As well as Elon Musk remarking that the company may have had its “best ever quarter” for solar since the SolarCity takeover, Tesla’s energy storage deployments have enjoyed a ramp up, while a fellow exec hinted the stationary battery business is constrained by cell supply.

The solar roof tile remains delayed from reaching volume production until next year. Nonetheless, in an earnings call with analysts, Musk commented that “we saw higher revenues and better profitability in our energy business. In fact, it may have been our best quarter ever for solar”. Tesla CTO and self-professed battery tech fanatic JB Straubel said later in the call that cell supply is “somewhat tight” for the energy business which includes the Powerwall and Powerpack residential and grid storage products.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

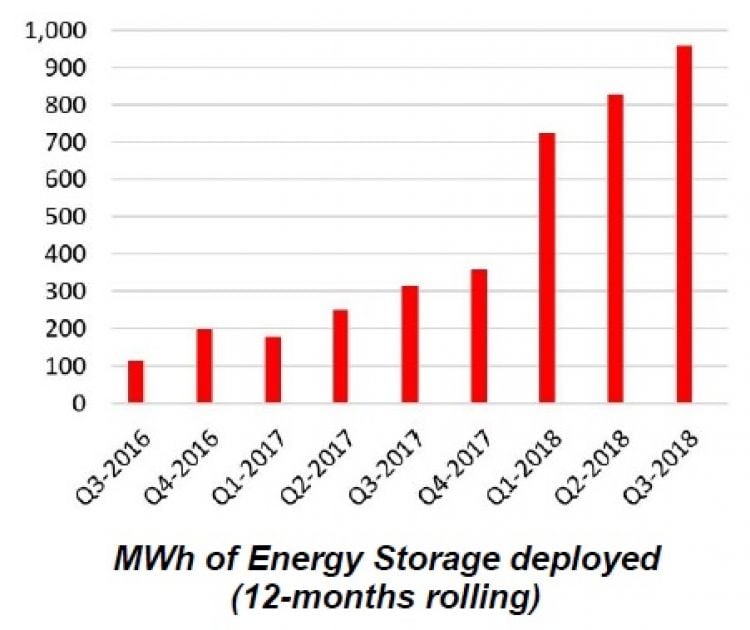

Tesla reported third-quarter energy storage deployments of 239MWh, an increase of 18% from the previous quarter (203MWh) and 118% compared to the prior year period. Energy storage continues to be the major catalyst in the segment revenue growth, which reached the second highest ever level of US$399.3 million. The company touted that due to the storage install growth, tripling of energy storage deployments in 2018, compared to 2017 was on track, despite expected seasonality issues in the fourth quarter of 2018. Supporting the growth claims was the eventual increase at Gigafactory 1 of its Powerwall production in the quarter, which was having an effect on reducing its order backlog.

Energy-Storage.news has reported on several grid-scale projects supplied or soon to be supplied with Tesla’s Powerpack battery systems during the quarter, including a contract to deliver a 52MWh storage system for a 280MW wind farm in Australia, the inauguration of New Zealand’s first grid battery storage facility and an order from Amazon for a 3.77MW system at the retail giant’s ‘fulfilment centre’ in Tilbury, England. Meanwhile the 129MWh battery Tesla put into operation in South Australia a few months ago is reportedly generating healthy revenues as well as network cost savings.

Julian Jansen, senior analyst, Energy Storage at IHS Markit pointed out that “strategically, it's quite simple” for Tesla to serve both the C&I and front-of-meter market segments with the Powerpack, which is scalable to either or both sets of applications. This includes acting as supplier and integrator of Powerpack systems in the US C&I market for projects developed and operated by AMS (Advanced Microgrid Solutions). Jansen said that partnership alone equates to more than 100MWh of operational Powerpacks, based on publicly announced figures from AMS.

Solar performance at peak

Tesla reported third-quarter 2018 total solar installations of 93MW, 11% higher than the previous quarter (84MW), which are the best installation figures since the fourth quarter of 2017, yet lower (107MW) than the prior year period.

Tesla expects solar installations in 2018 to have peaked in the third quarter, guiding lower solar mix and seasonality within its Energy generation segment to be lower in the fourth quarter.

The company claimed that its previous decision in early 2018, to change the way it sold residential PV systems from call centres and third-party leads to mainly online and Tesla automotive stores was working but reducing acquisition costs had been problematic.

However, without providing data, Tesla said: “We have significantly improved the time to install our solar and energy storage products and customers will continue to see faster installation”.

The company also reported that in the third quarter, cash and loan sales made up 80% of residential installations, up from 46% in the prior year and 68% in the second quarter of 2018.

Despite performance, earnings call mostly ignored storage business

There was the opening allusion to improved performance in the energy business and Musk stated later that “we’ve got to continue improving” Powerpack, Powerwall and other energy products. However the earnings call which followed the quarterly results report focused almost entirely on electric vehicles, as might have been expected. Vehicle safety and new autopilot features as well as expected production and sales volumes for the Model 3 and a newer, even more ‘affordable’ car launch next year were all discussed.

Dan Galves of Wolfe Research asked the Tesla representatives whether there was truth in “some noise about” battery cell supply being “tight” and whether “demand is outpacing supply”. Galves went on to ask what Tesla’s long-term expansion plans were, including thoughts on cell supply from China.

JB Straubel replied that there had been one brief period in the quarter when “supply was fairly tight” for Model 3 production, but that production had not been constrained in any meaningful way. Musk interjected that it had been less than a week of delays, which Straubel confirmed to be “a few days”.

“The impact was largely felt on the energy products,” Straubel added.

“And that still is somewhat tight. But we do, as we've pointed out in previous discussions, we do have third-party supplies of energy cells.”

Moving on, supplies from partner Panasonic are expanding. Straubel mentioned one cell production line which has just gone live, plus “another line coming on and then one other after that” while existing lines are “continuing to improve” their productivity.

CFO Deepak Ahuja and Musk did some quick arithmetic to claim that just over half the lithium-ion batteries tracked globally that went into EVs made in the last quarter – about 19GWh or 20GWh according to Ahuja – were in Tesla vehicles. Musk added that long-term, cell supply “would be produced in China. Short-term, we’re not certain of the short-term situation, but long-term certainly”.

Additional reporting by Mark Osborne.

Conference call transcript by Seeking Alpha and audio via Tesla.