Navigant Research suggests that as the need for energy storage systems to provide grid ancillary services such as frequency regulation and load following is increasing, utility-scale energy storage will continue breaking into the mainstream electricity market this year. Image: Flickr

The power capacity of global installed front of the meter energy storage is expected to reach 21.6GW in 2025, according to a new report by Navigant Research, with one of the firm's analysts calling this exponential growth prediction "dramatic", but also realistic.

Considering current installed capacity for grid-scale energy storage is at 1.1GW, “21.6 GW of new capacity annually in 2025 represents a dramatic increase in the grid-scale storage industry," Alex Eller, Navigant Research analyst, told Energy-Storage.News.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

"However, given industry expectations and other studies that have been published on the technology’s potential, these are not aggressive forecasts.”

As the need for energy storage systems to provide grid ancillary services such as frequency regulation and load following is increasing, utility-scale energy storage will continue breaking into the mainstream electricity market this year, due to a shift away from research & development (R&D) projects, to more mainstream commercial deployments.

The report cites the main drivers for this growth include the overall substantial growth of renewable energy that is being seen globally, as well as macro trends such as a declining upfront cost for energy storage systems – considering grid modernisation is a trend that needs to happen anyway, and storage systems provide a more cost-effective solution to achieving this, versus building infrastructure such as substations. However at the same time, adding more renewables into the grid increases the volatility of the grid due to the variable generation nature of renewable energy sources. Again, storage here is a solution to mitigate against the effects of this grid volatility:

“Renewables integration is a major driver for the grid-scale storage industry, as renewables penetrations increase, we will need greater amounts of the fast acting grid services that storage can provide,” said Eller.

“The main drivers will be falling system costs and the changing regulations that will allow storage to earn revenue in energy capacity and ancillary services markets. Additionally we expect exponential growth as each successful project establishes greater trust in the technology, and utilities become comfortable investing in storage,” said Eller.

What remains unclear is how much of the expected new storage capacity will be of utility-scale magnitude versus distributed energy generation. According to Eller, as technology develops, distributed systems are increasingly being configured to provide some of the same in front of the meter services as utility storage systems. For example, Duke Energy recently launched a new hybrid ultracapacitor-battery energy storage system that provides long-term grid support services such as load shifting and real-time solar smoothing.

Navigant anticipate that the majority of new energy storage technologies will be systems supporting the need for generation capacity; with capabilities for spinning reserves and load following, as well as shifting peak load on the system over time. “This also includes the shifting of renewable energy between time periods, for example shifting night-time wind energy to match load during the day. We also expect systems allowing for the deferral of T&D infrastructure investments to become increasingly common,” added Eller.

As well as overall global installed capacity forecasts, the report details forecasts for other channels – including energy capacity, revenue, technology and application, through 2025.

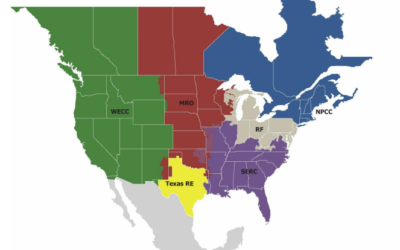

In terms of revenue, Asia Pacific is predicted to be both the largest and fastest growing region over the next decade. However, Navigant forecasts North America to see the most revenue this year with just under US$500 million for new projects, and western Europe is expected to be the third largest market with the remaining world regions expected to be much smaller market players. “Globally we expect the industry to increase from about US$1.5 billion in revenue in 2016 to [more than] US$18 billion annually in 2025,” said Eller.

In Five trends in energy storage in 2016 and beyond, a whitepaper published by Navigant earlier this year, the firm predicted that 2016 will be the year that utilities "embrace storage" and that standardised contracts for storage will start to become more prevalent.