Fire safety has become a key consideration in the burgeoning battery energy storage industry. Adam Shinn, Michael Cosgrave and Ross Kiddie report on efforts to mitigate the risks of thermal runaway and the future of BESS insurance.

This is an extract of a feature article that originally appeared in Vol.40 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

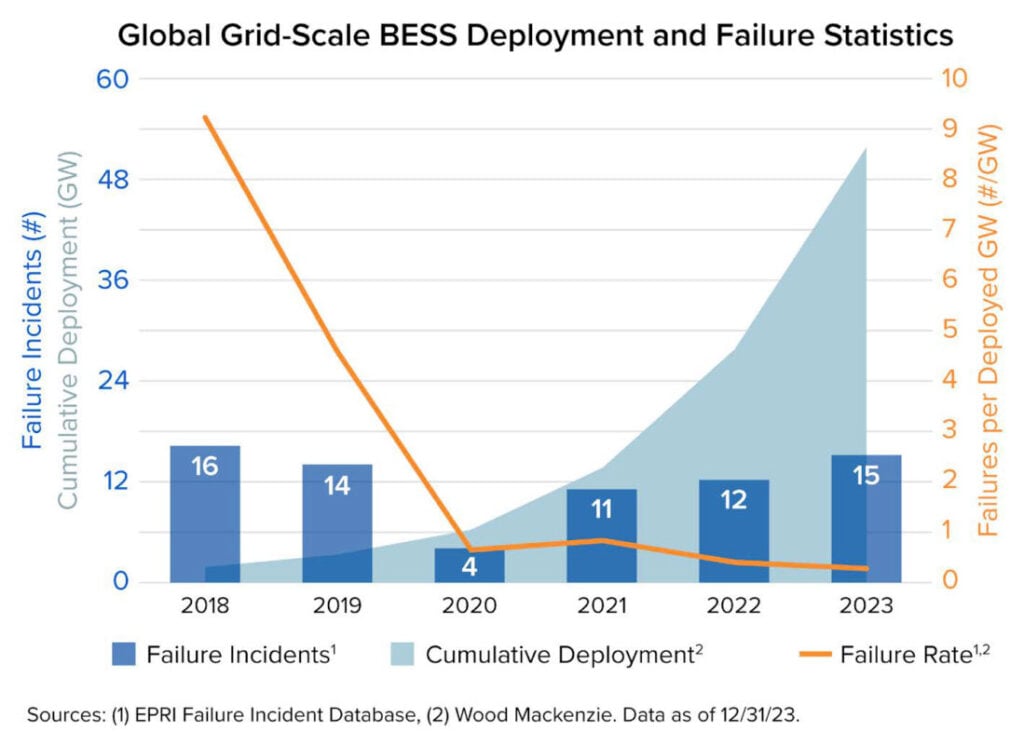

The energy landscape is undergoing a profound transformation, with battery energy storage systems (BESS) at the forefront of this change. The BESS market has experienced explosive growth in recent years, with global deployed capacity quadrupling from 12GW in 2021 to over 48GW in 2023. These sophisticated systems are revolutionising how we generate, distribute, and consume electricity, offering unprecedented flexibility and efficiency to power grids worldwide.

The trajectory of BESS growth shows no signs of slowing. According to Lloyd’s article in the 2024 Solar Risk Assessment [1], the industry is poised for a staggering 13-fold expansion, with an additional 181GW either planned or under construction.

This surge is driven by several key factors, capturing the attention of developers and investors alike. The intermittency of renewable energy sources such as wind and solar power has created a pressing need for storage capabilities to balance irregular supply with demand. BESS offers crucial grid stabilisation services and enables the delivery of more clean energy.

However, with these opportunities come significant challenges. The rapid growth of the BESS industry has outpaced the development of comprehensive safety standards and regulations. The technology itself, while advancing quickly, still faces issues related to energy density, cycle life and overall performance. Perhaps most critically, BESS installations face a unique risk in the form of thermal runaway events, which can lead to fires and explosions if not properly managed.

Battery chemistry plays a crucial role in both the performance and risk profile of BESS. Lithium iron phosphate (LFP) has become the standard for commercial-scale energy storage due to its balance of cost, environmental impact, and safety characteristics. However, other chemistries such as traditional lithium-ion, lead-acid and flow batteries each offer different advantages and challenges depending on the specific application and use case.

Insuring BESS installations presents unique challenges due to the novelty of the technology and the potential for catastrophic events such as thermal runaway. However, insurance is not just a cost of doing business—it’s an enabling form of capital that’s critical for the continued growth and adoption of BESS technology.

Understanding how to protect these assets effectively is key to securing favourable insurance terms and, by extension, unlocking the financing necessary for new projects. Delving into the intricacies of BESS risks and mitigation strategies may help shed light on how asset owners, developers and insurers can work together to foster a more resilient and insurable BESS industry, ultimately supporting the transition to a cleaner, more sustainable energy future.

The growth of global installed capacity of utility-scale BESS has naturally led to increased scrutiny of asset safety, particularly in light of high-profile fire incidents that have garnered significant media attention. However, it’s important to note that despite these incidents, the overall rate of failures has decreased sharply [2] (and Figure 1).

Risk mitigation strategies and best practices

The BESS industry’s approach to risk mitigation, particularly regarding fire protection and suppression, has undergone a significant evolution over the past eight years. This journey reflects the industry’s growing understanding of the unique challenges posed by large-scale battery installations.

