The US’ installations of advanced energy storage — almost entirely lithium-ion battery systems — went beyond the 1GW mark in 2020, while in capacity terms the figure was close to 3.5GWh.

Research firm Wood Mackenzie Power & Renewables’ quarterly US Energy Storage Monitor report which forecasts, then records and analyses energy storage deployments. The latest edition, gathers together stats for Q4 2020 while collating the full-year data for the whole of last year.

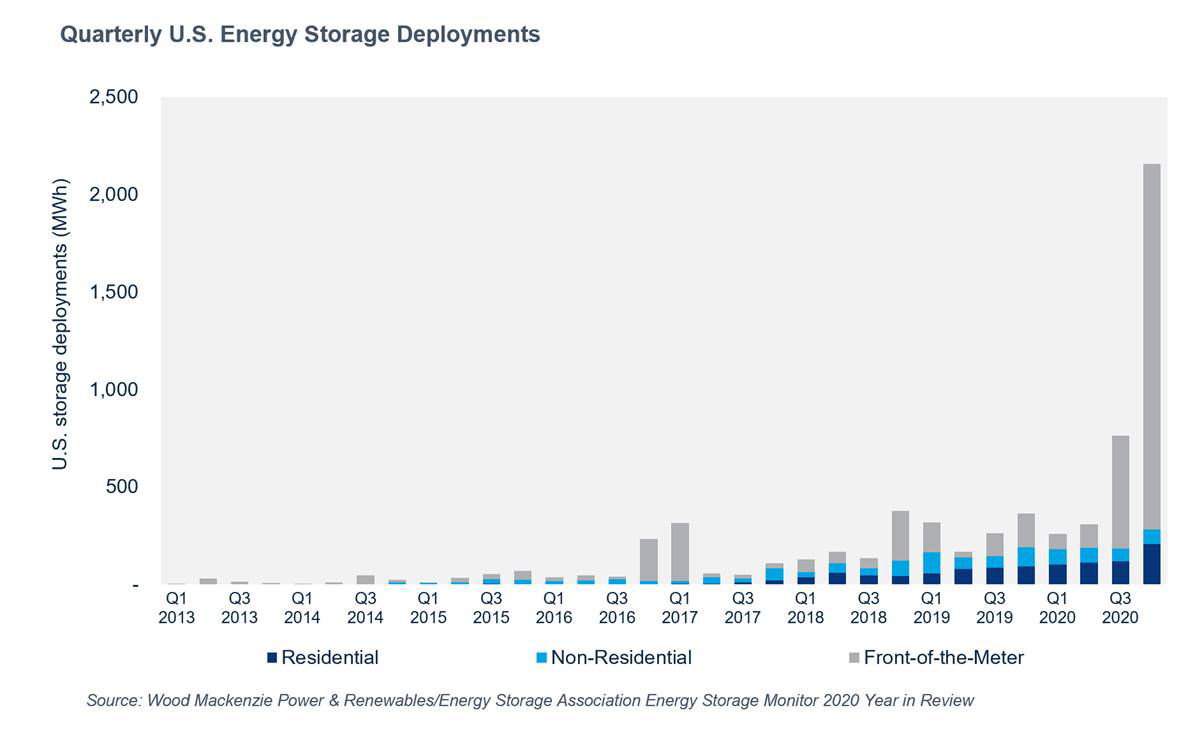

Last year, 1,464MW / 3,487MWh of new energy storage went online in the US. In megawatt-hour terms, Wood Mackenzie head of energy storage Dan Finn-Foley said that last year saw more storage deployed than the six years between 2013 and 2019, when 3,115MWh was installed in total. Meanwhile there has been close to a 200% jump in megawatts from 2019 to 2020. The number also exceeded the expectations of Wood Mackenzie’s own early-2020 forecast, which had been for 1.2GW.

“The data truly speaks for itself… This is the hallmark of a market beginning to accelerate exponentially, and momentum will only increase over the coming years.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Finn-Foley said that the coming online of the world’s largest battery storage system to date, the 300MW / 1,200MWh Moss Landing Energy Storage Facility, “likely won’t hold the title for long,” with other mega, or even giga, projects under development in hot markets like California (where Moss Landing also is) and Australia.

The Wood Mackenzie team foresees that that exponential market acceleration rate will see the US add around five times more storage in 2025 than it did last year. In the previous quarterly edition of the Monitor, Wood Mackenzie predicted the annual market could even be as big as 7.5GW / 26.5GWh by then.

As hinted at by that mention of the Moss Landing project, the front-of-the-meter (FTM) segment continues to drive the bulk of the sector’s growth and going forwards will form about 75-85% of the market in terms of megawatts each year until 2025.

Jason Burwen, Interim CEO of the national Energy Storage Association (ESA) said that the year’s activity represented a “tremendous milestone” on the US’ path to potentially deploying the 100GW of new energy storage that the ESA has called for in its strategic vision for 2030.

“With continuing storage cost declines and growing policy support and regulatory reform in states and the federal government, energy storage is on an accelerating trajectory to enable a resilient, decarbonised, and affordable electric grid for all.”

Another record-breaking quarter and aftermath of Winter Storm expected to boost behind-the-meter interest in Texas

FTM storage also led the charge forwards in the fourth quarter of 2020, which itself was a record-breaking period: 651.1MW / 2,156MWh of the total US deployments for the year happened in its final quarter of which around 80% was front-of-the-meter, utility-scale energy storage. Wood Mackenzie had said that Q3 2020 installations totalled around 476MW / 764MWh as the previous edition of the US Energy Storage Monitor came out.

Along with Moss Landing which was built by generator and retailer Vistra Energy, the Alamitos standalone battery storage project by AES Corporation (100MW / 400MWh) came online in Q4 although its commissioning was announced to press early in 2021, and that pair of projects therefore accounted for a huge share of the FTM segment’s recorded 529MW of installations.

That said, the other two major market segments, residential and non-residential (commercial and industrial) also enjoyed a strong final quarter to the year, with a 73% increase in residential over the previous quarter and a 13% increase in non-residential. Non-residential however does continue to be a challenging segment in which to attain scale, and Wood Mackenzie said COVID-19 slowed down activity in the segment throughout 2020.

In residential, homeowners are increasingly seeing battery backup as an option as factors like wildfires and extreme weather events contribute to resiliency concerns. This is particularly true of California, where solar-plus-storage installs are incentivised through schemes like the Self-Generation Incentive Programme (SGIP).

“But the ability of solar-plus-storage to provide backup is increasingly driving sales even in markets without additional incentives, particularly states that suffer from regular power outages,” Wood Mackenzie research analyst Chloe Holden said. Holden added that a strong uptick in home battery sales can be expected in Texas following the recent impacts of its February Winter Storm.

Texas was in fact also the second biggest front-of-meter market throughout 2020 in megawatt-hour terms, but it and other states have a long way to go to come close to dethroning California at the top: Texas installed 116MWh while California’s industry installed 2,372MWh of utility-scale storage. By contrast New Jersey, in third place installed 42MWh throughout the year. California also topped residential and non-residential deployments in megawatt-hours for 2020.