The California Energy Commission (CEC) has published an environmental impact report (EIR) for a huge 4.6GWh co-located BESS and solar project spread across 9,500 acres of land in Western Fresno County under development by US-based independent power producer (IPP) Intersect Power.

Rather than pursuing local permitting routes, Intersect Power chose to utilise the CEC’s Opt-In Certification Program, established in 2022 under Assembly Bill (AB) 205. Although the CEC is currently reviewing a handful of renewable energy developments, Intersect Power’s Darden Clean Energy Project is the first to make it to this stage in the review process.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The publication of an EIR is a crucial step of the CEC’s project review process that not only outlines the potential environmental effects of a proposed project, but also identifies ways to mitigate these impacts. The EIR follows Intersect Power’s initial application which was first submitted during 2023, and deemed complete by the CEC on September 19, 2024.

Following this milestone, the CEC has 270 days, or until June 16, 2025, to decide whether to certify development of the project. During this period, the public and other interested stakeholders are able to submit comments on the EIR that will be used by the CEC in its final decision.

Plans dropped for California’s “largest green hydrogen producer”

As outlined within its original CEC application, Intersect Power’s Darden Clean Energy project was first envisioned as being California’s “largest green hydrogen producer”.

However, according to a memo submitted with the CEC on October 3, 2024, the developer has since decided to drop the hydrogen portion of the project.

The majority of the world’s hydrogen is currently manufactured through a carbon-intensive process known as steam methane reformation (SMR), whereby natural gas is turned into what’s called grey hydrogen alongside carbon dioxide as a byproduct.

In order to move away from the oil and gas industry, some companies have explored utilising excess renewable energy to produce what’s known as green hydrogen. In this process, renewable energy is used to power an electrolyser that splits water into hydrogen and oxygen.

Despite being the benchmark for environmentally friendly hydrogen production, with several small-scale facilities having shown proof-of-concept, no company has yet demonstrated an “at-scale” green hydrogen facility. Unfortunately, it’s still more expensive to produce green hydrogen when compared to less environmentally friendly approaches. This, alongside other challenges associated with the production of green hydrogen, could have affected Intersect Power’s decision to produce hydrogen at its Darden project.

As part of the Inflation Reduction Act (IRA) and to stimulate industry growth, the Biden Administration earmarked a whopping US$7 billion in federal funding for seven hydrogen hubs across the US, each creating a regional supply network for the gas which so many heavy industries rely upon. Although specific details of each hub are sparse, each one will require vast amounts of renewable energy generation and storage, similar to Intersect Power’s Darden Clean Energy project, in order to keep electrolysers running 24/7.

Federal funding for hydrogen hubs, alongside other essential clean energy projects, has since been frozen pending review, as instructed by President Trump’s ill-thought-out “Unleashing American Energy” executive order. Amongst other things, the order turned back the clock on the country’s climate policies, expanded offshore drilling and promoted fossil fuel exports.

Energy-Storage.news has contacted Intersect Power as to why it dropped plans to include up to 800MW of electrolyser capacity at its Darden project, but has yet to receive a response.