The landscape changed dramatically following a series of fires in Korea in 2017 and 2018. These incidents prompted a shift towards gaseous fire suppression systems in containerised units and dedicated BESS rooms. The theory was simple: remove oxygen from the environment to suppress fires effectively.

However, the limitations of this approach became apparent with the APS Surprise, Arizona event in 2019, where quelled fires reignited upon the reintroduction of oxygen into the system. In response to the Surprise, AZ incident, many fire departments and authorities began requiring water-based fire protection systems for BESS installations. Yet, several events since 2020 have revealed flaws in relying solely on water-based systems, particularly in remote locations where water availability can be limited.

Today, the industry has come full circle, returning to an approach that echoes the pre-2017 era but with pivotal enhancements, specifically the mandatory inclusion of battery management systems (BMS). These systems are the nerve centres of modern BESS installations, playing a role in both performance optimisation and safety management.

BMS provide sensing and control of critical parameters and, importantly, trigger protective or corrective actions if the system is operating out of the norm. These parameters include battery module over or under voltage, cell string over or under voltage, battery module temperature, temperature signal loss, and battery module current.

In the event of any abnormal condition, the BMS will first raise an information warning and then trigger a corresponding corrective action should certain levels be reached.

While the battery management system is an essential component of BESS safety, a comprehensive approach to risk management includes several other best practices:

Spatial separation and explosion relief: Effective explosion relief systems require design conformance to NFPA Standards and sufficient spatial separation between containers or structures to avoid collateral damage. The standard minimum distance for non-sprinklered LFP containers is six feet.

Multi-layered approach to fire protection: While the emphasis is on prevention, many installations still incorporate fire suppression systems as a last line of defence. This may include a combination of gaseous suppression, water-based protection and emerging coolant-based systems.

Adherence to evolving standards: Compliance with applicable fire and building codes provides a basis for resilience. As these standards continue to evolve, BESS operators must stay informed and adapt their systems accordingly.

Conforming to these best practices is not just a matter of regulatory compliance; it is necessary for the long-term viability and growth of the BESS industry. As energy storage becomes increasingly central to our power infrastructure, the safety and reliability of these systems directly impact public trust, regulatory support and investor confidence.

BESS operators who prioritise these best practices not only mitigate their own risks but also contribute to the overall resilience and reputation of the industry. Moreover, as insurers and regulators scrutinise BESS installations more closely, those adhering to best practices are likely to find themselves in a more favourable position for insurance coverage and regulatory approval.

Beyond compliance: proving resilience to insurers

For battery storage asset owners, navigating the insurance landscape can be as complex as the technology itself. Insurers are looking beyond mere compliance; they seek evidence of a comprehensive, proactive approach to risk management.

The BESS industry stands at the cusp of a transformative era, with rapid growth driven by technological advancements and the pressing need for sustainable energy solutions. As deployments scale up, emerging technologies such as artificial intelligence and advanced data analytics are reshaping how we approach battery management and risk mitigation.

This technological revolution, however, must be balanced with a thorough understanding of the risks inherent to BESS. The industry’s future hinges on our ability to build resilience into every aspect of BESS design, operation and insurance.

From innovative battery chemistries to sophisticated monitoring systems, each advancement plays a crucial role in enhancing safety and reliability.

As insurers and operators gain more experience and data, we’re seeing a shift towards more nuanced risk assessments and tailored insurance solutions.

In this evolving landscape, brokers play a pivotal role. They should be proactively seeking detailed information and documentation from their clients and marketing these accounts across the insurance market. Not all insurers are equipped to make price adjustments based on resilience measures, making it crucial for brokers to work with those who have their arms around this risk class.

Looking ahead, there is reason for optimism for battery energy storage. The industry has shown adaptability in the face of adversity, and the collaborative efforts between developers, brokers and insurers are paving the way for safer projects.

Carriers are only likely to become smarter and more comfortable with storage as the technology matures. By continuing to prioritise resilience, embracing innovative risk management strategies,and communicating with the insurance markets, we can ensure that BESS continues to play a vital role in our clean energy future, powering us toward a more sustainable and secure energy landscape.

This is an extract of a feature article that originally appeared in Vol.40 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

Notes:

[1] kWh Analytics Solar Risk Assessment

About the authors

Adam Shinn is a data science manager at renewable energy insurance firm kWh Analytics. Prior to joining kWh, Adam worked at both the Space Sciences Division of the Southwest Research Institute and the Laboratory for Atmospheric and Space Physics at the University of Colorado at Boulder. He is a co-author of multiple peer-reviewed scientific publications and has a BA in astrophysical and planetary sciences from the University of Colorado at Boulder.

Michael Cosgrave specialises in placing complex property and casualty programmes for renewable energy portfolios that are non-recourse financed. He has 14+ years of experience in renewables and serves as the agency principal for insurance brokerage Renewable Guard. His personal experience spans risk consulting, broking and placement of more than 12GW of renewable energy assets throughout the United States.

Ross Kiddie is a senior risk manager at Renewable Guard. He has over 25 years of experience in the renewable energy and power space and is a recognised industry leader and specialist in battery storage, risk and insurance. He has had articles published in technical magazines on topics covering nat/cat impacts for insurance, software tools for modelling risk and has been a featured speaker and panellist at the Energy Storage Summit and other international conferences.