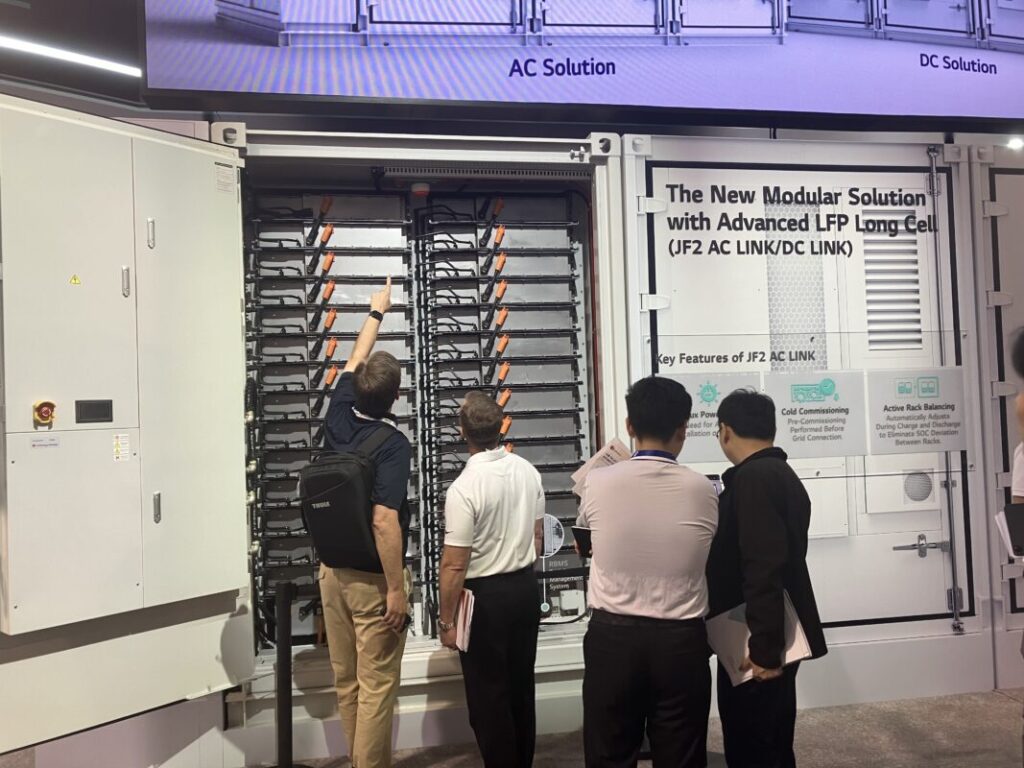

LG Energy Solution VP Hyung-Sik Kim and CEO of system integrator LG ES Vertech Jaehong Park speak with ESN Premium.

At the 2023 edition of the RE+ clean energy trade show for North America, LG Energy Solution (LG ES) launched its system integrator arm for the US, LG ES Vertech.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

That was in September last year, and just three months later, LG ES claimed Vertech was already in advanced talks or had signed contracts for 10GWh of battery energy storage system (BESS) projects.

ESN Premium spoke with the system integrator’s CEO Jaehong Park a few months ago, hearing about Vertech’s strategy for the US market, which included a focus on vertical integration and leveraging the assets and knowhow of NEC Energy Solutions, the former industry-leading integrator which LG Energy Solution acquired after parent company NEC pulled the plug in 2020.

At this year’s RE+ in Anaheim, California, last month, Jaehong Park took part in another interview, with Hyung-Sik Kim, VP of LG Energy Solution’s energy storage system (ESS) division, also joining the conversation.

The discussion ranged this time from LG ES’ US manufacturing plans to the group’s approach to localisation and the relationship between the ‘mother company’ and its system integration subsidiary.

‘Full commitment’ to US BESS market

Hyun-Sik Kim has been leading ESS activities globally at LG ES since last December, from a role with the South Korean battery manufacturer’s electric vehicle (EV) division.

Developing strategy is the main function of the LG Energy Solution headquarters where Kim works, across R&D, production and business strategy, to product planning and marketing. Meanwhile LG ES Vertech, its 100%-owned subsidiary, serves as its system integrator for the US.

“We design everything from headquarters, and then we transfer our product to ES Vertech. Vertech consolidates the container system, together with power conversion systems (PCS) and other components,” Kim says.

In turn, the main role of Vertech is to create system integration business opportunities for LG ES.

The US market is “very important” for LG ES’ ESS business, he says, and the company is “fully committed” to it, forecasting that the US will overtake China for BESS installation numbers by 2028, with similar drivers in both countries including policy support and load growth to accommodate the rise of data centres in the artificial intelligence (AI) age.

