Research firm Wood Mackenzie Power & Renewables has downgraded its forecasts for US demand for energy storage in 2022 and 2023 by around one-third, in its most recent global outlook report.

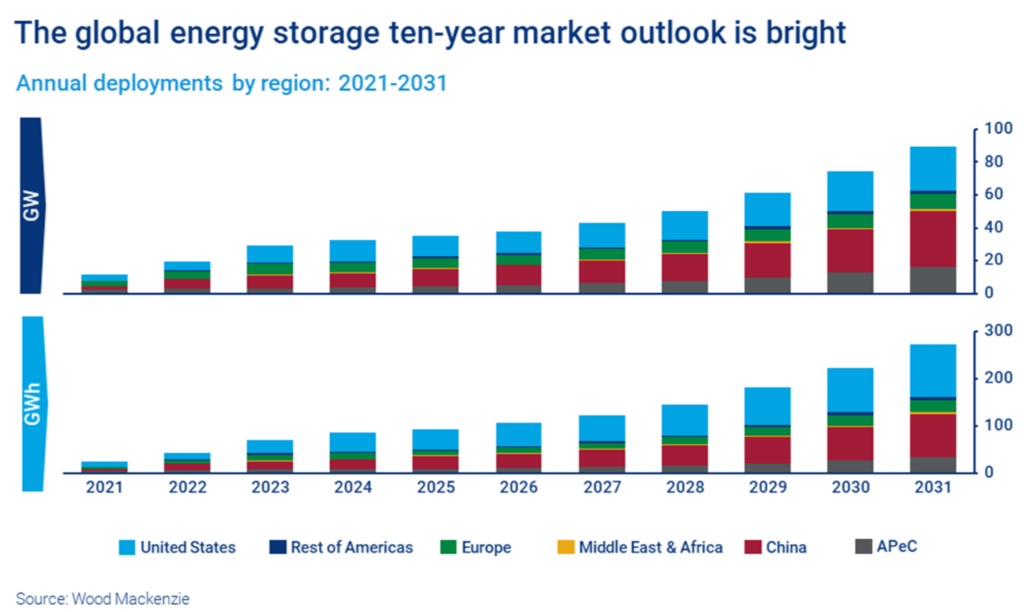

The global energy storage market is set to reach a cumulative deployment level of 500GW by 2031, of which 75% will be in the US and China, the firm said in the latest quarterly edition of its ‘Global energy storage market outlook update’.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

A summary blog did not reveal its GWh forecast for 2031. BloombergNEF forecast back in November 2021 that by 2030 there would be a cumulative 358GW/1,028GWh of energy storage installations worldwide by 2030.

The US remains an energy storage market leader but disruption from trade actions has caused WoodMac to downgrade its forecasts for the coming two years. It has reduced its demand forecasts for the market by 34% for 2022 and by 27% for 2023.

The downgrade has come as a result of disruptions within the grid-scale and distributed segments from the antidumping and countervailing duties (AD/CVD) tariff suit in Q2. The move by the US government has been covered in-depth by Energy-Storage.news‘ sister site PV Tech.

The US solar-and-storage market was particularly hit hard by the AD/CVD tariff petition, with approximately 35% of 2022 hybrid grid-scale installations delayed, the firm added. Some relief was brought by an Executive Order from the Biden administration on 6 June which saw a two-year delay to new duties on solar cells from four Southeast Asian markets. As such, it said that a market rebound is still possible.

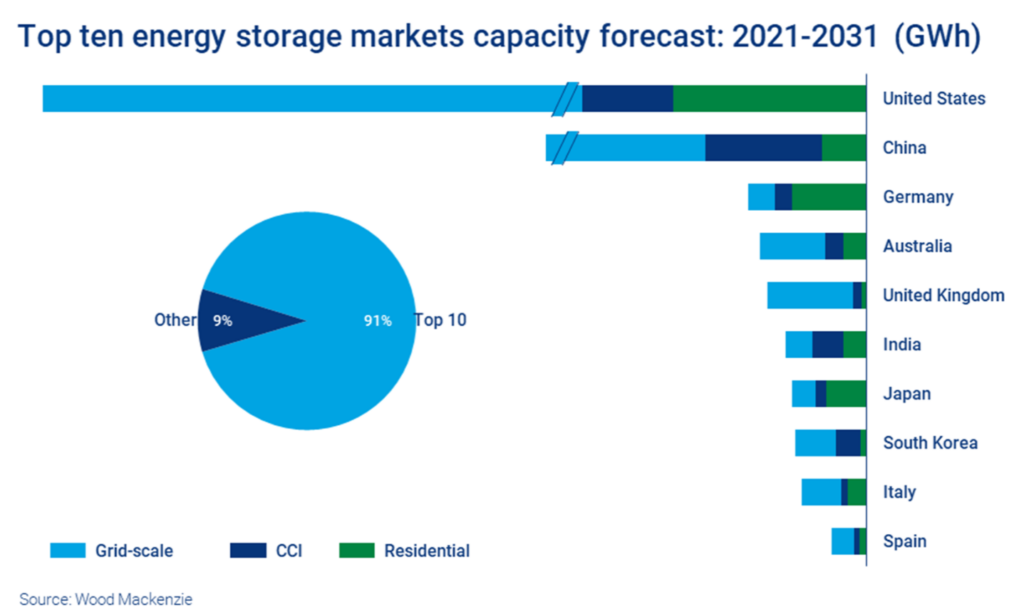

As show in WoodMac’s chart below, the US and China are set to the dominate the market over 2021-31 by GWh deployments, while the top 10 markets will account for 91% of additions over the period. Grid-scale will be the biggest portion in most places other than German, India and Japan, where residential and commercial & industrial (C&I) sites together will account for the majority.

The research firm also said the REPowerEU plan has provided a boost to Europe’s energy storage market, with five-fold growth expected over the decade, but that project economics remain a challenge. It quantified the boost from the plan at 12GWh.

Grid-scale storage has yet to take off in most countries on the European continent but renewables growth, gas supply constraints and overburdened interconnectors can help kickstart growth in the sector.

China, meanwhile, will continue to dominate the Asia-Pacific market but the profitability of energy storage projects remains a challenge to sustainable development of the sector there. The state is considering what national policies could improve the compensation for energy storage costs and enhance the economic incentives of projects.

The country’s Fourteenth Five-Year New Energy Storage Development Implementation Plan, released in March, has been followed by 12 provinces and cities announcing 2025 cumulative energy storage deployment targets totalling 40GW.