The Italian utility-scale battery storage market is one of the most exciting in Europe. Just under 4GWh is completed and/or operational, with a further 2GWh+ under construction. The demand for energy storage in Italy has been clear over the last half a decade, with solar and wind generation increasing.

According to Terna, Italy now has over 41GW of operational solar capacity, with around 4GW located in Puglia, and significant volumes also in Lazio and northern Italy, including almost 6GW in Lombardy. Puglia is also the leading region for wind generation, with approximately 4GW currently operational.

As shown in Figure 1, which maps planned battery storage developments, Puglia stands out as the most heavily targeted region by developers, 8.5GWh approved in the region. This is unsurprising as Puglia has a comparatively low population to the other areas mentioned above, yet it produces more solar & wind generation than any other Italian region.

This imbalance has already led to curtailment, and where curtailment becomes frequent, the economic and system value of battery storage increases significantly, making Puglia the most attractive location for BESS deployment in Italy.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The concept: store excess energy in regions where energy is cheaper, then transmit it to higher population, higher demand, more expensive areas, such as northern Italy, which has significantly higher consumption, more industry, and greater grid constraints, causing electricity prices to spike more frequently. Batteries then help smooth this imbalance by shifting energy from low-price, oversupplied regions such as Puglia.

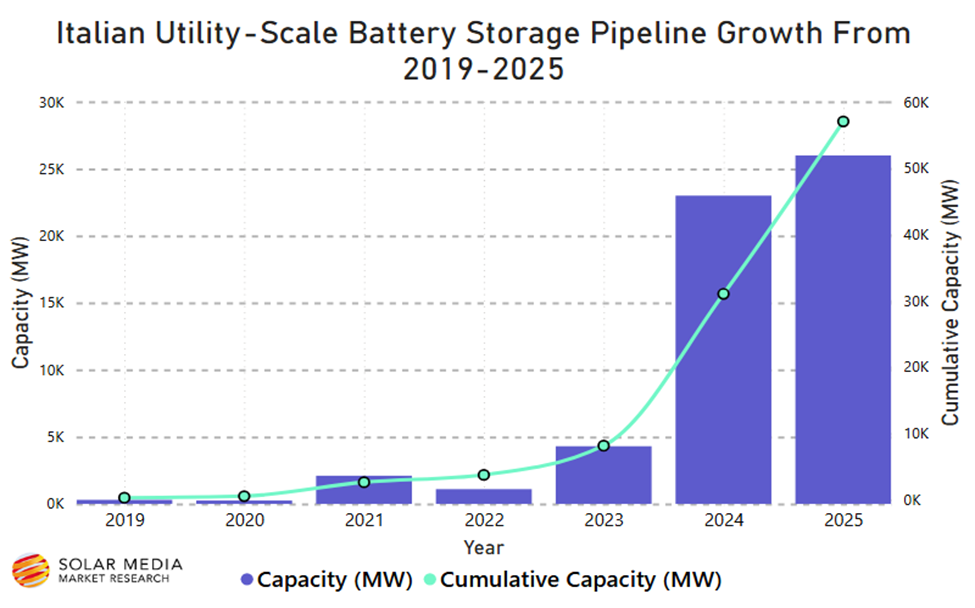

Figure 2 shows the ever-growing pipeline. According to Solar Media Market Research’s new Italian Battery Storage: Pipeline & Completed Assets Database, what started as a small market in 2019, with realistically only 1 or 2 developers. The ~300MWh of projects submitted in 2019 is dwarfed by the ~42GWh of projects starting the planning process in 2024. The number of players in the market has also skyrocketed. Over 100 different developers have projects backed by various funds around the world. It’s clear the market is intriguing more than just the Italian companies such as Enel or Sorgenia.

It’s worth noting, the above graphic does not include Q4 2025 and as mentioned in the caption of Figure 2, Q4 is the second most active quarter for submissions. With 11GW being submitted in December 2024, don’t be surprised if the 2025 bar grows significantly over the next 2 months. It’s also difficult to identify exact MWh due to the constant shift toward longer term batteries.

With a growing pipeline, backing from the government is required. This has been shown in abundance, The Ministry of Environment and Energy Security (MASE) have a fantastic track record for approving projects, with a constant flow being approved each month, 15 in August 2025 alone.

Within each MASE approval, it is clearly stated that “if the holder does not communicate the start of works within 12 months of the authorisation becoming final, the authorisation automatically lapses.

This decree pushes developers to actively progress their projects rather than sit on unbuilt capacity or speculative grid reservations for years, a problem seen in several other major European markets.

One of the most talked about topics of late are the MACSE results. Eight developers secured contracts, Enel, ACL, Greenvolt Power, BW ESS, Ze Energy, Whysol, Eni Plenitude and Natpower, spanning across what was originally 15 sites (10GWh). Enel won just over half of this capacity, ~5.2GWh. One project was withdrawn, a 32 MWh in Palo del Colle, Calabria region, this was by far the smallest project.

The next smallest project was 205MWh, expected to be a 6-hour battery. This highlights the shift toward larger-scale, longer-duration energy storage solutions. This transition is driven by the increasing demand for systems capable of delivering sustained energy output over extended periods, which are essential for enhancing grid stability and supporting other renewables technologies within the region.

With a rapidly growing market there are always going to be challenges and bottlenecks. As mentioned above, post-approval, developers have 12 months to begin construction but there is some leeway. This deadline can be extended in cases of unforeseen delays such as grid connection issues, permitting complications, or other causes. This 12-month deadline is fantastic in concept however does receive pushback. In practice, all within 12 months, developers must: secure EPC, financing, equipment, and land agreements, some which are long and arduous processes. This is why we see developers using the same solutions and EPCs across their portfolio’s.

Although MASE does have a strong track record, specific municipalities can always slow down the process, with some projects taking up to two years for approval, some being suspended / mothballed indefinitely due to opposition.

Additionally, the global shift toward long-duration storage is driving competition for equipment and suppliers, resulting in longer lead times and rising capex.

The Italian Battery Storage market is exciting and attracting interest globally. The rapidly growing demand and grid instability in high-demand areas has led to necessity for storage in regions where renewable generation is in abundance, and demand is lower. The intention from the government is clear with MACSE being much anticipated and delivering strong results, there’s still a long way to go but the market is off to a strong start.

All the data above is taken from Solar Media Market Research’s analysis, which can be accessed here.

To book a demo and access the data please email [email protected].