It’s still to early to see the financial impact on energy storage suppliers in the wake of Trump’s tariffs and legislation, writes Solar Media analyst Charlotte Gisbourne, analysing their H1 revenues.

This year has seen strong uncertainty around the future of the US clean energy industry in the wake of new tariff announcements and legislation. However, as negotiations are still ongoing, the US-China tariff truce granted another extension by Trump in August, and the long timeline of developing renewable projects, the energy storage suppliers based overseas have yet to see any major financial difficulties.

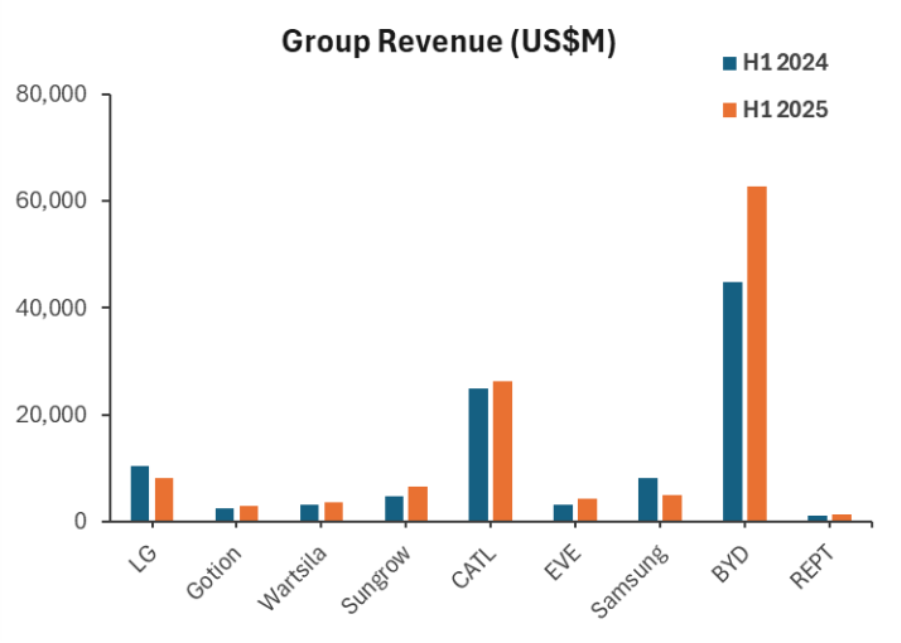

Fig 1. Korean companies saw a decline in group revenue as other suppliers continue to see growth.

The only two companies that reported a decline in year-on-year revenue were South Korea-based LG Energy Solution and Samsung SDI, both of which mentioned sluggish EV demand as a contributing factor. These companies strongly depend on the US market and key deals with American automakers, who may have been more cautious in procuring batteries during the first quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, South Korean battery manufacturers could be set to benefit in the near future with tariffs being currently set at 15%, shifting and EV battery imports away from China. In regards to energy storage systems, both LG Energy Solution and Samsung SDI have a notably larger exposure to the American market compared to the other suppliers in the graphic, leading them more susceptible to any turbulence in market sentiment in the country.

While energy storage adoption has been on the rise in recent years and share of energy storage revenue trending upwards, it is not the main source of revenue for companies featured in the infographic. EV batteries is what tends to take the top spot, particularly with cell manufacturers.

The companies with the highest year-on-year revenue growth were Sungrow and EVE Energy at 40% and 30% respectively. Despite EVE Energy shipping 28.71 GWh of ESS batteries compared to 21.48 GWh of EV batteries, ESS revenue was only 80% of EV revenue and the company marked a decrease in gross margins for energy storage. CATL also saw a slight decrease in ESS revenue of 1.4%.

Price competition and fluctuating raw material costs could be tightening profit margins for both businesses; BYD’s profits dropped 29.9% year-on-year in Q2, although more attributed to its automobile division. For Gotion, despite energy storage revenues increasing, the proportion to overall revenue fell along with gross margins falling 3.21%.

