Thousands of residents of social housing in Adelaide, South Australia, will get Tesla PV panels and battery storage in their homes if they join a virtual power plant (VPP) project run by the state.

Creating the VPP – where thousands of small-scale solar-charged battery storage systems are aggregated together and centrally controlled to effectively perform the same tasks an old-fashioned centralised power plant might serve such as balancing the electricity network – has been an ongoing effort since 2018.

The Australian Renewable Energy Agency (ARENA) has helped provide AU$8.2 million (US$5.93 million) towards the total AU$60.6 million cost of rolling out the VPP to include 50,000 homes by 2022. This equates to around 20MW of generation and 54MWh of battery storage. Tesla itself is contributing AU$18 million of equity, the government Clean Energy Finance Corporation is providing AU$30 million in debt funding and the project is also being supported by the state of South Australia’s Grid Scale Storage Fund.

So far, Tesla has installed just over 1,000 solar and battery storage systems for the project. Last week ARENA said that among those 50,000 homes will be 3,000 units of social housing. Tesla will offer a system including 5kW of PV panels and 13.5kWh battery storage systems at no upfront cost to households. Those households then continue to pay for the electricity via monthly bills, but according to ARENA will see their electricity costs fall by 22% compared to a standard tariff offered by the local ‘green’ energy provider, Energy Locals.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

A report was released earlier this year on the VPP by the Australian Energy Market Operator (AEMO), which covers large portions of the south eastern and western parts of the country. The report gave an assessment of the first six months of operation of the VPP from July 2019 to the early part of this year, finding that the home batteries delivered significant revenues and helped maintain stability of the grid by responding to frequency deviation events as well as to energy pricing signals.

At one stage in January 2020, after a freak storm literally flattened transmission towers, the VPP earned more than a million dollars in under two weeks. The benefit to individual households could also be seen to pen out at something close to AU$3,000 per year, meaning that enrolling in VPPs could potentially give solar-plus-storage systems a payback time of less than seven years.

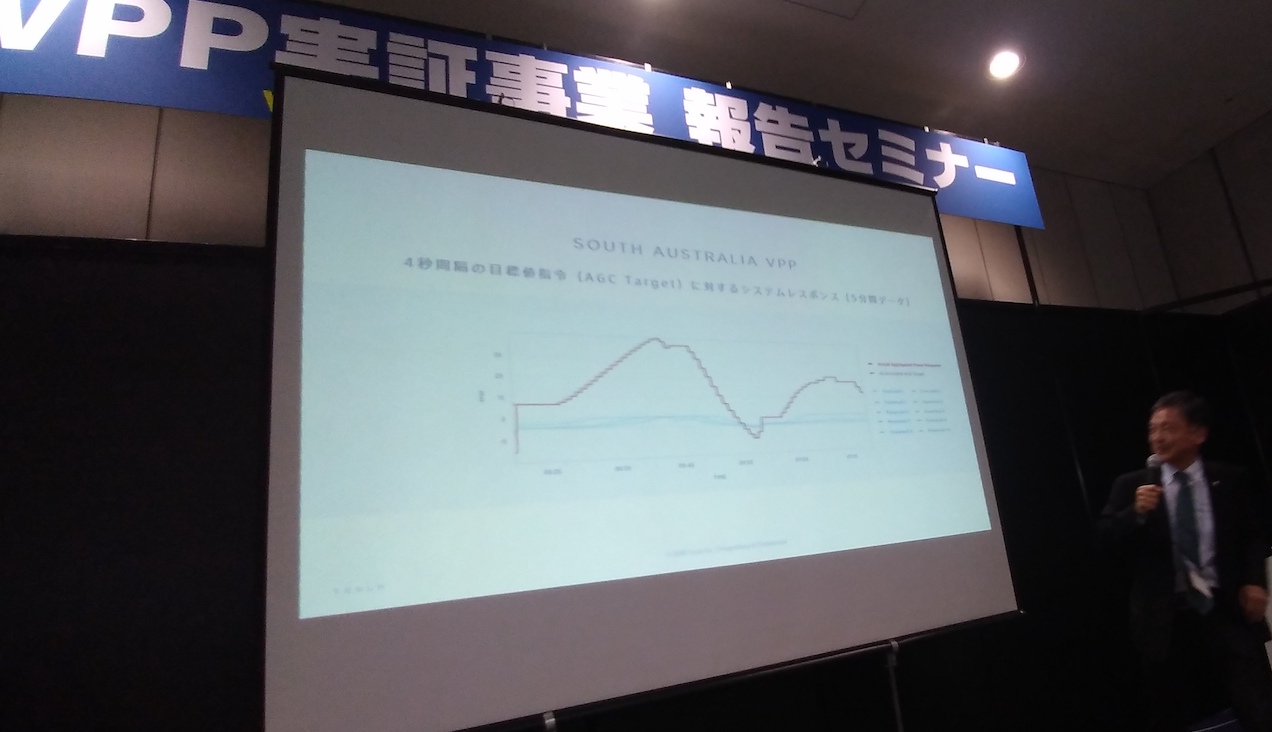

VPPs are now being rolled out across Australia by parties including major utility AGL, while besides Tesla, other equipment providers and system integrators including Sonnen and SolarEdge are getting involved. They are also starting to catch on in other parts of the world, with Sonnen announcing what is thought to be its biggest such project to date, a 60MWh VPP in California, a few days ago. Tesla is also thought to be targeting the scale-up of VPP projects, with a company regional manager giving a presentation in Tokyo earlier this year on the South Australia project and the potential for replicating the VPP concept globally.