A total 3.8GW/9.9GWh of energy storage was deployed in the US in the third quarter of 2024, according to Wood Mackenzie’s US Energy Storage Monitor.

The figure is a record for Q3, and represents 84% annual growth in megawatts (MW) and 60% in megawatt-hours (MWh) according to the report, which is produced by Wood Mackenzie Power & Renewables in collaboration with trade body American Clean Power Association (ACPA).

Over 90% of the deployments were in the grid-scale segment, with residential around 9% and commercial & industrial (C&I) around 1% (the exact figure is slightly different for MW and MWh).

The grid-scale segment saw 3,431MW/9,188MWh installed, of which 93% was in Texas and California, the two leading states for energy storage. Two-thirds of the figure was in California, while Texas accounted for a quarter – Arizona’s 180MW installed accounted for around 1%, followed by smaller figures elsewhere.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

California, Arizona and North Carolina meanwhile led installations in the residential segment.

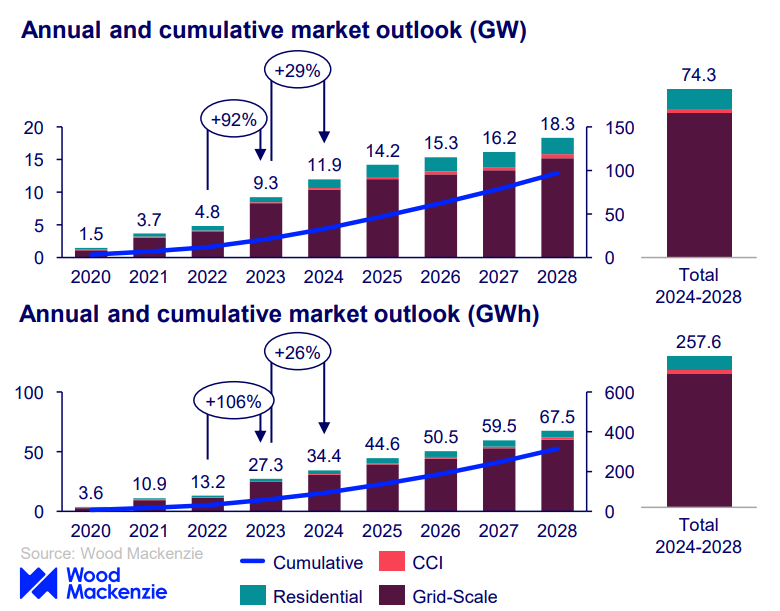

Across all segments, 2024 is expected to see a total 11.9GW/34.4GWh of energy storage deployed, up 29% by GW and 26% by GWh (though, the figure is some 50-60% higher than the 7.8GW/20.6GWh deployed last year according to ACPA‘s own figures published earlier this year).

The forecast is slightly lower than the one issued in its Q2 figures, covered by Energy-Storage.news at the time, owing to 600MW of projects whose commercial operation date (COD) has been pushed from 2024 to 2025.

Although not specified by Wood Mackenzie, the vast majority of installations across these segments will have been lithium-ion battery energy storage systems (BESS).

The firm’s five-year outlook, outlined in the charts below, shows how the firm expects the market to grow going forward. Overall, GWh are expected to grow faster than GW, most likely owing to an increase in average durations of projects.

The firm added that the industry is still evaluating the impact of Trump’s victory in the presidential election. A full repeal of the Investment Tax Credit (ITC) for energy storage is not expected, but some adders may be at risk, it said.