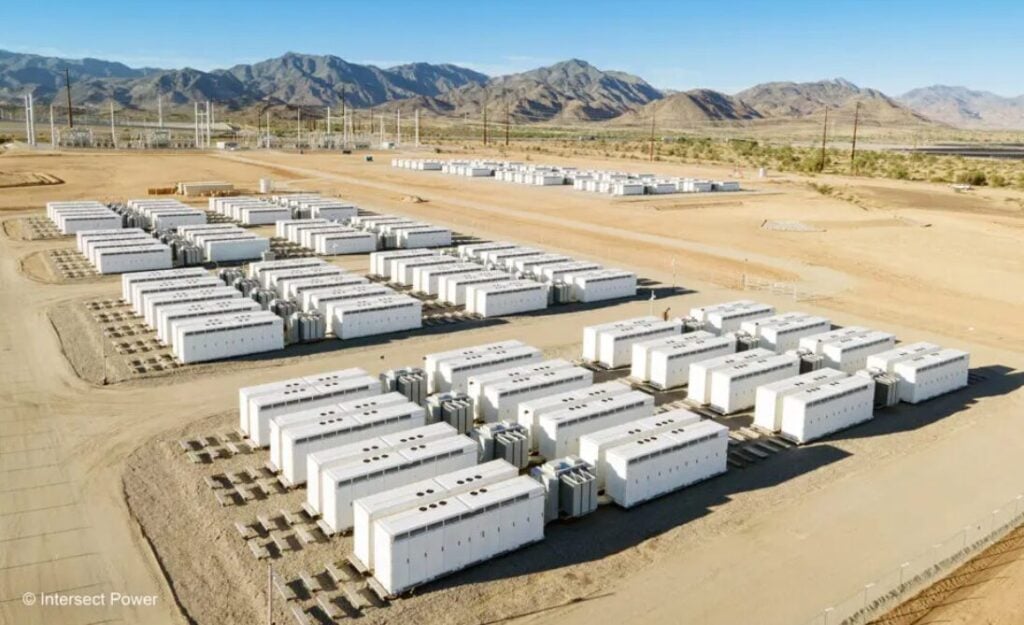

4.6GWh of Tesla 2XL Megapacks

According to Intersect Power’s most recent application, the Darden project will pair 1.15GW/4.6GWh worth of Tesla lithium iron phosphate (LFP) 2XL Megapacks with a 1.15GW solar farm encompassing approximately 9.500 acres of land in Western Fresno County, California.

As reported last year by Energy-Storage.news, Intersect Power secured a battery supply agreement with Tesla for it to supply 15.3GWh of its Megapacks through 2030.

The Darden project will connect to the California Independent System Operator (CAISO) grid via Pacific Gas & Electric’s Manning-Midway 500kV transmission line. Intersect Power has secured an interconnection agreement for the project, processed under the system operator’s Cluster 14 group.

According to Intersect Power’s application with the CEC, the developer is targeting commercial operations as early as 2027 and as late as 2028. However, CAISO’s interconnection queue shows the Darden project coming online during 2031.

First project to reach key milestone with CEC

As pointed out in a recent news release from the CEC, this is the first time a project has reached this stage of the Opt-In Certification Program. This milestone comes at a pivotal time for the CEC, after recent scrutiny aimed at the agency and its authority over battery storage projects following the recent fire at Moss Landing.

The program, which essentially bypasses the need for local regulatory approval, was introduced by California Governor Gavin Newsom to streamline and accelerate the approvals process for utility-scale renewable energy projects.

Although potentially faster than local approval processes, the CEC approvals process is considerably more expensive. Developers wanting to go down the CEC route will need to shell out US$356,282 for an application plus an additional US$712/MWh of gross energy storage capacity, capped at US$1,068,853.

There are currently eight projects pursuing approval from the CEC through the opt-in program, with all but one of these facilities incorporating some form of battery storage. Details of these seven projects incorporating storage, along with links to relevant coverage in Energy-Storage.news, can be found below:

| Project Name | Developer | California County | BESS Size (MW/MWh) | Co-located? |

| Compass Energy Storage | Engie | Orange | 250 / 1,000 | Standalone |

| Corby Battery Energy Storage | NextEra Energy Resources (NEER) | Solano | 300 / 1,200 | Standalone |

| Perkins Renewable Energy | Intersect Power | Imperial | 1,150 / 4,600 | Co-located with 1,150MW of solar |

| Darden Clean Energy | Intersect Power | Fresno | 1,150 / 4,600 | Co-located with 1,150MW of solar |

| Potentia-Viridi BESS | Capstone Infrastructure & EuroWind Energy | Alameda | 400 / 3,200 | Standalone |

| Soda Mountain Solar | VC Renewables | San Bernardino | 300 / Unknown | Co-located with 300MW of solar |

| Viracocha Hill BESS | Ignis | Alameda | 90.7 / 362.8 | Co-located with wind |

As of March 4, 2025, the CEC deems the applications associated with the above projects, minus Darden, incomplete, and has requested further information from the developers.

Although some of these projects have received little to no media attention, the Compass Energy Storage project made the news last year, after officials at San Juan Capistrano accused Engie of looking for a “more favourable project decision” with the CEC after the developer had a rezoning request denied.

As California looks to rapidly increase its renewable energy deployment, the next few months will test whether the CEC’s review process can truly fast-track the state’s clean energy transition, without forfeiting legitimate community concerns.