Tesla and Sungrow continue to top the Battery StorageTech Bankability Ratings Report, which also shows how revenue, profitability and shipments are trending in the industry, writes Solar Media Market Research analyst Joe Hennessy.

A little over a year after the initial release of the report, for which updates are issued every quarter, this article offers an update on how both the market and the report have evolved compared to last year, providing analysis on the top 15 companies based on the bankability scores within the report.

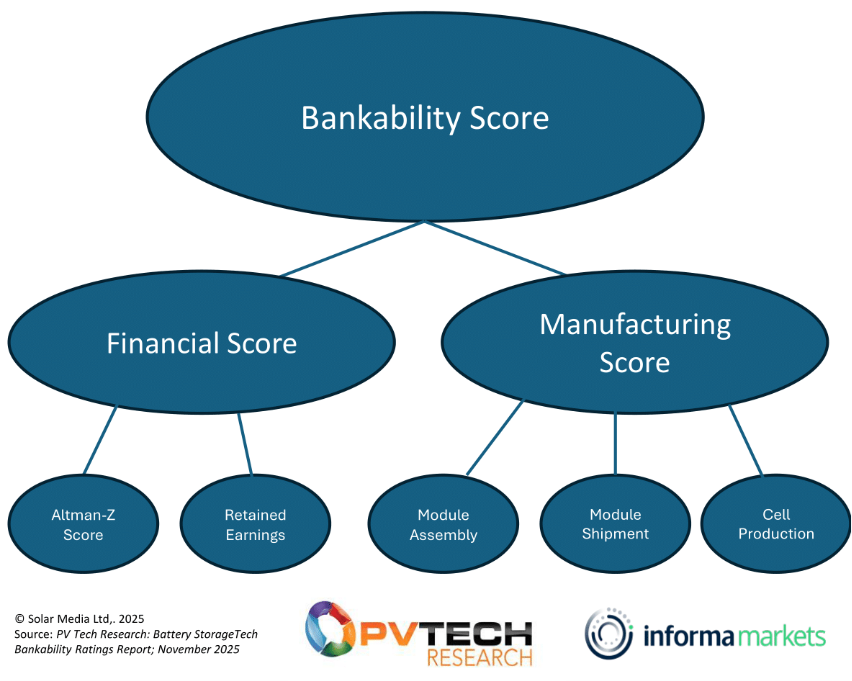

For a quick overview of the Bankability score, Figure 1 shows the direct observables each of the scores are based on. These are then benchmarked against those of other companies in the report to generate an overall score for each company.

The financial score primarily utilises an Altman-Z analysis for each company. This tool was originally developed as a bankruptcy prediction method. However, instead of using the standard safe zones, it is applied within the context of the industry and each company for greater relevance.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The manufacturing score mainly focuses on the shipment and assembly of energy storage system (ESS) modules. An adjustment was made to slightly lower the weight of the cell production score due to the industry’s shift towards a more system integrator model. Although this change had a minimal overall impact on each company’s scores, it reflects the trend of many companies in the business thriving over the last year by purchasing cells for their ESS modules.

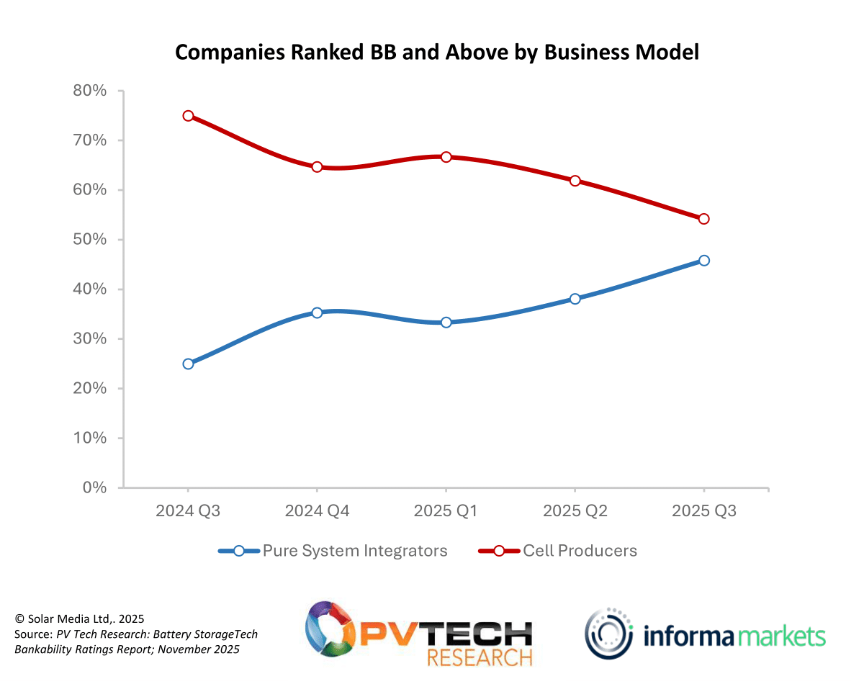

When examining all companies rated BB and above, the first release of the report indicated that almost 80% of the companies were involved in some form of cell production. In contrast, the most recent release, in Q3 2025, shows that this figure is just above 50%. Part of this change can be attributed to the shift in methodology. However, even prior to this change, there was a noticeable trend; for example, in Q2 2025, the percentage was just over 60%.

