There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy demand. Andy Colthorpe speaks with companies working to establish a framework of opportunities in the region.

This is an extract of an article which appears in Vol.33 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Almost all Southeast Asian countries have experienced a doubling of their GDP since the turn of the millennium and seen their energy demand increase by around 3% every year in that time, according to the International Energy Agency (IEA).

The IEA’s 2022 Southeast Asia Energy Outlook reported that under stated policies by the ten countries in the ASEAN region, three-quarters of that increasing demand will be met with fossil fuels, leading to a 35% increase in CO2 emissions.

However, with six of those countries now committed to a future net zero target date, renewable energy buildout is set to accelerate. In a scenario where global warming is restricted to “well below 2°C” within the aims of the Paris Agreement, Southeast Asia countries must deploy around 21GW of renewable energy each year to 2030 and about a quarter of cars sold must be electric vehicles (EVs).

Under that Sustainable Development Scenario (SDS), wind and solar PV reach an 18% share of generation by 2030 and 44% by 2050. To integrate these higher shares at lowest cost and balance the system flexibly, that could equate to a need for about 45GW of energy storage.

‘Very big need for energy storage systems’

“For all of these countries, we see that there is going to be a very big need for energy storage systems,” Frederic Carron, VP for the Middle East and Asia region at Wärtsilä Energy.

“Most people have a feeling that yes, energy storage is going to be part of the solution, but they don’t know exactly what benefit it is going to provide in terms of emission reduction, plus also in terms of overall system cost benefit.”

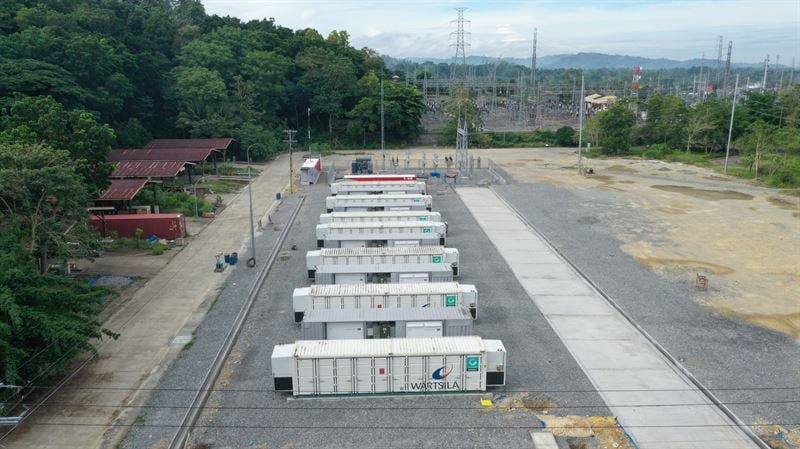

Wärtsilä has delivered a number of projects in the region, including Singapore’s first-ever pilot grid-scale battery energy storage system (BESS) and several large-scale projects in the Philippines, building on the company’s existing presence as a provider of flexible engine power plant solutions.

Wärtsilä is also among the international players to have been awarded projects in Taiwan, not one of the ASEAN countries, but often included in considerations of the Southeast Asia region. In studies of its own, Wärtsilä modelled the power systems of three key ASEAN countries, the Philippines, Vietnam and Indonesia. Wärtsilä inputs the targeted net zero date as well as the current power generation portfolio in place for a territory in its power system studies.

For example, Luzon, the largest and most populous island of the Philippines, would only reach 26% renewable energy by 2030 and 34% by 2040, under a national Power Development Plan.

That’s far short of the 35% and 50% called for by the Philippines’ National Renewable Energy Program 2020-2040. As well as faster buildout of renewable energy, Luzon will need about 6GW of energy storage, according to Wärtsilä’s study.

So how has the market progressed so far? There has been a real “uptick in investments” in the past couple of years, George Garbandic, principal consultant and energy storage lead for DNV in the APAC region, says.

DNV entered the region about eight years ago as an “exploratory presence” and focused on market-making activities. An unknown field at the time, the market lacked investment funds, developers and off-takers making a concerted effort to get into energy storage.

“The real uptick in investments into BESS projects, I’m talking about real commercial projects with solid financial fundamentals, came about three to four years ago and in the last two years, it is going exponentially up,” Garabandic says.

It’s still not at the same sort of level seen in the US, in Europe, or even in Australia nearby, but year-to-year growth in the market has been “like crazy”, he says.

Those countries include Vietnam, Thailand, Taiwan, Philippines, Singapore, Malaysia and Indonesia. That growth is distributed quite equally throughout the region, although each country comes from a very different starting point.

What’s missing?

The main market barriers are similar to what was first seen in now more mature energy storage markets – battery storage is a relatively new technology that was never factored in when it came to grid or energy capacity planning in the past.

“We still need a unifying and a firm grid interconnect norm, which is valid for every single large utility-scale renewable project in Vietnam, in Thailand, in Taiwan, in any one of these countries that has reached the limit for hosting capacity of renewables,” Garabandic says.

“Once this is available, then potential investors will look at these new interconnect norms, that will encompass some level of dispatchability of renewables, and based on these norms, they will provide the necessary storage capability within their renewable parks and maintain compliance.”

Institutional investors still not ready

A year and a half ago, at the Solar and Storage Finance Asia conference hosted by our publisher Solar Media, Alexander Lenz, CEO of Aquila Capital’s APAC business said the industry should be proactive in offering input to regulators and other stakeholders in Southeast Asia.

With grids in ASEAN countries dispersed around many islands and less interconnected than other parts of the world, energy storage presents an excellent opportunity to keep networks stable while integrating higher shares of solar PV and wind.

However, as Lenz said at the time, under the current regulatory environment energy storage can’t generate the revenue streams to give investors certainty, and grid operators in the region need to understand how different storage applications and technologies can benefit their networks.

Aquila Capital invests in sustainable infrastructure including renewable energy on behalf of institutional investors.

“We wish we could say that the permitting and regulatory environment for renewables has massively shifted in the last 12 months, but unfortunately, we are still facing many of the same headwinds we did in ASEAN a year ago – namely a challenging permitting, regulatory and policy environment and now with the added macroeconomic pressures of rising material costs, inflation and supply chain challenges,” Alexander Lenz said when approached for comment.

But despite those challenges, Lenz says he has “no doubt” battery storage will be critical to balance the load across grids and handle the intermittency of renew able generation and is hopeful this will be the case in the ASEAN region too.

“With a surer picture of the boundary conditions around any investment or project in ASEAN, we would be more than happy to take on the required risk to build the needed battery energy storage capacity across the region,” Lenz says.

This is an extract of an article which appears in Vol.33 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Asia, 11-12 July 2023 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.