Quidnet Energy, a provider of a novel geomechanical pumped storage (GPS) technology, has struck a 15-year commercial agreement with Texas utility CPS Energy to supply an initial 10MWh system.

Phase one of the project will involved Quidnet delivering an initial one-megawatt (MW) 10-hour storage facility with an option to extent the project to 15MW. The 15-year agreement allows the time for both parties to explore Quidnet’s technology, the press release says.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The Houston-based company’s technology is a form of pumped hydro storage with a 10-hour plus duration. It works by pumping water into an underground reservoir to be stored between impermeable rock layers at high pressure. When the system needs to dispatch electricity, the water is released upwards to power a hydroelectric turbine in a close loop system.

Unlike conventional pumped hydro, it does not need elevated terrain and requires a fraction of the time and cost to build, Quidnet claims. Specifically, it claims that its solution requires half, or less, of the capital expenditure and long-term costs of battery and conventional pumped hydro storage.

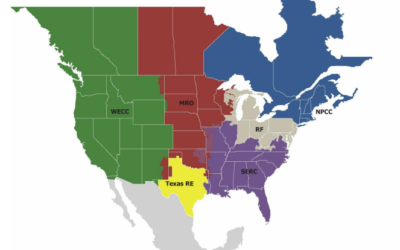

The CPS Energy deal marks Quidnet’s sixth test/pilot project, with the previous five in Texas (2), Ohio, New York and Alberta. It claims its projects employ “much of the same expertise, workforce, and supply chains as the oil and gas industry,” providing a natural pathway into the green economy for those professionals.

It has received investment by Bill Gates’ Breakthrough Energy Ventures, Evok Innovations, Trafigura and others, funding from the Department of Energy, and is a founding member of the Long Duration Energy Storage Council. The foundation of acting couple Will and Jada Smith backed the company at its foundation in 2015.

Quidnet’s Texas location and focus is unsurprising. The state is the highest energy consumer in the US, accounting for around one-seventh of the country’s power needs according to the US Energy Information Administration (sixth-highest per capita). It has large energy-intensive sectors based there like petroleum refining and chemical manufacturing, though is still the third-highest net exporter of energy among US states.

For its part, CPS Energy serves the city of San Antonio, portions of seven adjoining counties, and the electric and natural gas infrastructure for a collection of US military installations in the state. The utility is targeting having a 50% renewable energy resource mix by 2040 and full carbon neutrality by 2050.