Significant policy support for the long duration energy storage (LDES) sector may be needed until 2030-35 when the market matures, says a new LDES Council policy toolbox report.

The report, “The journey to net-zero: an action plan to unlock a secure, carbon-free power system”, provides an overview of key considerations and options for designing and implementing energy transition policies and regulatory frameworks that will help catalyse the LDES sector.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The LDES Council, a CEO-led organisation launched at COP26 in November 2021 and comprising 50 companies and stakeholder organisations in the sector, said that “signals need to be created today to spur scale-up, investment and adoption”.

Echoing similar recent figures by the European Association for Storage of Energy (EASE), the LDES Council report said the need for long duration solutions increases significantly when renewables reach 60-70% of power capacity, and that some 85-140TWh may be needed globally by 2040.

The report noted that the major existing barriers to deployment include limited policy certainty for LDES, limited awareness and definitions of the asset class, high initial project costs, increased risk perception among investors, a lack of revenue streams and length development timeframes.

Its first policy consideration outlines that the level of policy intervention will evolve as the market does, and it categorises that evolution into three stages. The first is ‘market creation’, from now until 2025, which will need comprehensive revenue certainty and scale-up support from policymakers.

From 2025-2030, ‘market growth’ takes over, during which increasing deployment and cost reductions will occur but ‘significant support’ will still be needed from regulators and policymakers. ‘Market maturity’, when revenue stabilisation mechanisms can be phased out and merchant exposure increased, will happen over 2030-35.

Revenue support mechanisms that should be considered to help the LDES sector grow include cap and floor mechanism, capacity markets, CFDs (contract for difference), hourly energy attribute certificates, long term bilateral contracts for ancillary services, nodal & locational pricing, regulated asset base and 24/7 clean power purchase agreements (PPA).

Various direct technology support, including grants, incentives, sandboxes and targeted tenders, should also be used to create favourable environments for nascent technologies. Sandboxes are a structured form of regulatory flexibility that enable the testing of innovative technologies with minimal regulatory requirements.

The report contains a policy tool assessment framework which allows readers to compare how different policy options score on seven indicators covering project viability, ease of implementation, and long-term effectiveness in delivering a secure, reliable, affordable and low-carbon energy future.

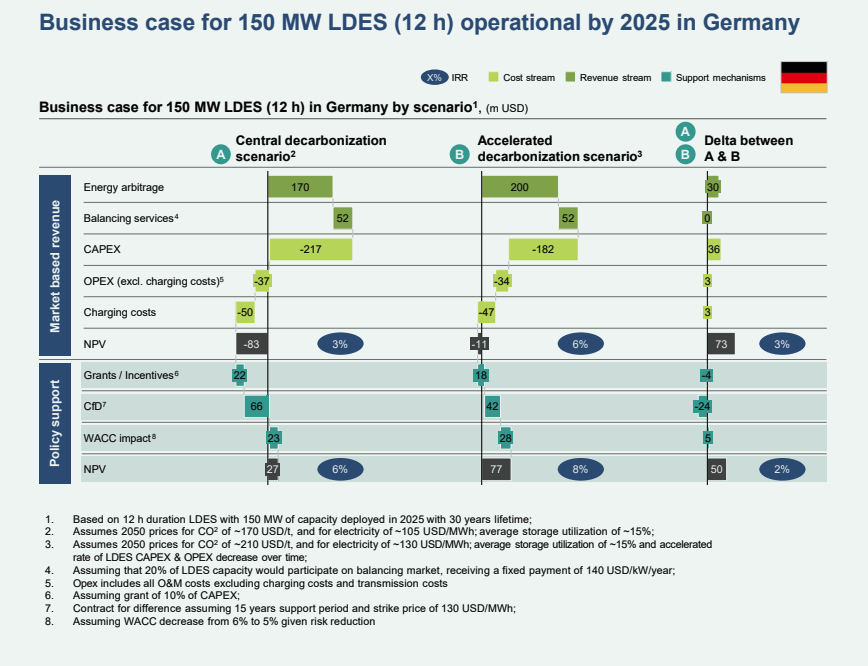

Showing how all of this might be used in practice, the LDES Council included a theoretical business case for a 150MW, 12-hour solution operational in 2025 in Germany, outlined in the table below.