According to the Q4 2025 US Energy Storage Monitor from Wood Mackenzie Power & Renewables and the American Clean Power Association (ACP), 2025 energy storage installations surpassed 2024 capacity.

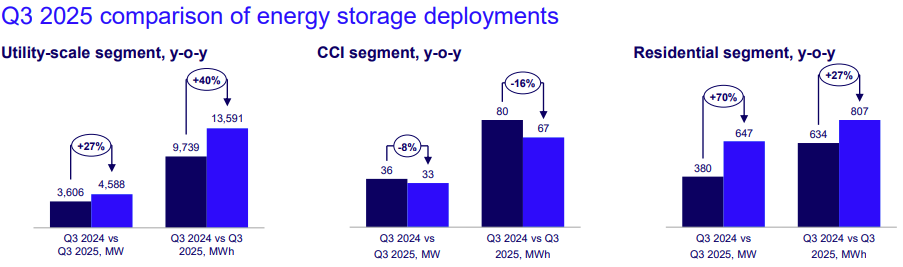

According to the new edition of the quarterly report, 5.3GW/14.5GWh of storage was installed in Q3 2025 in the US, pushing 2025 year-to-date installations past 2024 capacity. Last year marked the first time installations exceeded the double-digit gigawatt mark, with 12GW recorded across the utility-scale, residential, commercial, community & industrial (CCI) market segments.

Combining the headline findings of Wood Mackenzie’s previous reports from earlier this year with the latest quarterly numbers adds up to 12.6GW of installations in the first nine months of 2025.

Utility-scale storage increased by 27% year-over-year, reaching 4.6 GW and 13.6 GWh in Q3 2025. Most deployments occurred in major markets, with Texas and California making up 82% of the installed capacity. In the first three quarters of this year, 10.9GW/33.7GWh of utility- or grid-scale energy storage was deployed, around the same amount deployed in the whole of 2024.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Notably, Wisconsin installed 210MW over Q2 and Q3. In October, Wisconsin utility Alliant Energy integrated its first 100MW/400MWh battery energy storage system (BESS), next to a 200MW solar project in Grant County.

In July, Wisconsin regulators approved a 20MW/200MWh long-duration energy storage (LDES) project by Energy Dome and Alliant Energy.

In Q3 2025, community-scale, commercial, and industrial (CCI) storage was predominantly in California, which accounted for 54% of installations. Illinois also became a significant market, representing 4% of deployments.

Residential storage installations increased by 8% quarter-over-quarter, led by California, Arizona, and Illinois, as attachment rates reached new peaks and larger capacity systems gained market share.

Puerto Rico experienced the highest quarter-over-quarter growth in installations, mainly due to high retail power prices and ongoing demand for resiliency. Meanwhile, North Carolina and Arizona achieved record quarterly installation levels in Q3 2025, influenced by the PowerPair Programme and decreasing solar export rates, respectively.

Forecasted installations

ACP and Wood Mackenzie forecast that 92.9GW/317.9GWh of storage will be installed in the US over the next five years, driven by project economics and policy incentives.

The utility-scale storage five-year forecast has grown by 15% following the passage of the ‘One Big Beautiful Bill Act’ (‘OBBBA’), which, during its lengthy negotiations, had initially led Wood Mackenzie to lower its expectations. In the Q2 edition of the report, published just a few days before the legislation passed for final debate in the Senate, the research firm estimated that, had the bill eliminated tax credits for energy storage, it could have led to a 29% fall in utility-scale deployments in 2026.

Deployment is fuelled by ongoing access to the investment tax credit (ITC), competitive domestic cell manufacturing costs, merchant revenue opportunities, state policies, and load growth.

Wood Mackenzie anticipates the C&I storage market will reach an additional 892MW between 2025 and 2029 as programmes like California’s Net Billing Tariff (NBT), Massachusetts’ Solar Massachusetts Renewable Target (SMART) 3.0, and Illinois’ rebate initiatives mature, alongside expanding wholesale market access.

Federal policy changes

The US utility-scale storage market is expected to shrink by 11% in 2026 and 8% in 2027 year-over-year as supply chains adapt and domestic manufacturing increases.

However, it is projected to bounce back in 2028 and 2029 with double-digit year-over-year growth once domestic cell supply becomes more accessible. In the Q3 edition of the report, Wood Mackenzie had said that, although demand remained strong, the OBBBA and global trade uncertainty could still lead to a 10% year-over-year fall in utility-scale installations in 2027.

Responses in distributed storage show mixed results. The CCI segment will continue steady growth despite federal restrictions, mainly because deployments are focused in California, Massachusetts, New York, and Illinois, which offer significant state incentives.

Meanwhile, the residential storage sector is predicted to decline by 6% in 2026 due to the removal of Section 25D ITC, with residential solar facing an even sharper drop of 18%.

Allison Feeney, research analyst at Wood Mackenzie said of the report, “Despite new federal policies and tariffs, the market fundamentals remain exceptionally strong. Continued access to the ITC, cost-competitive domestic cell manufacturing, merchant revenue potential, state policy and load growth are driving our increased five-year outlook.”

The Energy Storage Summit USA will be held from 24-25 March 2026, in Dallas, TX. It features keynote speeches and panel discussions on topics like FEOC challenges, power demand forecasting, and managing the BESS supply chain. For complete information, visit the Energy Storage Summit USA website.