High cost and material availability are the main non-technical barriers to energy storage deployment at the scale needed, according to a new report from MIT.

The report, ‘Battery deployment in the U.S. faces non-technical barriers’, explored why this is and what steps can and are being taken by the industry to mitigate them and ensure enough energy storage assets are deployed.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Unlike other battery markets like consumer electronics or EVs, grid-scale applications require much lower cost solutions to compete with incumbent, fossil fuel-generating assets, author Kara E. Rodby wrote.

Although lithium-ion battery cells have fallen enough in cost over the last three decades to be viable for such applications, new battery technologies like vanadium redox flow batteries (VFRBs) or metal air batteries (MABs) need to be deployed in greater numbers to achieve long-term deployment goals.

Yet, while these newer technologies possess long-term cost benefits over lithium-ion thanks to things like an open architecture (both) or a decoupling of the power and energy components (VRFBs), up-front cost has remained prohibitively high.

Part of this is due to a lack of demand for long-duration energy storage solutions from the grid, Rodby wrote. Another is the fact that the technologies are only really economically viable for large, grid-scale applications and so have not benefitted from a ‘beachhead market’ like EVs to drive down costs.

This means it is unclear if the private sector alone can drive down costs and improve performance enough for when demand does arrive, and government intervention may prove essential in getting there. The Long Duration Energy Storage Council recently set out a roadmap for what governments can do, and how long they may need to do it for.

One thing that (currently) small long-duration energy storage companies could do is use contract manufacturing from companies that already make similar products at scale, rather than source and build solutions themselves, as this would be cheaper. The largest pure-play lithium ion battery energy storage system (BESS) integrators Fluence and Powin do this.

And even if you can’t outsource your entire production process, centralised parts of the industry could lead to cost reductions. For example, if all VRFB, MAB, fuel cell and electrolyser companies sourced their stainless steel end plates, Teflon gaskets, graphite bipolar plates and current collectors (which all use) from one third party, economies of scale could be realised, although concern around intellectual property is a barrier to this solution.

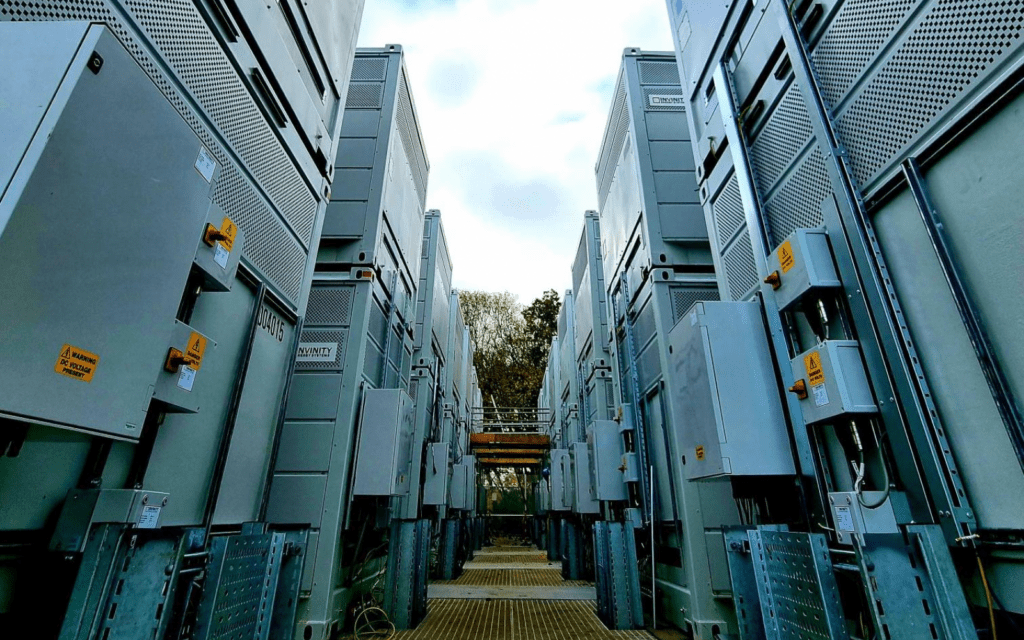

The VRFB industry is exploring other cost reduction initiatives including vertical integration into system deployment by primary vanadium suppliers like Largo Incorporated, Bushveld Minerals and new incumbents too. Another solution is to lease electrolyte to project owners instead of selling it, which removes some of the upfront capital cost. Avalon, which became Invinity Energy Systems through a merger, started this business model.

A solution to the shortage of critical materials, the other of the report’s non-technical barriers to energy storage deployment, is to pivot to chemistries which require less expensive and rare materials. But, it may be necessary to deploy solutions that are ready now, regardless of cost, to help accelerate the deployment of new chemistries which will use the same supply chains.