stated, it may end up becoming a race to the bottom.