Energy storage can enhance the reliability and lower the costs of operating and maintaining Ontario’s electricity distribution network, but current rules and regulations make that tricky.

Batteries are being seen as a useful tool to help add flexibility to electricity networks and at transmission and distribution (T&D) grid level are often described as “non-wires alternatives” (“NWAs”) to expensive investment in new infrastructure.

However, according to a new report from the trade association Energy Storage Canada, local distribution companies (LDCs) in Ontario are finding “several legislative and regulatory barriers” to deploying energy storage as NWAs and from recovering the costs of investing in them.

In a Guest Blog for this site last week, Energy Storage Canada executive director Justin Rangooni wrote about how energy storage is a proven technology class that can provide peaking capacity, flexibility in operations and enhance the reliability of networks for LDCs, which operate as regulated utilities.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Rangooni noted in his blog that many of the costs associated with investment in energy storage can be offset if storage technology – so versatile that it is often compared to a multi-purpose ‘Swiss Army Knife of the grid’ – would be allowed to earn from multiple revenue streams.

In other words, while being used for the LDCs’ purposes as NWAs, the storage systems could also earn revenues from the wholesale market, for example.

This market participation would also be compatible with the regulator Ontario Electricity Board’s 2021 instructions that distribution companies should utilise technologies like energy storage, energy efficiency and demand response to address their system needs and “avoid or defer” the need to invest in T&D infrastructure.

The OEB has said it is open to allowing LDCs to find new ways of cost recovery and risk allocation and that the utilities should be allowed to participate in the wholesale market.

Meanwhile Ontario energy minister Todd Smith has explicitly said that policies supporting NWAs versus traditional forms of investment “will be essential in maintaining an effective regulatory environment amidst the increasing adoption of Distributed Energy Resources (DERs)”.

However, other codes and guidelines that OEB currently has in place, as well as government regulations, are preventing this from happening, as yet.

Energy Storage Canada commissioned consultancy Power Advisory to look into the issues associated with LDC deployment of energy storage as non-wires alternatives for its new report. Power Advisory also examined four different potential ownership models through which it could work.

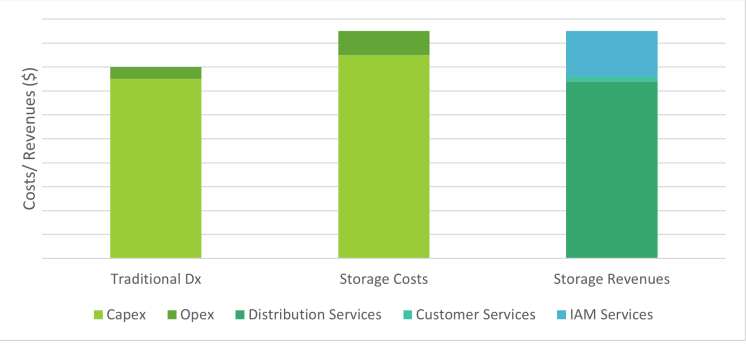

Analysis found that even if traditional infrastructure investment had lower upfront costs, energy storage systems participating in market opportunities such as those overseen by the Ontario Independent Electricity System Operator (IESO) would have lower costs, which ultimately are rate-based and passed onto consumers (see below).

The white paper report, ‘Leveraging energy storage for distribution services: How

maximizing revenue streams can lower costs to electricity customers,’ examine ownership models as follows:

- Utility owned and operated energy storage

- Third-party owned and operated

- Utility owned and third-party operated

- Utility and third-party shared ownership and operations

The authors considered energy storage to be able to provide a range of applications in addition to capacity for the utilities. These include behind-the-meter services such as demand management or peak shaving, as well as front-of-the-meter services to the regional or bulk grid, like transmission or wholesale market services, ancillary services and more.

Importantly, the white paper notes that while the analysis weighs up the pros and cons of each approach, it does not make specific recommendations in favour of either. The authors and Energy Storage Canada instead hope to prompt consideration and conversations around which may work best.

It also highlights the specific barriers, from Ontario’s electricity rate design regime to barriers to uncertainty over what sort of revenues could be earned from stacking multiple value streams.

The white paper can be downloaded from Energy Storage Canada’s website here.