Several Chinese companies active in the energy storage space have recently released their financial reports for H1 2025, with the majority posting strong growth. Their energy storage business segments have been a key driver of that growth.

Of 55 listed Chinese companies in the energy storage sector, 47 were profitable, with 31 reporting year-on-year growth in net profit attributable to shareholders according to data for the first half of this year on Chinese financial data platform, Wind.

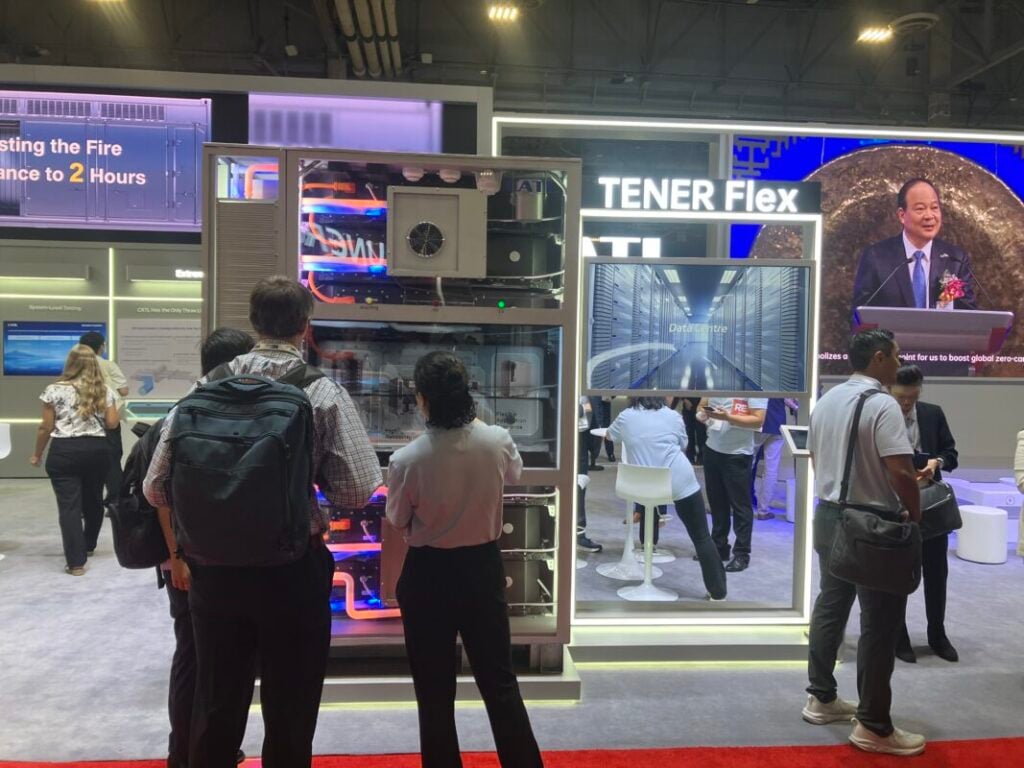

According to the financial reports, CATL reported operating revenue of RMB178.886 billion (US$25.15 billion) in the first half of the year, a 7.27% increase year over year. Its net profit attributable to shareholders stood at RMB30.485 billion, up 33.33%.

The company stated in its interim report that the sustained rapid growth in demand for energy storage cells, fueled by clean energy transition goals worldwide, has been a key factor driving its performance.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Sungrow recorded an operating revenue of RMB43.533 billion, a year-on-year increase of 40.34%. Its net profit attributable to shareholders reached RMB7.735 billion, surging 55.97% year-on-year. In particular, the energy storage business showed robust growth, generating revenue of RMB17.803 billion, up 127.78% year-on-year.

Meanwhile, the energy storage battery business became the fastest-growing segment for Deye. In the first half of this year, Deye recorded an operating revenue of RMB5.535 billion, a year-on-year increase of 16.58%, and net profit attributable to shareholders of RMB1.522 billion, up 23.18% year-on-year. Specifically, the energy storage battery business contributed revenue of RMB1.422 billion, an increase of 85.80% year-on-year.

