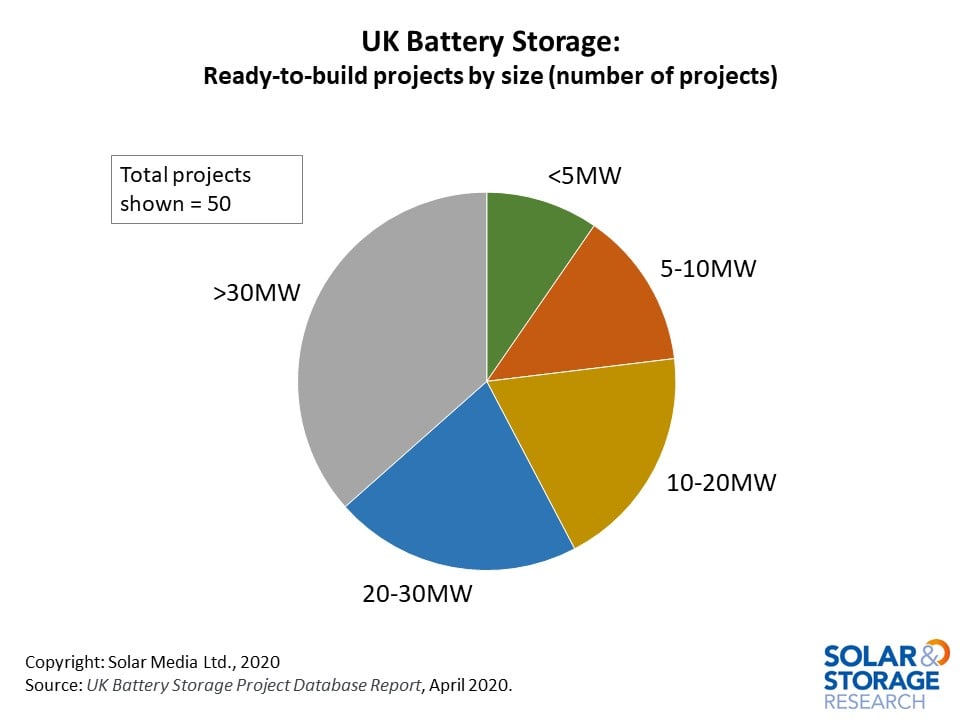

There are 1.3GW of read-to-build battery storage projects in the UK, with the majority between 30MW and 49.9MW power output per project, according to new analysis from Solar Media Market Research.

While many projects planned for completion this year are likely to be delayed until next year due to COVID-19, Solar Media analyst Lauren Cook writes in an exclusive blog for our sister site Solar Power Portal this week that the total UK project pipeline stands at over 13.5GW. Of those, 1.3GW – 50 separate projects – have received planning permission and “have other leading indicators suggesting these projects are close to starting construction”.

Around a third of the ready-to-build projects are over 30MW, most of those at the 49.9MW level, with 50MW being the cut-off point at which an energy project becomes an infrastructure play in Britain, which then presents further levels of complexity in getting project development over the line.

Despite COVID-19-related delays, Lauren Cook writes that the first quarter’s activity “shows that companies are still actively building portfolios of projects and preparing for the build phase”.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Battery suppliers and other component suppliers are continuing to develop their pipelines and will be looking at strategies to access the large portfolios of projects that are being acquired now,” the analyst writes in the blog, which trails some of the key findings of the UK Battery Storage Project Report, updated monthly by the in-house research team at Solar Media (Energy-Storage.news’ publisher). You can find more information on how to access the report here.

In related news from the UK, stock exchange-listed investment fund Gresham House Energy Storage Fund (GRID) said on releasing its first yearly results that it plans to increase its portfolio by nearly 200MW during this year.

Solar Power Portal reported that the company now has an investment portfolio of 174MW of operational Energy Storage System (ESS) projects, according to its full year results to 31 December 2019, released this week. This portfolio has been built up since the company’s first IPO in November 2018. It now has a Net Asset Value of £205.9 million (US$256.1 million), or 100.79 pence per share. This is an increase of 6.48% on a total return basis.

Additional reporting by Molly Lempriere.

Read the full story about Gresham House’s results and plans going forward at Solar Power Portal here.