While market opportunities for energy storage in Texas are considered to be limited, the largest battery project in the state so far, a 42MWh system, has just come online.

Texas has no capacity market payment mechanism, utilities are not allowed to own storage due to competition rules as it is still classed as a generation source and as early as March this year, analysts were saying that frequency response markets for the state’s main network operator, ERCOT, are rapidly reaching its maximum cap.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Thus far, the state has deployed a large amount of wind power generation and some batteries have been deployed at wind farms to limit the curtailment of the generators’ excess energy. However, integrated power company Vistra Energy, identified that some niche opportunities exist to use batteries for the integration of solar energy, while also seeing a half-formed business case for energy arbitrage, charging batteries cheaply with off-peak grid power or renewables.

Located at the 180MW Upton 2 solar plant, West Texas, Vistra Energy’s subsidiary Luminant delivered a 10MW / 42MWh lithium-ion battery system. Upton 2 is capable of generating 200MW during peak solar production hours and the batteries allow some of that extra generation to be captured and then discharged during peak times. The batteries can also be charged with off-peak power from the grid at night, which again can be resold at higher prices when demand has risen. In Texas that’s also likely to include a proportion of wind power, Vistra said. A recent 10MWh project announced by RES (Renewable Energy Systems) for utility CPS Energy also serves a similar purpose.

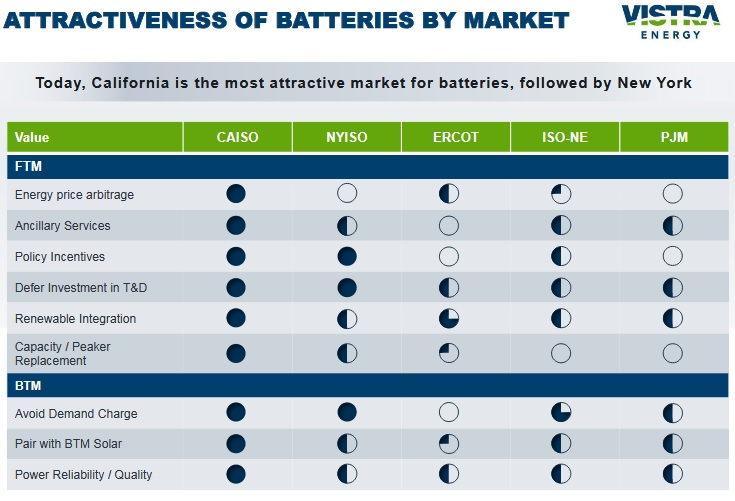

An investor’s note: “Batteries, renewables and electrification of transport” published by Vistra during 2018 shows that the company identified opportunities across a number of service areas of major US transmission network operators, including California’s CAISO, the New York NYISO, Texas’ ERCOT and PJM across 12 states in the Mid-West.

The chart above shows that Vistra sees California as unsurprisingly the market to tick the most boxes. The company is building a 1,200MWh lithium battery storage project in that state but has in Texas also spied opportunities for renewables integration, transmission and distribution (T&D) investment deferral, energy price arbitrage as well as limited chances to serve other applications.

Luminant finished construction on the site before the end of the year and got it connected on 31 December. A company statement said that the project in Upton County is “direct evidence that competitive generators will invest in batteries in Texas when supported by market economics”.

In setting out the business case for the project in its investor’s note, Vistra said it expected estimated unlevered returns from the Upton 2 battery in the mid-to-high teens range. This will come from both energy arbitrage opportunities and from capturing solar generation that would need to be clipped or curtailed otherwise. Using an existing solar plant site meant substation and other associated grid interconnection costs stayed low, while in future the company may be able to integrate the site’s output into its retail product offerings to customers.

In a further boost to its feasibility, the project was able to capture savings through the Investment Tax Credit (ITC) as well as bonus depreciation. In addition, Luminant also received a US$1 million grant from the state of Texas, from the Texas Commission on Environmental Quality under its New Technology Implementation Grant scheme, as part of its overall Texas Emissions Reduction Plan.