Harmony Energy Income Trust plc has secured a £60 million (US$73.8 million) debt facility from major UK retail and commercial banking group NatWest to support the acquisition of the first project in the developer’s new pipeline.

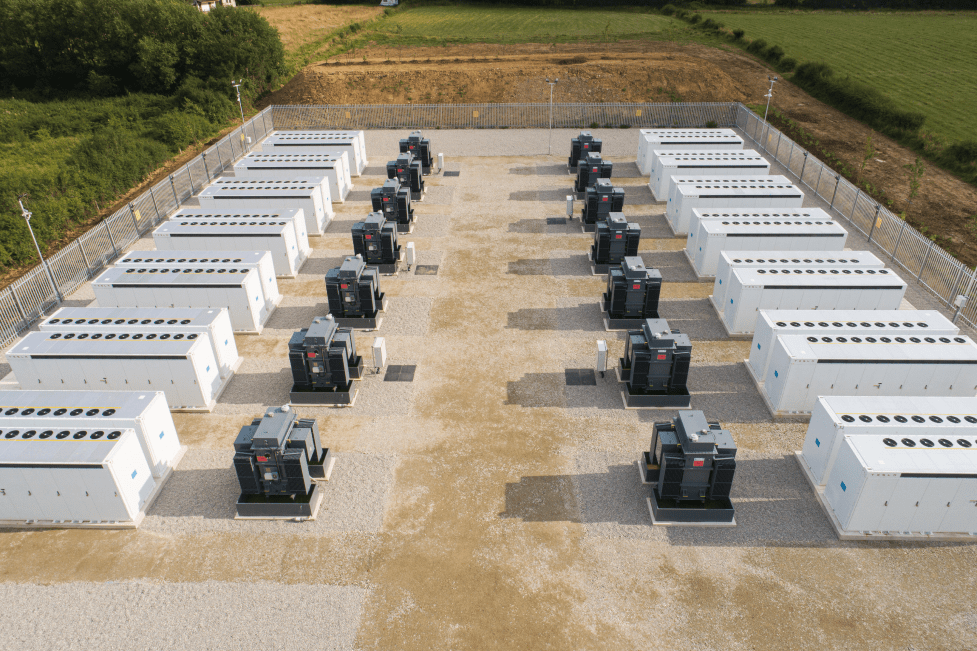

The 99MW/198MWh battery energy storage project is located in Buckinghamshire, England, and known as Bumpers. Harmony has the discretion to allocate the funds to alternative pipeline projects if desirable.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

NatWest has provided the five-year facility with an initial margin of 300 basis points (bps) over SONIA interest rates, which will then rise to 375bps after five years. It is set to be interest-only for the first three years and also provides for an uncommitted accordion that could see the total amount borrowed increase to £130 million over time.

Harmony raised £186.5 million through the placing and offer for subscription of its Initial Public Offering in November 2021. This is helping it expand its battery storage portfolio in the UK, including the company securing a lease for its 100MW Creyke Beck project in February.

NatWest meanwhile has expanded its role in the battery energy storage sector, including providing a £380 million funding package to Gresham House Energy Storage Fund in November 2021, closing the funding round for Fotowatio Renewable Ventures’s 7.5MW/15MWh Holes Bay battery project in October 2021 and completing a financing deal with Statera Energy to support eight new projects in March 2021.

It is also an established lender for the UK solar sector.

To read the full version of this story visit Solar Power Portal.