The UK government is looking to bring in policy specifically around long-duration energy storage (LDES) by the end of next year.

The move was discussed on the “Financial Returns on Long Duration Energy Storage” panel discussion on Day 2 of the Energy Storage Summit in London last month.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In response to an audience question, Tom Vernon, CEO, Statera Energy said, mentioning his firm’s investment in pumped hydro energy storage (PHES) projects:

“Our investment in PHES is not a ‘bet’ – it’s what the sector needs. The government is indicating it will bring in policy to support LDES by the end of 2024. It’s exploring a cap and floor mechanism. We are working towards our assets being ready for that, but we can make our assets work on a merchant basis.”

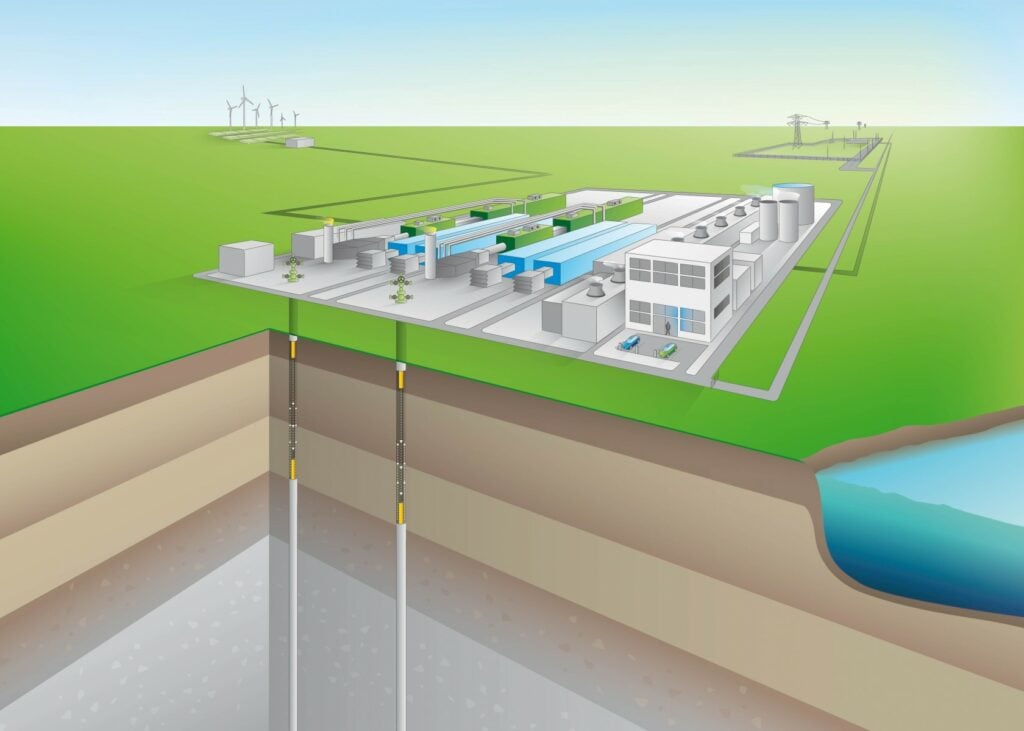

Also speaking on the panel was Ben Francis, director of InfraCapital which has invested in LDES companies EnergyNest (thermal) and Corre Energy (compressed air energy storage or CAES). Corre Energy is deploying a 320MW system for Dutch utility Eneco, which will have a duration of 84 hours, meaning a potential energy storage capacity of around 27GWh.

“Eneco has said that battery storage alone will only allow it to get to 50% decarbonisation. It needs LDES for the rest,” he said.

This is noteworthy considering that it is often said that LDES will be needed at 60-70% renewables, not 50%.

Later on the discussion circled back to cap and floors – such as the well established Contracts for Difference (CfD) scheme – for LDES, on which Vernon added: “I’m not clear on how a CfD works for energy storage. It’s a complex asset that charges and discharges.”

Speaking on PHES and LDES technologies broadly, Robert Hull of Riverswan Energy Advisory said that the market needed to be reformed.

“I don’t see some of these projects making it without financial support or government intervention. We have 3GW of PHES in the UK providing services and trading energy very well. But the big issue is building new ones and getting the capital for it. The market signals are just not there for large flexibility assets. They are ready to go but can’t because of the way the market is designed,” he said.

Independent power producer (IPP) Drax last year announced its PHES projects were contingent on a new market framework for LDES, as reported by our sister site Current. No new PHES projects have gone ahead in the UK since 1984.

Some £68 million (US$80 million) was made available for LDES projects in late 2021 by BEIS, the UK department which was until recently responsible for energy until it was replaced by DESNZ.

Vernon said that the increase of wind power on the grid will drive the need for LDES in the UK because its variations and oscillations are both greater and spread over longer periods than solar PV.

Discussing the broad array of LDES technologies out there, Greg Stevens of Abundance Investments mentioned mechanical energy storage as one area to look out for while Vernon said DESNZ needed to differentiate between LDES technologies when designing policy.

In response to an audience question around pension funds’ appetite to invest in LDES, Hull pointed out that although the 8-10 year project timeline might seem risky, the 50-100 year operational lifetime balanced that out. “That is the right timeframe for that kind of investor.”

Energy-Storage.news this week published a blog covering the five key talking points from the two-day event. LDES, and the US$4 trillion opportunity it is said to represent, was one of those big talking points.

Read more of our coverage from the Summit here. For more information and to register for next year’s 9th edition of the Summit, taking place 21, 22 February 2024 in London, visit the official website.