The US deployed 42% megawatts more energy storage in the second quarter of this year than in the first, with residential installations overtaking utility deployments for the first time.

The latest edition of ‘US Energy storage monitor’, a quarterly report produced by Wood Mackenzie Power & Renewables (formerly known as GTM Research), also found that the overall US market also enjoyed an increase in megawatt-hour figures. From 123.6MWh in Q1 2018, that statistic grew to 156.5MWh in Q2 2018, a 24% jump.

With the exception of Q2 2017, when a large amount of battery storage was deployed in California in the wake of the infamous Aliso Canyon gas leak, the second quarter of this year has been the US’ biggest quarter to date for storage capacity deployment.

The behind-the-meter (customer sited) segment, including residential, performed particularly strongly, constituting 75% of Q2’s megawatt deployment stats and almost two-thirds of megawatt-hour figures.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

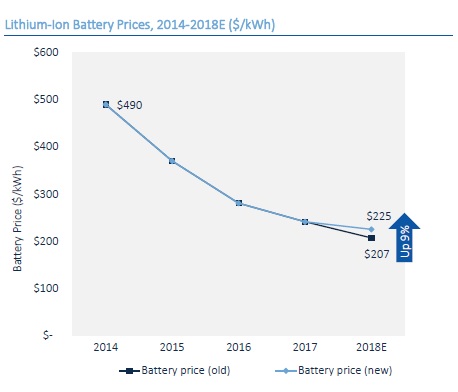

As with previous editions of the ‘…Monitor’, various policy moves and drivers for deployment in individual states are examined, while the Wood Mackenzie (WM) analysis team also look at macro topics. This includes a discovery that lithium-ion battery price declines have slowed in pace, with the report’s authors predicting a 14% decline over 2018, compared to 15% in 2017 (see picture).

The latter is the result of NMC (nickel manganese cobalt oxide) cells being in high demand from EV manufacturers as well as from the stationary storage industry, with demand outstripping supply. That said, over the next two years as production volumes increase, the WM analysts expect the price declines to resume their former rapid pace.

Conversely, lithium-iron phosphate (LFP) batteries, often favoured by stationary storage makers for their better performance under fire safety metrics are mostly made in China. Used mostly in E-buses and trucks, and with a lower energy density than NMC cells, WM expects price declines to continue at a fairly quick pace. This means that while LFP batteries remain abundant for stationary storage applications, lead times to get hold of large numbers of cells are much shorter than for NMC, where six to nine months waiting can sometimes be expected due to that high demand.

Wood Mackenzie has predicted annual energy storage deployments to “accelerate dramatically”, ramping up from 393MW during 2018 to “almost 1GW” in 2019. A raft of front-of-meter projects have been announced with scheduled completion dates in the year 2020 and the WM team said it now expected that cumulative installations could surpass 2GW in that year. Overall, this could contribute to a 3.9GW annual market by 2023. In the previous edition of the report, published for the first quarter of the year, WM predicted a total of 1,233MWh deployments during 2018, with analyst Dan Finn-Foley telling Energy-Storage.news that behind-the-meter deployments were expected to overtake grid-level figures by 2022.

While behind-the-meter segments are racing ahead, utilities have not been slouches in moving into energy storage deployment, as seen in the recent report from SEPA which found overall deployments in the US have passed the 1GWh mark. Meanwhile some utilities are also deploying behind-the-meter systems, such as Vermont’s Green Mountain Power which has offered low-cost or no-money-down deals for customers that buy home storage systems – if the systems are also able to be controlled by the utility to serve front-of-meter applications such as capacity services and peak demand management across the utility’s network.

Elsewhere in the world, European trade group EASE and analysis firm Delta-EE recently also found that the European market also enjoyed record-breaking levels of energy storage deployments, in an analysis of the market’s performance both in front-of and behind-the-meter in 2017.