The UK will exempt solar PV, energy storage and other clean energy technologies from business rate rises — the charges levied on non-domestic properties to pay for local services — from April 2023.

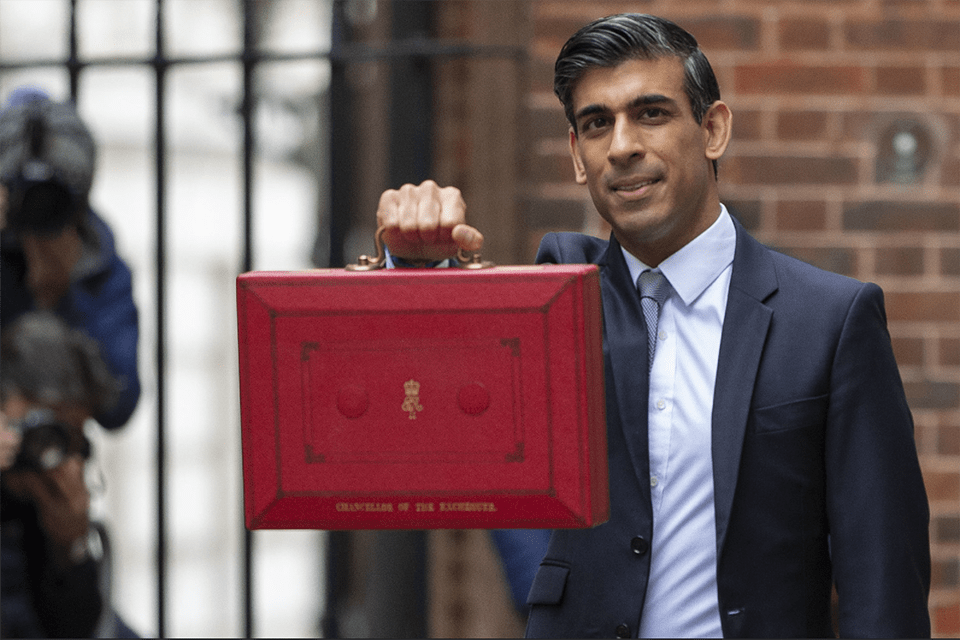

In what has been considered a major victory for the sector, the exemption was revealed as the country’s Autumn Budget was discussed by Chancellor of the Exchequer Rishi Sunak last week.

In a separate policy development, forthcoming tenders for large-scale renewables under the national Contracts for Difference (CfD) scheme will for the first time allow bids to include generation projects colocated with energy storage.

Chancellor Sunak said the Treasury was responding to calls by the Federation of Small Businesses and the British Property Federation by introducing new investment relief to encourage British businesses to adopt green technologies such as solar PV.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The treasury’s official document, the Red Book, confirms this within a section on ‘Warmer, greener buildings’ which states that “the government is providing business rates exemptions and relief in England for eligible green technologies to support the decarbonisation of non-domestic buildings”.

The finer details are laid out in the government’s final report on its review of business rates, also published 27 October and readable here, which states that the government is to introduce an exemption for all eligible plant and machinery used in onsite renewable energy generation and storage from 2023 until 2035.

Eligible technologies include rooftop solar PV, battery storage that is used in conjunction with renewables and electric vehicle charging points.

It represents a major victory for campaigners from the UK solar, energy storage and other clean energy industries who have been calling for such a change for almost five years. At present, a technically in the way business rates are calculated has meant that businesses investing in onsite energy generation have seen increases on rates payable for those investments of up to 500%, a factor which has served as a major deterrent.

Renewables trade associations in the UK have routinely lobbied for the change and last year addressed the Chancellor directly, calling for changes to business rates to reflect the need to decarbonise the built environment.

Madeleine Greenhalgh, policy lead at non-profit clean energy expert group Regen and trade group Electricity Storage Network, added: “The industry has been battling for fairer business rates for some time, so this change is very welcome and will encourage more businesses to invest in rooftop solar and storage. In an otherwise disappointing Budget for net zero, this offers a glimmer of hope and the rectification of a distortion which has penalised businesses who invest in decarbonisation.”

Whilst a major victory for renewables in the UK, the industry was otherwise largely absent from inclusion in Sunak’s budget.

Despite repeated calls from energy industry organisations, the Budget included no commitment to change VAT levels for technologies such as solar PV, heat pumps and domestic batteries. In July, the Treasury had noted that removing VAT on green products could “impose significant additional pressure” on finances.

Further green financing was confirmed, including support for offshore wind, nuclear and carbon capture utilisation and storage.

Within the executive summary, the Treasury wrote: “Taken together, this spending package, along with bold action on regulation and green finance, will keep the UK on track for its carbon budgets and 2030 Nationally Determined Contribution, and support the pathway to net zero by 2050. It does so in a way that creates green jobs across the country, attracts investment, and ensures energy security.”

Colocated projects eligible for government tenders

The eligibility of renewable generation projects paired with energy storage to participated in UK Contract for Difference (CfD) tenders was revealed at a webinar hosted by our publisher Solar Media, last week.

The Low Carbon Contracts Company (LCCC), the UK government-owned private limited company tasked with acting as counterpart to the CfD incentive scheme, said the amendment will be part of the next auction round four (AR4) which takes place on 13 December.

The LCCC’s head of strategy, stakeholders and business development Gordon Edge and head of scheme management Nick Blair discussed the changes.

Previously, CfD contracts specifically prohibited the import of grid energy to co-located storage, unless it was covered under a separate balancing mechanism unit (BMU).

The intention of this policy was to ensure CfD payments were made for grid imported power, with storage just used to export it back into the system, Blair explained as part of the Getting up to speed on CfDs: a discussion on solar power and the coming auction webinar.

As Blair mentioned, the LCCC have previously had feedback showing that this clause is a prohibitor to onsite storage, particularly as it is difficult and cost probative to set up a separate BMU, especially given the challenging business case for storage.

Through the LCCC’s engagement with generators and BEIS, the benefits of co-located solar and storage were made evident, in particular given the growing number of negative price periods. Thanks to the new amendment, storage will be able to be co-located on CfD sites on a bilateral basis.

However, if a generator wishes to disregard the original clause, they must meet a number of criteria.

They must be able to show that only electricity generated by the generating unit would be metered for CfD settlement, and that such metering will ensure the settlement happens at the time of generation.

Finally, generators must confirm that under no circumstance would the generator receive CfD payments for energy exported from their storage facility.

“We haven’t been too prescriptive over a what this [amended contract will] look like,” said Blair, “but what I would say is that we have metering experts who are contracted to us, EMRS, and we will be looking to them to really assist us with those.

“This will be about having a dialogue, about opening the door with us, and asking those questions.”

The full guidance around this amendment should be published in the next few weeks, but has now been agreed and signed off.

It looks set to be a welcome change, with trade association Solar Energy UK’s head of policy Cam Witten commenting in the Q&A segment of the webinar – which was chaired by the association’s CEO Chris Hewett – that concern around the impact of negative pricing on the solar assets had been a driver for interest in co-location.

“So the fact that now with those tweaks, you can disregard the prohibition of co-location if you can demonstrate the appropriate metering arrangements, I think that’s a really welcome change,” he continued. “I imagine that we’re going to see a lot more projects seriously considering storage additionality as part of their proposals.”

The UK hosts the COP26 multilateral climate talks this week, in Glasgow, Scotland.

Budget story by Liam Stoker, CfDs by Molly Lempriere.

These originally appeared as separate items on Solar Power Portal.