Additionally, multiple ‘hybrid’ companies – those that both produce and purchase cells for ESS units – are classified as cell producers in this model. This suggests that even more of the higher rated companies are involved in some sort of cell purchasing.

This will be an interesting trend to track, especially over the coming quarters, as the larger capacities of cells start to be utilised in utility-scale developments, by both integrators and suppliers.

Shipment Trends

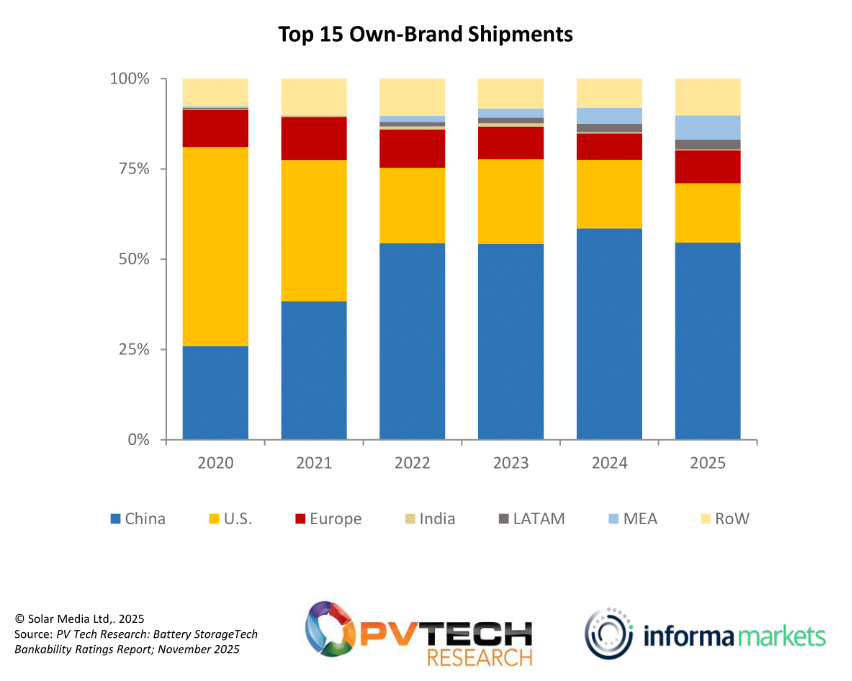

Figure 3 shows the destination for own-brand shipments from the top 15 companies across various regions. Just over 50% of shipments go to China, which is expected, given the size and the presence of many leading companies located in the country.

The data also highlights the emergence of new markets in the Middle East and Africa and Latin America, where there are increasing amounts of large-scale projects and therefore shipments. Given that the sizes of the newer projects are only increasing and the large amounts of money being invested, their proportion of the global market is expected to rise even further in 2026.

The Rest of the World (RoW) segment mainly consists of Australia and other Asia-Pacific countries. Australia is one of the largest developing markets, with multiple 1GWh+ sites expected to be completed in the near future.

While the US remains the second-largest market globally, there has been a slight decline in shipment shares over the past year. This downturn may be attributed to a strategic shift by many top Chinese suppliers, who are actively seeking to expand into other regions to avoid some of the current headwinds in the US market, such as supply chain disruptions, regulatory hurdles, and increasing competition within the sector.

