Recent policy developments in the US and European Union (EU) represent a considerable uplift to the prospects for global energy storage deployment, according to BloombergNEF.

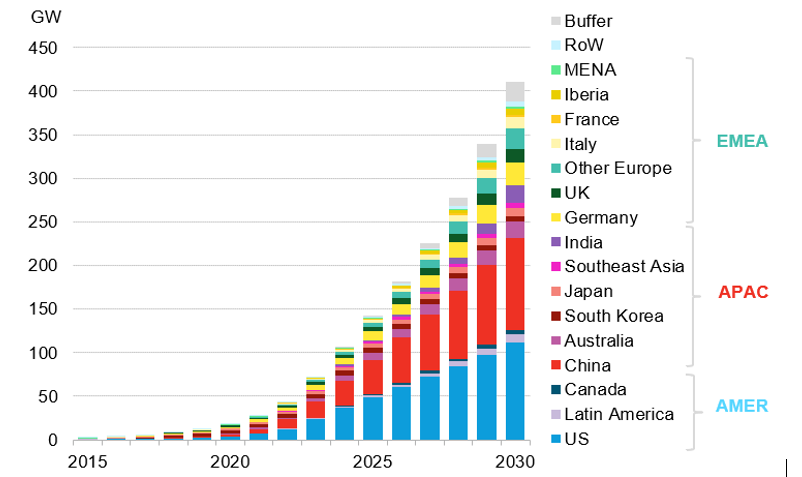

In issuing its latest analysis of the sector, the firm has forecast that by the end of 2030, cumulative installations worldwide will reach 411GW and 1,194GWh. That’s considerably higher than BloombergNEF predicted in November last year, when its forecast stood at 358GW/1,028GWh of cumulative installs by the end of the decade.

Even at that time, the analysis group highlighted that it expected the 2020s to be “the energy storage decade” and its most recent forecasts appear to strongly reinforce that message.

The Asia-Pacific region, driven largely by deployments in China supported by the country’s national storage strategy and associated targets, was expected to be the biggest market by region throughout that time in BloombergNEF’s previous analysis.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Albeit on a national level, China and US will be the two biggest markets, representing about half, if not more, of all global deployments in that time. That said, battery projects in the US typically have higher energy capacity to capture more hours of stored energy, meaning the megawatt-hours figures for capacity additions in the US will likely be higher than China’s.

Those overall dynamics remain the case, however changes in the US and EU outlook are what have really changed the overall picture in a short time, BloombergNEF analysts said.

Inflation Reduction Act, REPowerEU underpin optimism

In the US, the Inflation Reduction Act (IRA), the surprise legislative breakthrough that includes US$369 billion of climate spending and tax incentives, is the main driving force.

The IRA will introduce an Investment Tax Credit (ITC) for standalone energy storage – i.e. batteries or other storage assets built without being paired with, or hybridised, with co-located solar PV generation.

That has been hailed as a gamechanger, bringing the prospects for many more gigawatts of storage projects into economic viability and profitability. The “transformational” act incentivises use of locally produced equipment and labour in clean energy projects.

BloombergNEF head of energy storage Yayoi Sekine said companies “are already scaling up operations to capture the upside” of policy developments like the IRA.

In the EU, the REPowerEU policy is the big driver. Produced earlier this year in response to the Russian invasion of Ukraine and the European energy market’s dependency on fossil fuels that it exposed, specifically gas imported from Russia, the plan is undergoing its implementation process.

It includes considerable upping of renewable energy targets and explicit – if brief – mention of the need to develop and foster energy storage’s role in integrating those renewables and maintain electric grid reliability.

Although the impact of REPowerEU is therefore perhaps less immediately apparent than the IRA, a speech given this week by European Commission Vice President Maros Sefcovic highlighted that energy storage is being considered a vital component of ensuring European energy security and affordability. At the same time, of course, it will help the Union in decarbonising its energy sector.

Changing applications

BloombergNEF’s analysis of the market looks at stationary batteries used for a range of applications including, but not limited to, ancillary services, energy shifting, bolstering transmission and distribution networks as an alternative to more expensive investments in upgrades and behind-the-meter customer-sited applications. It excludes pumped hydro energy storage.

As the market evolves in tandem with the world’s shift to higher shares of renewable energy, the main application for battery storage will become more and more tied to energy shifting. Energy generated during the daytime from solar, for example, will increasingly be stored for long enough to contribute to providing peak time energy in the evenings.

By 2030, BloombergNEF said, about 61% of all megawatts of energy storage deployed will be primarily used for energy shifting applications, pointing to the growth of co-located solar-plus-storage as an example of a trend which is already taking shape.

Customer-sited storage, currently a relatively small wedge of the overall market except in some high growth regions like Germany, Australia and to a lesser extent Japan and California, will also grow significantly in market share. Residential and commercial and industrial (C&I) storage will make up about a quarter of all deployments globally by 2030, BloombergNEF expects.

Short-term supply chain shocks not killing demand

In the short-term, the outlook for storage deployment is perhaps a little more complicated.

As reported by Energy-Storage.news, another BloombergNEF analyst, Helen Kou, explained how supply chain constraints have dampened expectations for US deployments this year in an appearance at the recent RE+ 2022 trade event in California.

“Significantly higher” prices for lithium batteries over 2021 have been commonplace this year, with the impacts of the global logistics slowdown caused by the coronavirus pandemic converging with extremely high demand for batteries from the electric vehicle (EV) sector.

That led BloombergNEF to downgrade its 2022 US deployment forecasts by 29%, Kou said at RE+, with a similar stance taken by rival analysis group Wood Mackenzie Power & Renewables.

However, the analyst said at the California trade show and reiterated this week that demand for energy storage remains strong, with the challenges largely representing a series of delays in project development and execution, rather than cancellations.

“The energy storage industry is facing growing pains. Yet, despite higher battery system prices, demand is clear. There will be over 1 terawatt-hour of energy capacity by 2030. The largest power markets in the world, like China, the US, India and the EU, have all passed legislation that incentivises energy storage deployments,” Kou said.