Moreover, the proportion of revenue from energy storage businesses at other Chinese companies such as REPT BATTERO, Eve Energy, and CLOU Electronics continued to rise, gradually becoming core pillar operations.

For example, nearly half of CLOU Electronics’ revenue in the first half of this year came from its energy storage business, amounting to RMB1.282 billion.

CALB’s energy storage business has also emerged as one of the most prominent bright spots in its profit growth. According to the announcement, in H1 2025, the company’s revenue from energy storage products and other related businesses reached RMB5.757 billion, surging 109.7% year-on-year, far outpacing the 9.7% growth of its battery revenue.

Meanwhile, the gross margin of CALB’s energy storage business is substantially higher than that of traditional batteries. Its revenue contribution rose from approximately 25% in 2024 to around 35% in H1 2025, directly boosting the overall profit margin.

Despite facing challenges in its PV business that led to a year-on-year decline in its overall net profit, Canadian Solar saw its energy storage segment grow, providing crucial support. Revenue from energy storage products amounted to approximately RMB4.43 billion, accounting for about 21.04% of the company’s total revenue for the period, registering year-on-year growth.

In terms of cell shipments, according to disclosed interim reports from some other Chinese players:

– Eve Energy shipped 28.71GWh of energy storage batteries in H1 2025, a year-on-year increase of 37.02%.

– Sunwoda shipped 8.91GWh of energy storage products, soaring 133.25% year-on-year.

– Narada Power shipped 4.2GWh of energy storage products in H1 2025, up 110% year-on-year.

At the investor exchange meeting, Zhiguang Electric stated that the company has a sufficient backlog of energy storage orders. Zhiguang Storage has secured orders totalling over RMB1.8 billion. Since April this year, its production base has been operating at full capacity, and its annual delivery volume is expected to hit a new record high.

Narada Power also stated that the company currently has 7.8GWh of undelivered orders for large-scale energy storage projects, of which 2.3GWh are destined for overseas markets. Its key overseas markets include Australia, Europe, the United Kingdom, the Middle East, and other countries and regions.

Energy storage no longer just a ‘supporting player’

According to data from the China Energy Storage Application Branch, Chinese energy storage companies secured 199 new overseas orders in H1 2025, with a total capacity exceeding 160GWh, representing a year-on-year increase of 220.3%.

Companies including Sungrow, Hithium, and Cornex have secured large orders in markets spanning Europe, marking notable progress in their global expansion efforts.

The increase in orders has driven up the prices of cells. According to statistics from China Nonferrous Network, from June to July 2025, energy storage cell prices rose steady, with mainstream models (e.g., 280Ah, 314Ah) seeing a cumulative increase of 10%-20%.

Meanwhile, the rebound in lithium carbonate prices provided cost support, fuelling a notable upward trend in energy storage cell prices since June. Currently, prices have climbed from 0.25 yuan/Wh to over 0.27 yuan/Wh.

Feng Siyao, Deputy Secretary-General of the Energy Storage Application Branch under the China Industrial Association of Power Sources, stated that the rapid growth in energy storage demand is no accident but rather an inevitable outcome of the combined impact of policies and market mechanisms.

Energy storage has truly evolved from a passive “supporting player” in the past to a market-driven stage, with enhanced profitability and increased certainty. Capacity compensation driven by policies and market-based peak-valley price arbitrage have emerged as two scalable profit models.

Feng believes that surging demand in Europe and the United States, driven by policy incentives, rapidly expanding markets in the Middle East and Australia, and the unlocking of significant potential in emerging markets such as Southeast Asia, Central Asia, Africa, and Latin America are making the global growth trajectory of the energy storage industry increasingly clear.

Overall, global energy storage is expected to maintain an average annual growth rate of around 30% over the next three years, Feng said.