Peaxy CEO and President Manuel Terranova joins us to discuss some of the biggest challenges facing the battery industry, and how smart software like Peaxy Lifecycle Intelligence (PLI) for Batteries can solve them.

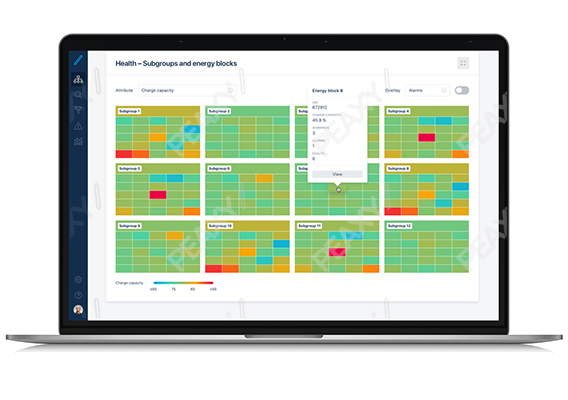

Peaxy Lifecycle Intelligence for batteries delivers predictive battery analytics powered by machine learning. New revenue streams are created by a unified data vision applied to battery R&D, manufacturing and field operations.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

What do you see as the top data challenges in the battery industry, and how can they be solved?

Batteries are unique and fickle industrial assets, and yet many companies use fleet-level or system level models to manage them. While that can be helpful, I don’t believe such models are good at predicting and optimising industrial equipment, including batteries. Simply put, if you’re unable to resolve data down to the individual battery — a unique serial number — chances are you won’t be able to monetise your analytics.

Why do we need to go that deep? Large-scale, industrial equipment is by its very nature unique, and a battery installation is no different. From varying electrolyte lot numbers to anode and cathode materials sourced from different suppliers, dozens of factors are at play before the battery reaches its final destination. Even the effects of vibration during shipping and customer commissioning tests can have an effect. Once in service, each battery degrades in its own unique way, even when batteries from the same batch are collocated on the same string or in the same container.

Compounding this challenge is the fact that battery systems are one of the richest industrial data producers. Industrial testing scenarios can see sampling rates of 10kHz and greater, but in field-deployed battery data is generally captured at 1Hz (once per second) across 2,000-3,000 housekeeping registers. What this all means is that even a small test-sized grid deployment can produce several gigabytes of data in a 24-hour cycle. A production-level battery farm generates 10’s of gigabytes of data per day at a 1Hz capture. In addition to capturing the raw data set, derivative data sets need to be generated downstream for data transport (HDF5), data shaping (parquet and HDF5), model training (.npy), and archiving.

With an at-scale battery farm producing roughly 50-100 million data points every second, implementing dynamically-updated models for each and every serialised battery is extremely demanding. I would characterise the problem not only in terms of dealing with the sheer volume of data, but also ensuring that the data is properly aggregated and transformed into a single optimised view. Many battery manufacturers, integrators, packagers, and operators still need to overcome the fundamental challenges of preparing the data systematically so that the analytics can happen systematically. I see the steps leading up to successful analytics, including data curation, as one of the driving reasons why companies are not able to successfully achieve monetisation.

What does this data transformation and curation process look like and what kinds of things drive it?

Transforming BMS and battery cycler data requires deep domain experience in telemetry, data architecture, data processing and algorithms (including machine learning or “ML”), along with extensive battery expertise. Preparing and processing all of the relevant data can be broken down into these broad steps:

- Data ingest and data shaping

- Data parameterisation and data modeling

- Ongoing data parsing and threading (by serial number, string, block, etc.)

- Data analytics including ML and visualisation, and ultimately

- Data monetisation

Threading and orchestrating thousands of registers, while coupling other exogenous data such as ambient profiling, requires careful construction. Computational workloads can become demanding and require both big data architecture and active data curation strategies. Consideration must be given to performance and cost at every step. At-scale, monetisation can occur only if these steps are all carried out successfully.

It’s unrealistic that fleet operators, battery packagers, integrators, and OEMs have all the in-house expertise needed to accomplish this, and therefore partnering strategies must be considered. A partner can bring specific skills that help to effectively thread and parse the data, process it with machine learning and other methods, and ultimately help generate high-impact revenue-accretive or cost avoidance insights.

What challenges do you see specifically for battery manufacturers, integrators, and packagers?

In the majority of use cases I’ve seen, customer battery usage profiles depart from the expected operating regime. Departing from warrantied or contracted operating cycling regimes introduces considerable risks including degradation and other implications. On the other hand, often a change in operating profile is necessary to give the operator a revenue advantage. Sure, load shifting, peak shifting, and frequency regulation are common use cases for battery-based grid-scale storage. However, over the asset’s lifetime a battery farm operator may want to apply any one of a dozen other revenue-generating use cases, including reserve capacity, black start, ramping, and demand response. These additional revenue generation opportunities should be accommodated by warranty regimes. To optimise investment and maintain competitiveness over a 6-10 year lifecycle, operators need predictive analytics to understand how their unique battery configuration will perform in various “what if” scenarios.

Battery manufacturers, integrators, and packagers have essentially two options for combatting usage profile uncertainty and risk: a restrictive, cost-avoidance approach and/or a revenue-accretive approach. The first approach deploys degradation analytics and monitoring to ensure that batteries are cycled in a manner consistent with warranty requirements and life-extension considerations. The second approach allows operators and battery providers to make decisions that maximise revenue potential, by focusing for example on incremental capacity and warranty upgrades.

What about batteries for EV and other mobility applications?

The uniqueness of batteries, coupled with uncertain operating regimes, make EV and transportation-based battery use cases challenging. Serialised degradation models that don’t account for driver/operator behavior, varying ambient conditions, and potentially erratic cycling regimes will not yield sufficient insight for monetisation. Recognise that some models/ML algorithms need to be “continuously” updated in 10-minute intervals, while others are updated hourly or daily. For example, a degradation model might be updated every minute to allow for alerting when discharge rates exceed dynamically-computed upper limits. Other models, such as Remaining Useful Life (RUL) might be computed every day or week.

I believe that transportation and energy storage batteries will increasingly fall under leasing regimes. That said, it’s hard to ignore the additional challenges presented by battery leasing models. One of the “apex metrics” in the leasing world is residual value, which helps determine the depreciation rate and payment schedule. Analytics solutions such as PLI for Batteries can dynamically compute the residual value of battery assets to provide real-time material insights both to operators and battery leasing businesses. Gaining better insights on how the asset is depreciating, and understanding how the residual value might be impacted in certain what-if operating scenarios will help fleet operators enormously. Enabling battery leasing programs with these insights, driven by machine learning, is a focus area for Peaxy, with features in PLI for Batteries that help lessors make sure they protect the long-term residual value of their battery assets.

For more information, please visit https://peaxy.net

Peaxy CEO and President Manuel Terranova is a technology veteran with a proven track record of bringing emerging technologies to market.

Before co-founding Peaxy, Manuel was at General Electric’s Drilling and Production business, where he led a US$5.2 billion portfolio as Senior Vice President. He managed the company’s commercial and regional resources worldwide, including the creation of a US$200 million subsea equipment joint venture in sub-Saharan Africa.