Samsung SDI is ramping up its manufacturing of energy storage batteries in the US to 30GWh by the end of 2026, while electric vehicle (EV) battery demand remains sluggish.

The South Korean battery, materials and energy storage manufacturer’s drive to capture market share in the US stationary battery storage market comes as Chinese manufacturers that dominate the space are expected to find supplying into the country a more challenging prospect due to this year’s policy upheavals.

Samsung SDI, which has Samsung Electronics as its biggest shareholder with 19.58% ownership, reported its third quarter 2025 (Q3 2025) financial results last week (28 October).

It reported KRW3.05 trillion (US$2.13 billion) revenue for the three months, marking a year-over-year fall of 22.5%. Meanwhile, both operating income and EBITDA figures turned negative, with KRW591.3 billion operating loss and EBITDA of KRW-77 billion reported.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company attributed a 23% decrease in revenues in its battery business, from KRW3,672 billion in Q3 2024 to KRW2,820 billion, to slow EV battery sales. Quarter-over-quarter, the deficit worsened due to a continued fall in sales, as US tax credit incentives for EV purchases ended in September.

Samsung SDI is putting energy storage system (ESS) sales at the heart of its turnaround strategy, particularly in the US. That said, in European Union (EU) markets, the company still intends to capitalise on an expected peak in demand for EVs towards the end of the year. Indeed, the company signed more than 110GWh of supply contracts with automotive manufacturers during the quarter.

South Korean battery makers chase FEOC advantage

US battery storage projects still qualify for investment tax credit (ITC) incentives. However, new provisions introduced with the One, Big, Beautiful Bill Act (OBBBA) budget reconciliation legislation mean developers receiving material assistance above a certain threshold from foreign entities of concern (FEOC) companies will be unable to avail of the capex subsidies.

FEOC restrictions will apply to Chinese, Iranian, Russian and North Korean entities, and of course, in the battery space, that effectively means China, given the industry’s heavy dependence on the East Asian powerhouse for everything from materials processing to finished products.

Rules introduced under the Biden Administration already awarded a domestic content bonus for ITC-eligible projects, and ultimately, the US government wants to see the market served overwhelmingly by products made domestically.

Samsung SDI’s fellow South Korean rival LG Energy Solution (LG ES) has announced an uplift in ESS battery sales that helped keep the company’s most recent quarter profitable, even as EV battery sales slumped for LG ES, too.

South Korean companies, which had already invested in EV battery lines in the US, now hold the cards with a first-mover advantage to supply the energy storage market by retooling those EV battery factories.

The difference between them is that LG ES has already got ESS battery cell production lines up and running in the US, at its factory in Holland, Michigan. These lithium iron phosphate (LFP) production lines were repurposed from producing nickel manganese cobalt (NMC) cells for electric vehicles.

LG ES aims to have 17GWh of annual production capacity across four lines in Michigan by the end of this year and 30GWh within the US by the end of next year, meaning that from a relative standing start, Samsung SDI plans to achieve a similar level of production much faster. SK On is pursuing a similar strategy of investing in US production of LFP cells.

Tesla deal reports, NCA cell production already underway

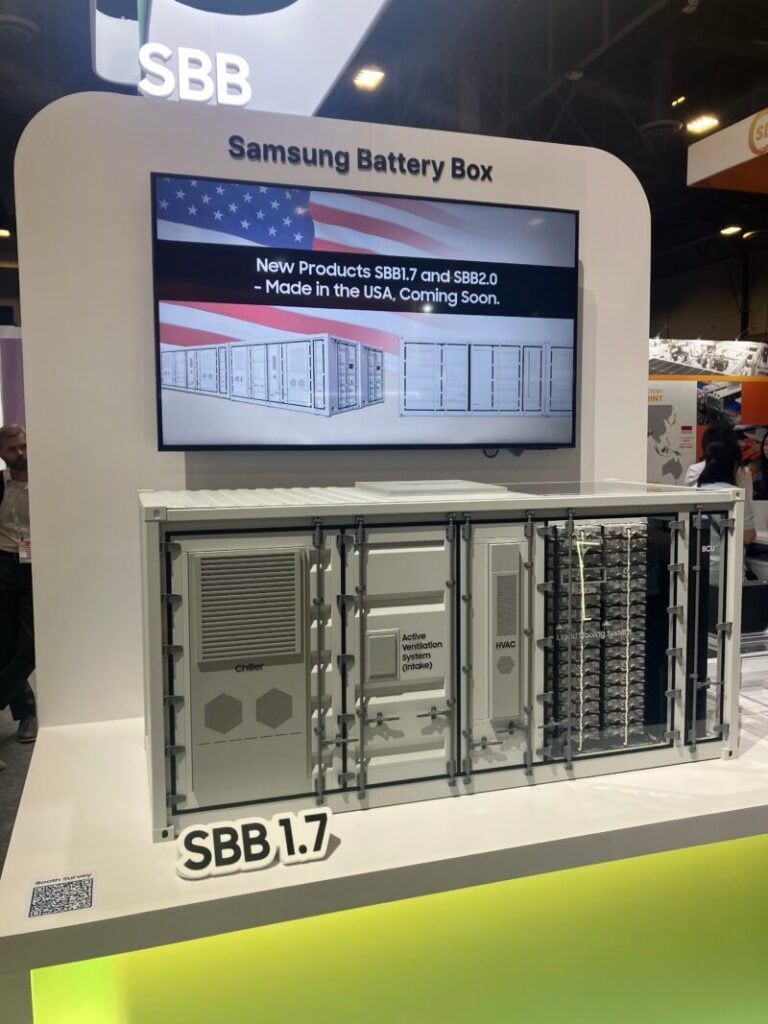

In September, at this year’s RE+, the biggest clean energy industry event in the US, Samsung SDI debuted two battery energy storage system (BESS) products it will make within the country, Samsung Battery Box 1.7 (SBB 1.7) and SBB 2.0.

Both are 20-foot containerised BESS solutions, but SBB 1.7 is a 6.14MWh high energy density system utilising nickel cobalt aluminium oxide (NCA) battery cells and SBB 2.0 uses LFP cells. Although Samsung SDI did not offer a capacity for SBB 2.0 in launch materials, some sources speculated that it would hold a similar capacity to SBB 1.7.

SBB 1.7 will come onto the market sooner than its LFP counterpart. The company said in its results release that local production of NCA batteries already began last month at a factory in Indiana, through StarPlus Energy, a joint venture (JV) with auto OEM Stellantis.

Mass production of LFP batteries will begin this quarter. Samsung SDI highlighted its position in the market as the only non-Chinese manufacturer of prismatic LFP cells, which would mean its cells could be a simpler drop-in solution for system integrators used to working with Chinese suppliers.

Earnings improvement is expected in the fourth quarter, according to Samsung SDI, driven by growth in EV demand in Europe and ESS demand in the US.

This morning, newspaper The Korea Herald and news agency Reuters both reported that the company is in talks over a multi-year, multi-gigawatt-hour stationary energy storage battery supply deal with Tesla.

Each news outlet cited anonymous sources familiar with the matter, and the news follows a recent unconfirmed report that Tesla struck a similar deal with LG Energy Solution. Tesla’s energy storage business is more exposed to US-China trade tariffs than its EV segment, as its EV batteries are made in-house in the US and ESS cells are purchased from overseas third parties, including a majority of Chinese suppliers.