In the new political era, the US battery gigafactory ‘power play’ will see smaller vendors take a step back, write Anjali Joshi, market intelligence analyst at Clean Energy Associates (CEA).

This continues our regular series of exclusive Energy-Storage.news Guest Blog contributions from Clean Energy Associates in 2025, following ‘For energy storage fire safety, will perception become reality?‘ published in February, written by CEA market intelligence consultant Aaron Marks.

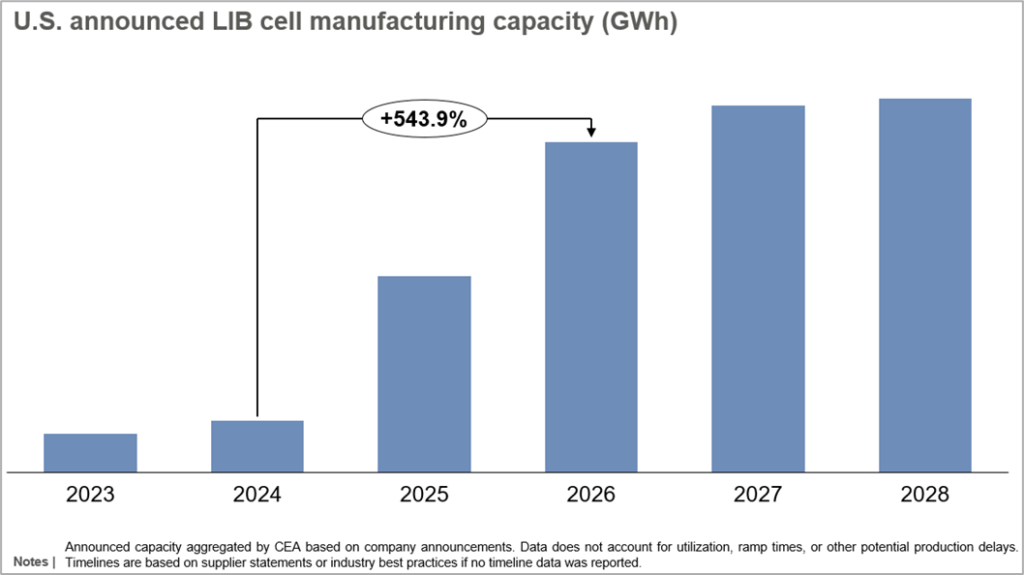

The 2022 Inflation Reduction Act (IRA) spurred a flurry of investments in domestic battery cell manufacturing, driving announced projects in the US to more than 1TWh of planned annual production capacity, an increase of over 50% compared to pre-IRA data.

The law’s focus on reshoring the full battery manufacturing supply chain led to a ramp up not just in planned domestic battery capacity, but also in battery material and component manufacturing.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In recent months, however, some of the planned capacity has been delayed, put on hold, or even cancelled due to weaker-than-anticipated EV demand growth and the impact of policies implemented by the Trump administration.

The obvious question becomes: can the nascent industry weather these shifts?

Spending freezes affect the domestic battery industry

President Trump followed through on his election campaign promise to roll back clean energy initiatives by freezing funding for clean energy projects, which has impacted many in the industry, but particularly smaller manufacturers. Two battery manufacturing projects were cancelled in the first week of Trump’s presidency.

Further challenges emerged in early February 2025 when KORE Power announced that it would not move forward with its planned battery cell production project in Buckeye, Arizona. KORE Power’s project was first announced in 2019, with a projected capacity of 12GWh. In June 2023, the project received a conditional loan commitment of US$850 million from the Department of Energy (DOE). However, a year-and-a-half later, these funds have still not materialized.

Considering that this loan was meant to cover nearly 80% of the US$1 billion needed to construct the KOREPlex factory, the decision taken by the current administration to freeze all grants and loans for clean energy is likely to be a significant reason behind the cancellation of this project.

FREYR’s 34GWh battery cell production project in Georgia was also cancelled earlier this year, and tells a similar story. In 2023, the Norway-based supplier refocused on its Giga America project rather than its Giga Arctic project to benefit from tax credits under the IRA. The company cited factors, including declining battery prices and rising interest rates, as reasons for the withdrawal of its Giga America project.

Small suppliers delay operational timelines and cut costs as uncertainty mounts

Small suppliers were struggling with making any significant progress towards their planned projects even before the 2024 election, due to issues around financing, availability of technical expertise, and declining battery prices.

Kontrolmatik, for example, delayed the operational timeline of its planned battery cell production capacity twice in 2024, owing to challenges in sourcing materials and rising costs. Other suppliers like FREYR, Our Next Energy, Microvast, and iM3NY announced major layoffs as a move to preserve liquidity and reduce overall costs. iM3NY has already filed for Chapter 11 bankruptcy due to lack of capital to survive in the price-competitive market. Earlier, it had applied for a DOE loan but did not get selected, indicating just how important these now-frozen incentives are to a nascent player.

