News of major project acquisitions in another busy week for the UK battery storage market.

28 October 2022: Fotowatio Renewable Ventures buys another 100MW of UK BESS projects

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Developer Fotowatio Renewable Ventures (FRV) has acquired two new battery energy storage projects, with a combined capacity of up to 100MW, from RE Projects Development Limited (REPD).

The lithium-ion battery storage projects collectively cover a little over one hectare, and are expected to reach the ready-to-build phase during the third quarter of 2023.

Developer Tyler Hill Renewables sourced the acquisition opportunity for FRV – which is part of Abdul Latif Jameel Energy – and will assist in the development process.

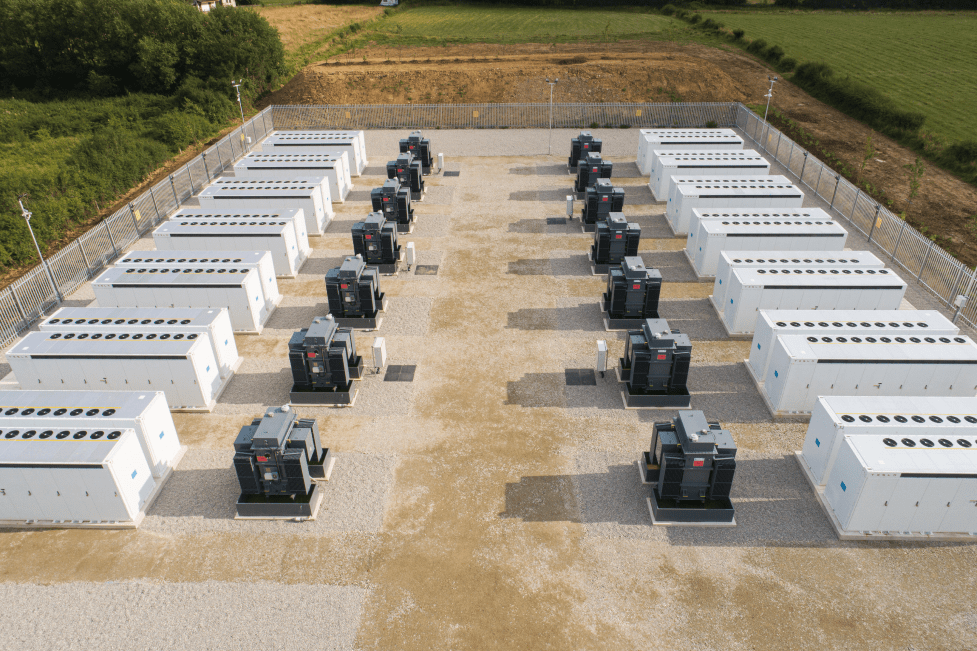

FRV has been working to build out its portfolio of assets in the UK. It currently has five battery energy storage projects in operation, under construction and in development. Collectively these have a capacity of 340MW, including projects it is developing together with Harmony Energy (pictured).

Additionally, FRV signed a £1 billion (US$1.15 billion) partnership with Tyler Hill Partners earlier in October, to create a platform dubbed RV TH Powertek Limited to develop, build and operate up to 1GW/2GWh of battery energy storage system projects in the UK over the next five years.

By Molly Lempriere.

To read the full version of this story visit Solar Power Portal.

31 October 2022: Gore Street Capital’s energy storage fund makes biggest acquisition to date

Gore Street Energy Storage Fund has acquired a 200MW battery storage project in development by Kona Energy.

It marks the stock exchange-listed energy storage investment fund’s single largest project acquisition to date, bringing its total portfolio of contracted or operational battery energy storage system (BESS) assets to 898MW.

The project is in Heysham, Lancashire, and will be connected directly to National Grid’s transmission network. Kona Energy got planning approval in May this year and at the time said the BESS will help increase utilisation of energy from six offshore wind farms, which connect to the grid nearby.

The developer said the asset will also perform reactive power services and provide inertia to support the stability of the local grid. Grid connection and land rights have also been secured and it is expected to be connected to the grid no later than the fourth quarter of 2026. However, Gore Street Capital wants to accelerate that start date, provided that doesn’t bring up the EPC costs of the Heysham BESS.

Gore Street Capital reported surging revenues for its 2021 financial year, as reported by Solar Power Portal in late July. Gore Street Energy Storage fund’s EBITDA went up to £23.3 million as of 31 March 2022, from £2.9 million in the previous year.

It said revenues for battery storage had been more than 68% higher on average in the 2022 fiscal year than in 2021 and O’Cinneide said Gore Street Capital’s strategy of optimising Capex of its portfolio was working to increase “both performance and profitability”.

The CEO, who spoke with Energy-Storage.news about Gore Street’s international expansion in April, also said today that the portfolio benefits from diversification across the four key high-growth markets, adding that the “strategy of avoiding country single risk is clearly of benefit to our shareholders given recent events”. In addition to the Great Britain and Ireland markets, the fund has projects in Europe and the US.

By Andy Colthorpe.

To read the full version of this story, visit Solar Power Portal.

31 October 2022: NextEnergy Solar Fund acquires 250MW ‘strategic portfolio’

NextEnergy Solar Fund has acquired a “strategic portfolio” of battery storage development projects located in a grid-congested area in the East of England.

The solar PV and energy storage investment vehicle said today that it has acquired the 250MW portfolio of two-hour duration (500MWh) battery projects from an undisclosed developer. The value of the deal was disclosed however, at £32.5 million.

With planning permission and grid connection agreements in place, NextEnergy Solar Fund (NESF) gets the development rights, permits and grid connection work for the standalone battery energy storage system (BESS) projects.

NextEnergy Solar Fund (NESF) intends for the 250MW/500MWh project portfolio to be online in 2025. It is expected to perform grid-balancing services, and is also located, like the 200MW project Gore Street Capital’s energy storage fund announced the acquisition of today, in a place on the grid where it can be used to charge from and absorb wind power at times of abundance.

By Andy Colthorpe

To read the full version of this story, visit Solar Power Portal.

Energy-Storage.news’ publisher Solar Media will host the eighth annual Energy Storage Summit EU in London, 22-23 February 2023. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.