Financial Trends

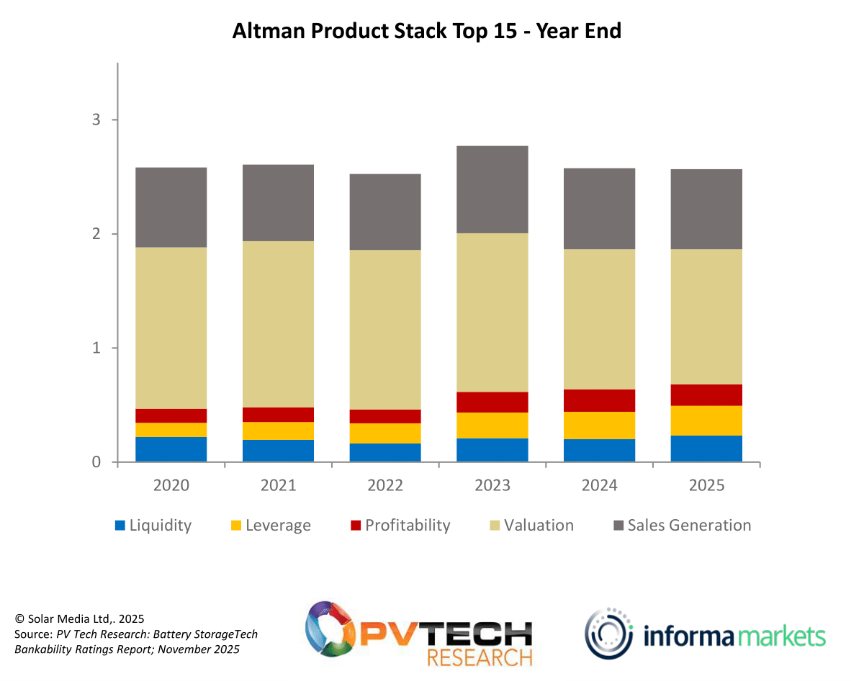

Figure 4 provides an analysis of the average Altman Z-score for the top 15 companies, breaking it down into its various components. The valuation metric continues to represent the largest portion of the overall score, consistent with our results from last year, but this is now at a more realistic level. Since some companies are still quite overvalued, we have continued to make modifications to certain scores using a Price:Sales ratio. This adjustment aims to ensure the valuation component does not overshadow the other critical metrics.

The Altman-Z score is divided into parts, allowing for a clear evaluation of the three key metrics that contribute to a company’s financial health: Liquidity, Leverage and Profitability. The Liquidity and Leverage metrics are trending upwards, increasing over the last three years in the sample, and profitability is staying around the same level. Especially for the cell manufacturers, this could be due to the larger investment in R&D, with many larger capacity cells being announced recently. These metrics consistently staying positive and rising is an excellent sign for the industry.

Tesla and Sungrow, being our only two AAA-rated companies in the report, also have the highest Altman Z-score by a wide margin. Most companies outside of these two, but in the top 15, lie around 2.1.

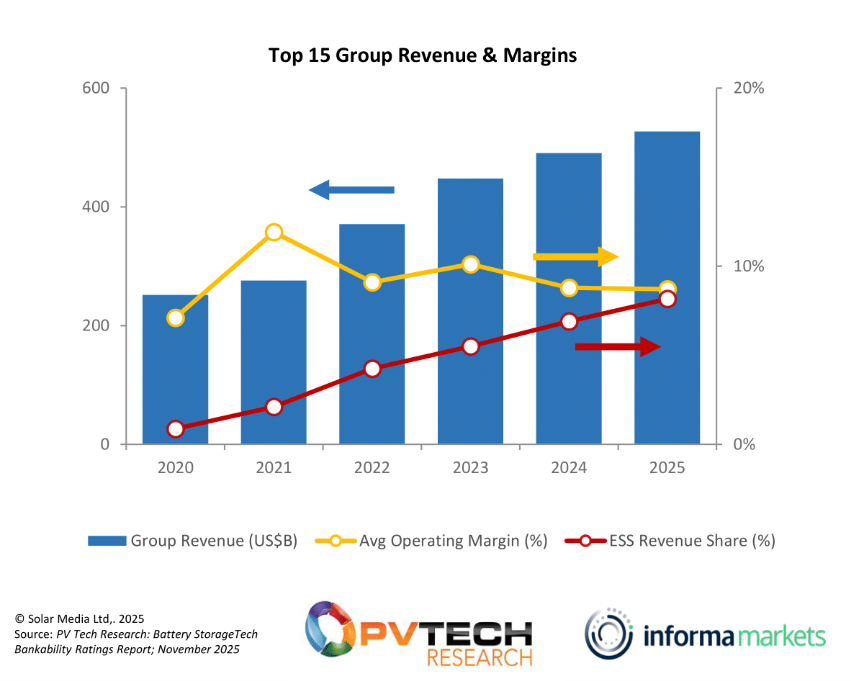

As you might expect from a growing industry, the ESS revenue share has increased every year in the sample. However, the scale of growth has been very impressive, moving from a tiny proportion of most of the larger players’ revenues to a solid percentage in only six years. The companies involved have also had revenue growth every year, with the last two years being a much smaller growth than from 2021 to 2023, the majority of this gap due to BYD’s revenue scaling in recent years.

The average operating margin for each of the companies has remained around 10% over the last few years, with it slightly decreasing after 2023, potentially as a result of the decrease in battery prices in the same period. The peak in 2021 comes from a lot of the larger cell-producing companies in the sample peaking in profitability, as a result of lower lithium and higher battery pricing.

In conclusion, the evolving landscape of the BESS market highlights significant shifts in both market dynamics and company strategies. Tesla and Sungrow continue to lead the industry with their AAA bankability ratings, underscoring their financial stability and manufacturing excellence.

However, the rise of system integrators, coupled with a growing reliance on purchased cells, signals a transformative shift in the industry’s operational model. Emerging markets in regions like the Middle East, Africa, and Latin America are driving new growth opportunities, while established markets like the US face challenges from regulatory and competitive pressures.

Financially, the industry remains robust, with key metrics such as liquidity and leverage trending positively, and revenue shares for top companies steadily increasing. As the sector continues to mature, the focus on larger capacity cells and utility-scale projects will likely shape the next phase of growth, making it an exciting time for stakeholders across the BESS ecosystem.

The learn more about the Battery StorageTech Bankability Ratings Report, or to arrange for a free demo, please contact our team at the link here.