Cancellations put ESS battery cell production capacity at risk

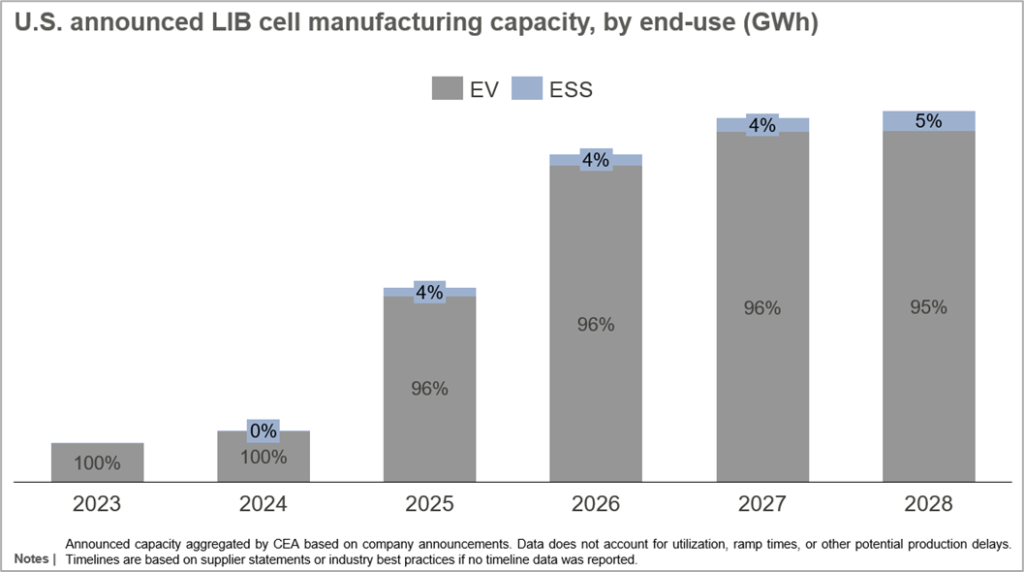

Cancellations of weaker projects are very unlikely to impact the overall domestic battery industry since four leading Korean and Japanese suppliers—LG Energy Solution, Panasonic, Samsung, and SK On—account for about 54% of the total domestic cell production capacity for 2026, but this more bankable supply is heavily weighted towards EV applications.

ESS-dedicated cell production capacity will account for only about 4% of the total domestic cell production capacity in 2026, based on the latest data tracked by CEA.

Smaller vendors, which will be affected disproportionately by these challenges, are much more likely to be targeting stationary storage applications, making impacts on this market much more likely than on the EV industry.

KORE Power, FREYR, Kontrolmatik, and Microvast, for example, were all planning to devote sizeable investment towards lithium iron phosphate (LFP) cells for ESS applications. Cancellations and delays may potentially put this investment at risk.

Compounding these challenges, many small suppliers lack the technical expertise to make a price-competitive product to effectively compete with Chinese battery manufacturers. Smaller vendors have encountered numerous issues, both publicised and private, in ironing out manufacturing processes and achieving manufacturing at scale.

KORE and FREYR’s decision to terminate their projects shows how difficult it is for a startup to survive in such a price-competitive market. Battery manufacturing is a complex and expensive undertaking, and there are numerous hurdles that can trip up a new entrant, from technology to manufacturing processes, and from quality to scale.

These smaller-scale companies represent over half of the announced 2026 ESS-dedicated battery cell production, making the stationary storage market uniquely exposed as industry expectations contract.

Established suppliers poised to take advantage of the new normal

While the EV sector commands the most scale, larger vendors are increasingly turning to stationary storage. Demand for this segment continues to grow, and the combination of project cancellations and increased tariffs on China has created a gap OEMs are eager to fill, particularly as sluggish EV demand growth has led to a decline in profit and further project cancellations.

Among the EV battery powerhouses investing in LFP technology LG ES stands out, aiming to start LFP cell production at its operational plant in Holland, Michigan, even as it pauses construction work at its planned 17GWh ESS-dedicated LFP battery cell production plant in Arizona.

Envision AESC is following LG ES’ footsteps, with plans to start LFP cell production at its operational factory in Tennessee. The message is clear: manufacturing for stationary storage presents a real opportunity, but executing on it may require capital and scale that smaller vendors will struggle to match.

About the Authors

Anjali Joshi is an energy storage market intelligence analyst at Clean Energy Associates (CEA), a North American-owned solar PV, green hydrogen, and battery storage clean energy advisory company across the whole value chain, with offices in Denver, USA and Shanghai, China. Since joining CEA in 2021, Anjali has been instrumental in building and delivering strategic market insights focused on the battery energy storage ecosystem, with a primary emphasis on the North American market. Anjali’s work centres on vendor profiling across the battery energy storage supply chain, detailed analysis of battery cell and upstream material capacity trends, and high-impact, data-driven presentations tailored for CEA’s global client base.

Information in this article includes forward-looking statements about future developments, trends, and conditions in the industry and markets. These involve known and unknown risks and uncertainties, and actual results may differ materially. Do not rely on these statements. CEA will not update any forward-looking statements due to new information or future events. This content is for informational purposes only and is not legal, tax, investment, financial, or other advice. It does not constitute a recommendation or offer by CEA. You are responsible for evaluating the information before making decisions. CEA is not liable for any damages from decisions based on this content. CEA strives for accuracy but does not guarantee it. Information may come from third parties and is not independently verified. No warranty is made regarding the information’s accuracy, completeness, or reliability. CEA is not responsible for any errors or omissions.