According to specialist renewable energy insurance company kWh Analytics’ 2025 Solar Risk Assessment, concern around battery energy storage system (BESS) safety has risen following recent fire incidents.

This has happened despite the fact that the overall incident rate decreased 98% from 2018 to 2024.

The assessment also found that hail accounts for 73% of financial losses for US solar PV projects. Our colleagues at PV Tech covered the solar findings in greater detail here.

kWh Analytics’ most recent assessment echoes its previous one. In 2024, the company also noted thermal runaway as the most important risk for ESS developers to consider.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company’s battery risk findings are based on reports from four primary sources: Clean Energy Associates (CEA), The Electric Power Research Institute (EPRI), ACCURE Battery Intelligence and TWAICE.

Last month, market intelligence firm CEA published its BESS Quality Risks report, which found that 72% of BESS manufacturing defects occurred at the system level.

As noted in the report, defects at the system level can significantly impact safety and lead to fires.

Additionally, 28% of the system-level defects were in fire detection and suppression. However, it is important to note that no systems were shipped with unresolved thermal management defects.

Last year, EPRI published an aggregate failure root cause analysis based on its BESS Failure Incident Database. The study found that 72% of BESS failures occurred within the first 2 years of installation.

Out of the 81 recorded failure incidents published, only 26 contained enough information to identify root causes, and 64 incidents had a documented system age at the time of failure. Some incidents might not be included in the database since it depends on public reporting.

State of charge (SoC) estimation errors can also present financial and operational risks to BESS developers.

Lithium iron phosphate (LFP) has become a standard technology in the BESS industry, the report notes, “accounting for more than 80% of new grid-scale storage developments,” but, it is difficult to estimate the SoC for LFP cells.

Accure Battery Intelligence and Modo Energy clarify that LFPs exhibit a flat open circuit voltage (OCV) curve, which complicates translating voltage measurements into precise SoC values.

They also explain that LFP OCV curves exhibit hysteresis effects, meaning that voltage relies not only on the SoC but also on the current flow’s direction and history.

Powin and Tierra Climate recently completed research into SoC, which Powin’s chief transformation officer, Michael Bennett, spoke about with Energy-Storage.news.

Bennett noted in that discussion:

“Anywhere between 10-20%, even 30% errors of SoC have been reported historically.”

kWh Analytics says that using more advanced SoC solutions can help to elevate LFP.

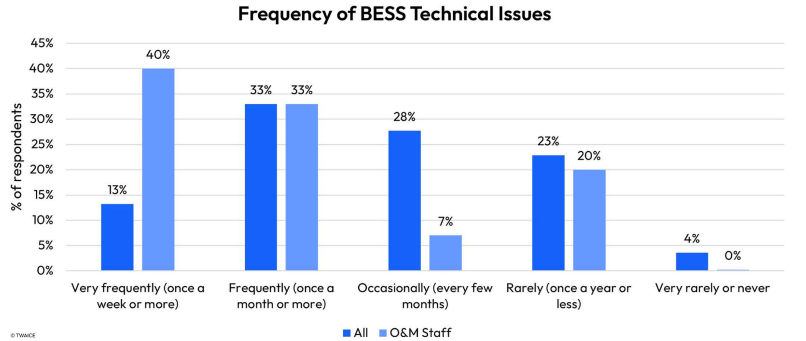

The company also highlighted battery analytics provider TWAICE’s BESS Pros Survey, which surveyed 83 professionals, including engineers, technicians and asset managers.

This survey found that “73% of operations and maintenance (O&M) staff encounter technical issues at least monthly, compared to only 53% of asset managers. Moreover, 40% of O&M staff reported issues weekly, double the rate seen by asset managers.”

The firm says the noted discrepancy highlights a disconnect between technical performance and financial oversight. If operational issues go unaddressed, it can lead to increased downtime and financial losses.

A potential way to address this would be to have a strong data strategy and BESS analytics so that any technical issues are available to multiple teams and can be addressed at several levels.

Overall, kWh Analytics notes the need for enhanced quality control and risk management strategies during rapid BESS deployment.

Geoffrey Lehv, SVP, kWh Analytics, recently wrote in a guest blog for ESN, along with other authors, and said:

“Despite headlines generated by incidents like Moss Landing, the outlook for the BESS insurance market remains stable. New monitoring technologies, improved design standards, and evolving risk assessment methods are creating a more resilient power generation industry.”