Capacity utilisation during EV demand downturn

LG ES is building eight new factories in the US to meet rising demand for batteries. This has largely been precipitated by the EV market, and the company has joint ventures in place with the likes of GM and Honda.

However, a new factory with 16GWh of annual production capacity dedicated to cells for stationary battery storage applications, set to be built in Arizona and announced last year, is currently on hold.

The decision came after an official groundbreaking ceremony had already taken place in March.

LG ES has previously described lithium iron phosphate (LFP) battery production in the US as a “major growth engine” for the company, it also predicted in January that battery demand from the global BESS sector would grow around 30% during 2024, with the US a major driver.

Hyung-Sik Kim and Jaehong Park say the reasoning behind the decision was not due to a depression in the ESS market, but rather due to lower-than-expected demand for EVs.

“We are adjusting our US production plan and are evaluating opportunities to adapt lines at existing [EV battery production] facilities to support US manufacturing,” Kim says.

This would help LG ES get products to market faster, utilising an existing EV battery factory to instead make ESS cells, rather than making an investment in the greenfield site in Arizona from scratch, he says.

The shortfall from EV customers is a “chasm,” the VP says, leading LG ES HQ to examine capacity utilisation closely and hedge the risk of that downturn in demand. At the same time, the company didn’t want to miss out on opportunities in the US ESS market.

“Compared to EV demand, ESS demand for the future is quite solid,” Kim says, “So we need to continue this market penetration, and our local production schedule.”

The Arizona factory does remain a key part of the overall plan, and once established will act as a central campus for the company’s US battery assembly activities, the pair say. In the meantime, adjusting existing production lines to make BESS products will help it to get products to market faster.

Localisation means partnerships as well as production lines

One of the recurring themes at this year’s RE+ was the challenge for US-based clean energy manufacturing to catch up to growing demand in both solar and storage and alleviate almost total dependence on imported products, largely from China.

LG Energy Solution has a head start on aspiring manufacturers when it comes to batteries, setting out its plans and putting down roots well before the Inflation Reduction Act (IRA) tax credits improved the business case for domestic manufacturing considerably.

“Localisation is not that easy for new investors, or new battery manufacturers in this market but we’ve been accumulating a lot of lessons learned and experience in the US market as a local producer,” Kim says, including mitigating risks.

Part of that mitigation, and a key part of the company’s wider strategy, is forming partnerships across the value chain.

“In order to really exercise those partnerships, we need to be localised, not only in production, but also as a fully functioning organisation. That’s the reason why, before the IRA, we already decided to be a local player,” Jaehong Park adds.

“We acquired local companies, and we built a fully functional organisation [in the US] from sales, engineering, execution, to services.”

‘We never worry about cell supply’

The relationship between LG ES and its system integrator subsidiary, meanwhile is obviously a very close one. Establishing Vertech was seen as a means for LG ES to have greater control of its products and solutions in the field, while leveraging its vertical integration from manufacturing to services.

Nonetheless, the parent company will continue to work with utilities and other system integrators besides LG ES Vertech.

Hyung-Sik Kim says that diversified strategy will help hedge seasonality in Vertech’s order book, while Jaehong Park points out that it’s ultimately the customer’s decision whether to work with Vertech or a different integrator.

“We have value as a vertically integrated company, but in the meantime, our mother company is a battery manufacturer,” Park says, meaning LG ES has a “huge capacity to enlarge the pie and play a role as an important stakeholder in the market”.

“We want to be a competitive full system provider by leveraging the vertically integrated structure. In the meantime, it doesn’t mean that the vertically integrated structure is everything: we need to be competitive, and Vertech is just more than a system integrator; it’s a US ESS division [for LG Energy Solution].”

Park claims that strategy will help drive a wider variety of business opportunities in the US market, which he describes as “dynamic and evolving.”

“Some customers want battery-only [deals] because they have their own engineering capability and a keen interest in developing their own software. Some customers really value the vertically integrated structure,” Jaehong Park says.

“We are a system integrator backed by a mother company, which is the battery manufacturer. That’s an advantage: we can be flexible depending on the customer’s needs.”

Kim says “tight competition” in the market will only make Vertech a stronger proposition. Still, Kim says, one of LG ES’ core competencies is as a cell manufacturer, holding relevant IP and the ability to make “quality assured and cost-competitive product” at scale. That feeds into its vertical integration capabilities when paired with Vertech’s system integration and containerised solution design concepts, he claims.

It does, however, mean that where some system integrators may find it challenging to source enough cells to deliver their projects on time, Vertech has a direct relationship that it can leverage.

“Frankly speaking, we never worry about cell supply,” Jaehong Park says.