While pumped hydro plants still account for around 96% of installed capacity of stationary energy storage worldwide, there will be more than 28GW of lithium batteries deployed for stationary storage applications by the year 2028, Navigant Research has predicted.

The US-headquartered research and analysis firm published its industry tracker report for the fourth quarter of 2019 last week. Navigant said 2019 had been a “transformative year” in energy storage, with the sheer numbers and scale of systems deployed surpassing anything seen in previous years, while batteries – and other technologies for storage – are also being deployed to serve a wider range of applications than ever before.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As well as observing the continuing and meteoric rise of lithium-ion batteries in use for stationary storage, the report’s authors also observed three distinct “types of storage projects [which] typified deployments across the globe” during 2019’s final quarter. These were:

Commercial and industrial (C&I) energy storage installations behind-the-meter (BTM) of utilities, deployed for the most part to help commercial entities including factories to reduce their energy costs primarily by reducing the amount of electricity businesses draw from the grid, especially during times of peak demand when electricity costs run highest for these grid users.

C&I customers are also installing storage to add resiliency and ensure power quality, while batteries are also often deployed in combination with solar in order to further reduce reliance on grid power and to hedge against future electricity price rises.

Utility-scale battery storage facilities are also starting to replace gas peaker plants on the grid. Often running for fairly short periods of time, but contributing a disproportionately high amount of pollution including GHG emissions, energy storage (and solar) developers have long argued that batteries can respond much quicker, more cleanly and at lower cost, to signals from the grid that more energy is needed to balance the system at peak times.

This view has been corroborated in recent years by a number of studies and analyses, but during 2019 and Q4 in particular, the real-world application of battery storage and solar-plus-storage peaker plants gained traction, Navigant’s analysts said. (Read the feature article, ‘Peak time to take action’, my own take on the topic, from earlier in 2019, here.).

Finally, and perhaps least surprisingly, Navigant found that there has been more development and deployment than ever before of utility-scale energy storage facilities co-located with large-scale solar and / or wind energy projects.

Renewables-plus-storage: winning on price, technical advantages

On that last topic, Navigant Research analyst Alex Eller blogged for the company’s own site in December 2019, describing “the rise of solar-plus-storage projects” as a “major driver of the energy storage industry in 2019” and calling it the “next technological frontier for large solar PV plants”.

In a separate report published that month, Eller had identified that this growth had largely been fuelled – in the US in particular – by the use of combined solar-plus-storage power purchase agreements (PPAs). There are both economic and technical advantages to combining the technologies, which Eller said are “significant”.

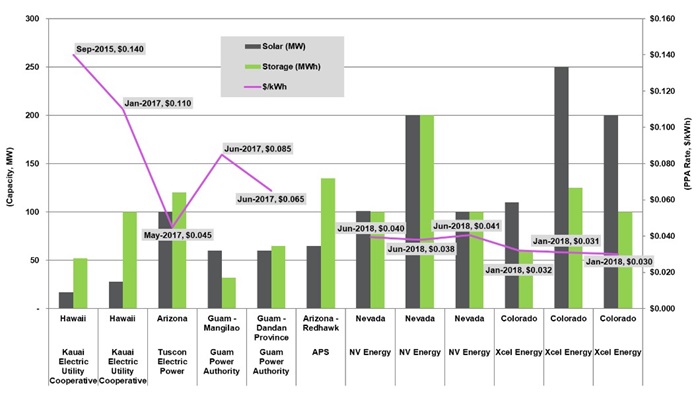

Indeed, according to Navigant, PPA prices fell by 79% between late 2015 and early 2018, levelling off at around US$30 per MWh. Meanwhile by way of reference, Navigant expected the levelised cost of energy (LCOE) for a combined cycle gas turbine plant – the type most commonly used in the US and elsewhere to provide peaking capacity – to be much higher in 2021, in the region of US$41 per MWh to US$47 per MWh.

During 2019, many of those projects were seen in the Southwestern US, Eller wrote. These included the likes of Hawaiian Electric, which awarded 260MW of solar PV and 1,000MWh+ of storage across seven contracted projects, priced between US$0.08 per KWh to US$0.12 per KWh, significantly cheaper than existing average fossil fuel-generated electricity prices in Hawaii which are around US$0.15 per kWh.

NV Energy in Nevada and Salt River Project in Arizona were among the other utilities in the US to make headway in this space in 2019. The former contracted developer 8minute Solar Energy to build the Southern Bighorn Solar & Storage Center (475MW PV with 540MWh energy storage) by 2023 with a combined PPA price of US$0.035 per kWh. Salt River Project meanwhile is planning to build two solar-plus-storage projects totalling 338MW solar PV with 1,000MWh+ of energy storage.