Stem’s latest 7.5MWh C&I contract in California

9 February 2018: US commercial and industrial (C&I) energy storage systems provider Stem Inc will deploy 7.5MWh of systems across eight office buildings in San Francisco and Los Angeles.

The company, which develops “artificial intelligence-powered” energy storage solutions for business customers, helping them reduce the demand charge portion of their electricity bills on a contracted service basis will install its ‘Athena’-branded systems for Kilroy Realty Corporation.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Energy services company Black Bear Energy, which helps businesses make renewable and clean energy purchases, contracted Stem as the realty company’s representative. Systems at four buildings in Los Angeles and four buildings in San Francisco will help the realty company to reduce peak demand, while also being incorporated into Stem’s network of aggregated energy storage systems where it will further help support the grid in constrained areas and enable greater penetration of renewables.

Read a recent Guest Blog from Stem Inc policy director Ted Ko: ‘How California demand response has opened up to energy storage, virtual power plants‘.

Leclanché working with NRStor, NEXTracker for Canada C&I project

8 February 2018: Leclanché has just announced its first behind-the-meter system contract in North America, working with developer NRStor and equipment provider NEXTracker.

The Switzerland-headquartered vertically-integrated battery storage solution provider has been awarded a turn-key EPC agreement to build a commercial and industrial (C&I) battery energy storage system by NRStor subsidiary NRStor C&I in Ontario, Canada.

In common with other C&I projects, the end customer is a business which has identified energy storage as a means to lower energy costs while also decarbonising supply and reducing other emissions. In Ontario, the Global Adjustment Charge policy acts as a surcharge on electricity bills to pay for grid modernisation, maintenance and decarbonisation, with business customers levied a fairly high amount on average, taken from their peak demand periods.

The system will be 2MW / 4MWh, using Leclanche energy and fleet management software suites to control and optimise performance of the asset. Leclanché said it is also working with NRSTor, which recently netted a significant amount of investment for work in this sector, on two other potential projects.

Additionally, solar tracker company NEXTracker – which now also supplies energy storage systems – said this week that Leclanché will be using its NX Drive lithium-ion battery energy storage system at the 4MWh project. NX Drive includes a storage inverter and the energy storage system in a standalone enclosure.

First Redflow electrode stacks arrive from Thai factory

7 February 2018: Australian flow battery maker Redflow hailed the arrival in Brisbane of the first battery electrode stack units to roll off its recently established production line in Thailand.

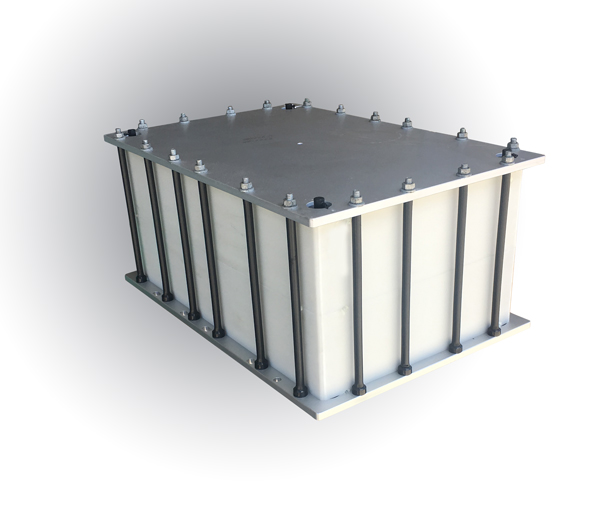

A key component of the manufacturer’s 10kWh ZBM2 zinc-bromine flow battery, the first set of completed stacks will be attached to systems part-completed at the company’s former production facility in North America. Around 200 stacks have arrived to begin with. Redflow started installing equipment at the plant in October last year.

“We aim to produce fully tested new batteries ‘end-to-end’ in our Thai production line prior to June this year. As I noted at our AGM, once we achieve this milestone, we will be able to ramp-up production in Thailand in line with customer demand. Once fully operational and orders warrant it, the manufacturing line should be able to manufacture up to 250 complete batteries a month,” Redflow chairman Brett Johnson said.

“Should demand increase beyond that volume, the capital cost involved to establish a second manufacturing line is not problematic.”

Several flow battery makers including Redflow have touted the potential for scaling up the technology to meet greater market demand, often producing systems which rely on relatively easily sourced raw materials, plastic parts which lower cost and other perceived advantages over currently more bankable lithium-ion technology. Rival manufacturer Primus Power has a production deal in place with Foxconn, the Taiwanese assembler of the Apple iPhone, while the UK’s RedT and USA-headquartered VIZn Energy have deals in place with Jabil, another large contract manufacturer.