Although Sungrow also saw a minor decrease in gross margins for energy storage systems, the company’s ESS revenue leaped 127.78% year-on-year. The company benefited from a strong global presence, expanding into new regions, and being an early mover into emerging markets. It was the largest BESS provider globally in H1 2025 according to Rho Motion, ahead of Tesla.

Sungrow’s domestic revenue only accounted for 41.8% in H1 2025, a clear difference between the company and other Chinese suppliers which tend to rely more heavily on domestic sales.

CATL’s overseas revenue for example was only around 34%. In general, overseas revenue for Chinese ESS suppliers has been increasing, with BYD’s overseas revenue increasing 50% year-on-year for the whole company, as the global market grows and domestic competition remains fierce.

The financial position of energy storage companies based in the US is fairing slightly worse than those abroad. Tesla, a key player in the market, saw its revenue fall 11% yoy, primarily driven by the decline in EV sales, and total energy storage shipments declined 8% from Q1 to Q2 2025. Powin, a company whose business was primarily in the field of energy storage, filed for bankruptcy earlier this year under the industry headwinds of tariffs and supply chain disruptions.

Powin’s business model of acquiring third-party cells, typically from China, is one often used by American ESS suppliers. The heavy reliance of outsourcing does tend to leave the companies open for more risk, especially in times of ongoing trade negotiations. Fluence saw this earlier this year when the company decided to halt some contracting activities in light of the tariffs and saw its revenue for the nine months ending 30th June 2025 down 16.9%.

Altman Stack

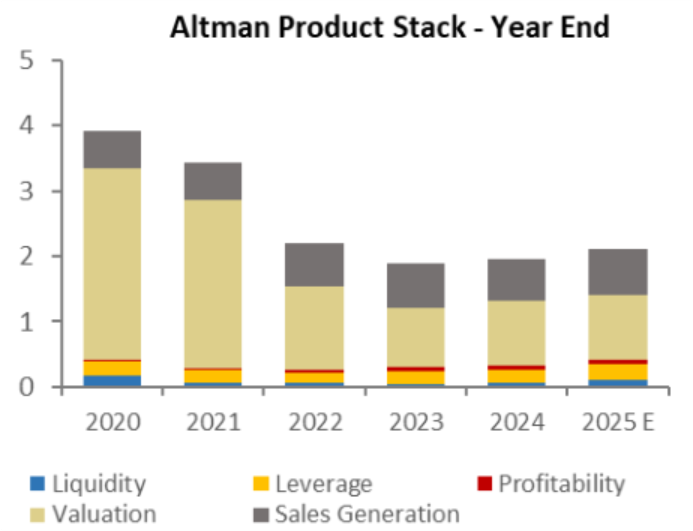

Fig 2. Suppliers are seeing an improved financial position with stronger investor confidence.

The graphic above shows the Altman Z-Score of the companies shown in Fig 1, where their financials are amalgamated into a single company, estimated to year end. The key liquidity, leverage and profitability ratios which looks at cashflow, debt, and the ability to generate profit, are predicted to not only remain positive but slightly increase.

On the whole, these companies are set to continue their strong balance sheets with year-on-year operating cash flow increasing for CATL by 31% and Sungrow by 100%. Capex is on the whole declining for several of the companies, with Samsung SDI’s capex to revenue down from 34% for FY2024 to 25% in H1 2025 and REPT Battero also seeing a decline from 21% to 11% for the same time period.

Overall, the companies looked at in this article are among the top non-US energy storage suppliers and signs of financial struggle could mark a struggle for the global ESS market. But despite the uncertainty around US tariffs, one of the largest end markets for energy storage, revenue for most leading suppliers is continuing to grow.

However, it is still early days with the effects of the One Big Beautiful Bill act not yet coming to pass. Integrator Wärtsilä marked an 82% decline in order intake in the first half of the year compared to the same time last year and REPT Battero remarked on overseas customers pausing orders for battery components. While group revenues are not yet affected, time will tell if this has a significant impact.

The data for this article comes from the Battery StorageTech Bankability Ratings Report, which provides a detailed analysis of each company. For more information, don’t hesitate to get in touch with the team here.