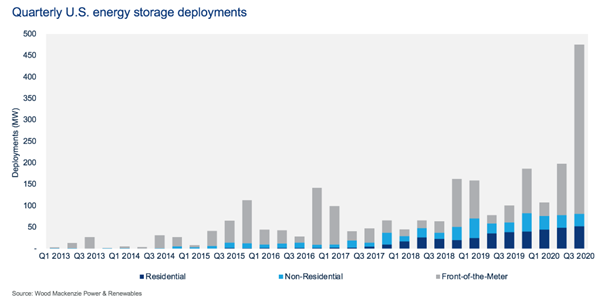

The US energy storage industry collectively deployed 476MW / 764MWh in a single three-month period between July to September, with analysis firm Wood Mackenzie Power & Renewables describing the record-breaking performance as a “sign of things to come”.

These are more than double the highest quarterly figures to date, according to statistics gathered by Wood Mackenzie in the latest edition of its quarterly US Energy Storage Monitor report, for Q3 2020. In the previous edition, the analysis firm’s head of energy storage Dan Finn-Foley had described the market to have proven “remarkably resilient to impacts from coronavirus lockdowns”.

This time out, Finn-Foley said that the “eye-catching deployment totals represent only the beginning of a long-anticipated scale-up for the US storage market,” with “massive price declines” and efforts to ensure that energy storage can be eligible for energy market participation setting the stage for “exponential growth”.

Those efforts towards eligibility look set to continue with the introduction of Order 2222 by the Federal Energy Regulatory Commission (FERC), which seeks to ensure fair market participation for distributed energy resources including battery storage into regional organised wholesale markets.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The US market as a whole is predicted by Wood Mackenzie to rise from 1.2GW in 2020 to close to 7.5GW / 26.5GWh by 2025. This growth will be primarily driven by utilities procuring large-scale energy storage and in Q3 2020 as well, the segment seeing the most growth was front-of-meter large-scale storage, although there has also been about 7% growth in the residential segment. The front-of-meter segment hit 400MW / 578MWh this quarter while the growing number of households seeking resiliency for their power supply drove the residential market to 52MW / 119MWh in Q3 2020.

As with Q2, the state with the most growth was California, with a “handful” of 1-hour duration front-of-meter systems deployed in the state accounting for a large proportion of the national total. Chief among those was the world’s largest battery storage system to date, LS Power’s Gateway project, which is 230MW / 230MWh and undergoing an expansion to 250MW / 250MWh in the coming months. Phase 2 of that project went online during the quarter.

While shorter duration systems with about an hour of storage were the majority of FTM deployments, Wood Mackenzie noted that numerous four-hour projects are underway, again, mostly in California. Meanwhile, in the previous quarter, Dan Finn-Foley had noted that the non-residential segment, including commercial and industrial (C&I) storage had suffered the only notable slowdown during the coronavirus pandemic and again this quarter’s deployments fell, this time 10% quarter-on-quarter.

On the policy front, the analysis firm noted that the election of Joe Biden as Donald Trump’s presidential replacement reawakens hope that an investment tax credit (ITC) could be introduced for standalone energy storage, even if the Republican party manages to maintain a majority in the Senate after run-off elections in Georgia. Uncertainty persists over this issue, however, Wood Mackenzie noted.

In an interview with Energy-Storage.news published this week, the CEO of the US Energy Storage Association (ESA) Kelly Speakes-Backman spoke of her group’s optimism for the prospects of the industry in 2021. Speakes-Backman also said that the election of Joe Biden as president and Kamala Harris as vice president is in part a mandate from the American people to act on climate. ESA also believes that the installation of 100GW of energy storage is possible in the US by 2030 and is actively campaigning for this to come into reality as part of the association’s wider vision for the energy future. The ESA partners with Wood Mackenzie on the publication of the US Energy Storage Monitor report and Speakes-Backman commented that the report’s statistics show once again the industry’s resilience in the face of the coronavirus-led downturn.

“The signs are pointing toward an unprecedented increase in energy storage in the coming months, moving us closer toward achieving our 100 GW by 2030 vision. With continued policy support and regulatory reform at the state and federal levels, energy storage is poised to continue this trajectory and enable a more resilient, efficient, sustainable, and affordable electric grid for all,” Speakes-Backman said.