The amount of VC funding invested in battery energy storage companies in the first nine months of this year has more than doubled from the equivalent period of 2016, according to a report from Mercom Capital.

Mercom produces quarterly reports on VC funding and mergers and acquisitions (M&A) in the battery storage, energy efficiency and smart grid sectors. The latest edition, just published, looks not only at the third quarter of 2017, but also at the nine months of the year passed so far.

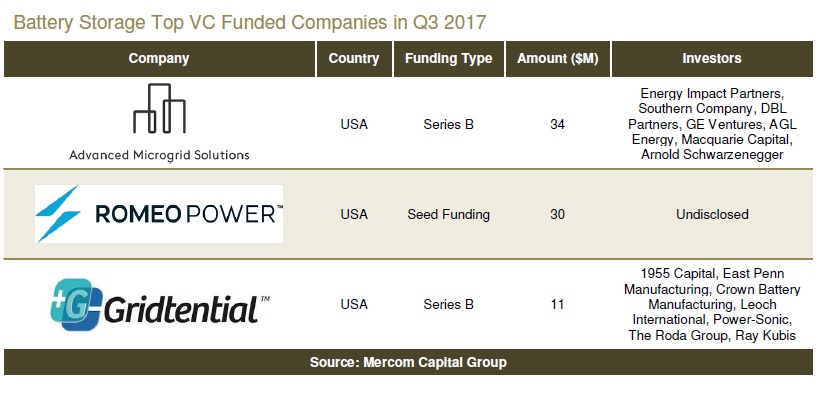

From January to September, some US$563 million was raised across 25 deals this year by battery storage companies, compared to US$209 million in the first nine months of 2016, across 29 deals. The largest single deal in the third quarter was successfully closed by Advance Microgrid Solutions (AMS) with US$34 million raised in a Series B investment this summer that celebrated cleantech investor Nancy Pfund said took energy storage “to a new level”.

Not far behind AMS with US$30 million raised in August was Romeo Power, a start-up which boasts a former SpaceX battery expert, Porter Harris, as its CTO. Romeo Power, launched in 2015, said it wants to use the seed funding to scale up manufacturing “as fast as we can”. In a distant third place was Gridtential, another start-up which claims it has a novel battery technology combining the advantages of lead acid and lithium and has just appointed a former SunEdison global asset manager as its new CEO.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

There appears to be a good spread in VC funding across the downstream, upstream and system technology segments, with areas invested in in Q3 2017 including downstream energy storage companies, energy storage systems (ESS), lead batteries, lithium batteries, zinc batteries and flow batteries, energy storage management software and thermal energy storage.

However, debt and public market financing in battery storage fell in the most recent quarter, with just US$45 million raised from two deals, compared to US$107 million raised in seven deals in Q2 2017. However, overall the first nine months of 2017 yielded US$174 million in 11 deals over 2016’s US$120 million across six deals, Mercom said.

Project funding appears down for the year – so far – just one company, Canadian energy storage developer NRStor, has successfully brokered such a deal, raising US$152 million. By contrast, the first nine months of 2016 saw seven funds raise US$820 million.