With Document No. 136 scrapping the mandatory energy storage allocation requirement for renewable energy and the rollout of policies governing new energy storage, China’s energy storage market is going through a period of dynamic change.

Document 136 was a policy note, published in February by state bodies the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA), which promotes market-based reforms for renewable energy. It signalled a shift in the industry away from subsidies and fixed tariffs and volumes towards more market-based competition.

Commenting on the impact of the new policies, Yishu Yan, China utilities and new energy analyst at UBS Securities, noted that China’s battery energy storage system (BESS) industry will nonetheless ride the policy tailwind and benefit from improved returns.

UBS anticipates that more diversified revenue streams, wider peak-valley price spreads, and capacity price mechanisms will emerge as key drivers. The bank’s analysis aligns with the diversified technology pathways and multi-model objectives outlined in the government’s new energy storage policy in September.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Yan noted that the standalone BESS sector in China is expected to become a larger portion of the market than the solar-plus-BESS model as well as adopt a more diversified revenue model.

Standalone BESS can capitalise on auxiliary services, capacity leasing, spot market arbitrage and capacity compensation, which are revenue streams that are relatively less accessible to solar-plus-BESS projects.

UBS estimates that if the peak-valley price spread expands from RMB0.25/kWh (US$0.035/kWh) to RMB0.4/kWh, the internal rate of return (IRR) of BESS projects could increase from 2.5% to approximately 8%. With the addition of capacity compensation, the IRR could potentially rise to around 13%.

She further pointed out that, thanks to the decline in lithium battery costs, the theoretical cost of solar-plus-BESS has reached RMB0.3/kWh in 2025, on par with the cost of thermal power generation.

However, constrained by low utilisation rates and short cycle life (only 248 cycles/year in 2024), the actual levelised cost of storage (LCOS) is significantly higher, estimated at RMB0.4-0.5/kWh. Yet, as standalone BESS utilisation rates improve and grid dispatch is optimised, UBS expects cycle life to extend and LCOS to decline accordingly.

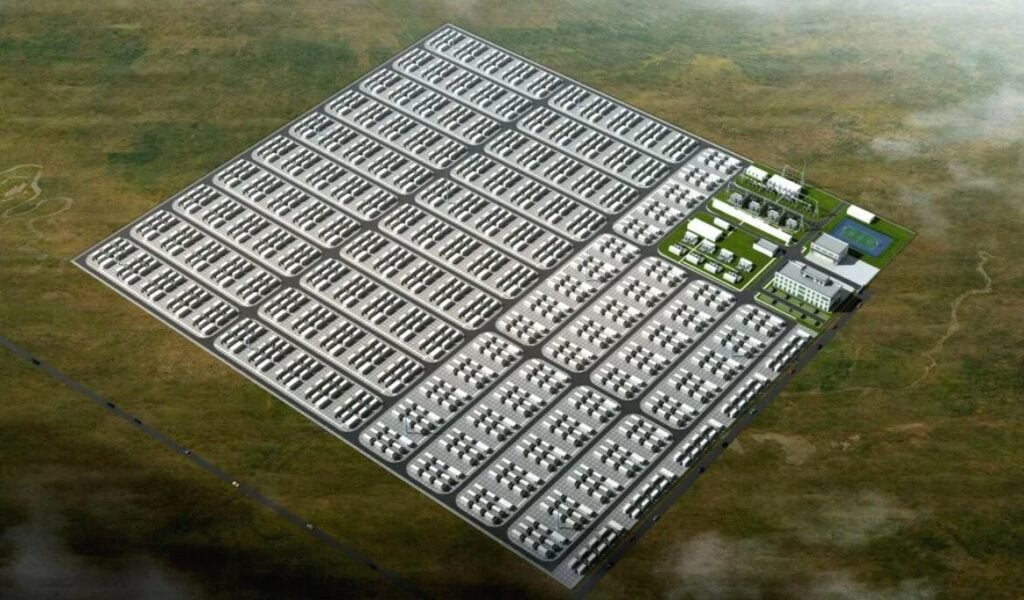

Furthermore, falling costs are likely to boost the economic viability of BESS projects, particularly amid the rapid growth in demand from AIDC (artificial intelligence and data centres) for direct green power connections and off-grid solutions. Such applications are expected to require an energy storage allocation ratio of at least 25-30% and a duration of over 4 hours—demand drivers that could double the need for grid-connected energy storage paired with renewable energy sources.

Drawing on these factors, UBS Securities has upgraded its 2025/26 China BESS installation forecast by 7-19% to 150GWh/232GWh. It also projects a 27% compound annual growth rate (CAGR) for 2027-2030, with installations expected to hit 666GWh by 2030.

Yishu Yan noted that this aligns with UBS’s upgraded global BESS installation forecast for 2025/26, which has been revised up to 276GWh/412GWh, with global BESS installations projected to reach 1,045GWh by 2030.