Energy storage systems (ESS) will become India’s most invested-in clean energy asset class during this decade, but it’s likely to be pumped hydro, not lithium-ion batteries, that see the most deployments.

That’s a prediction from a new report, ‘Energy storage: Connecting India to clean power on demand’, produced by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research, which found that ESS will be the “major disrupter” of India’s power market during the 2020s.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

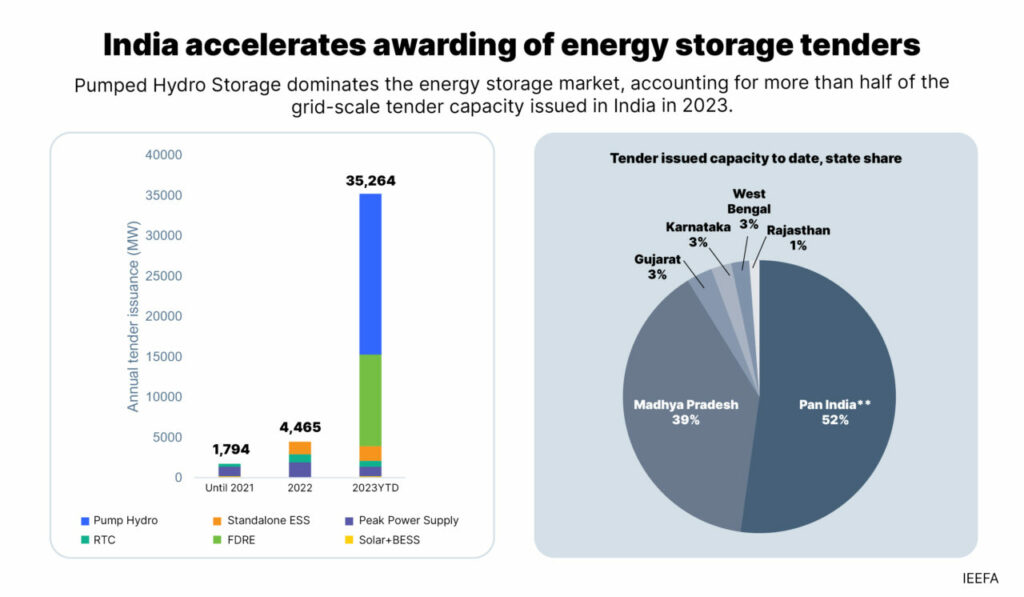

The report largely focuses on how, with a need for more than 60GW of energy storage by the 2029-2030 financial year expected by India’s national Central Electricity Authority (CEA), competitive tenders have been a vital tool for promoting ESS.

As of November this year, 8GW of energy storage tenders had been held by various national and state government agencies in India, of which over 56% were specifically for pumped hydro energy storage (PHES).

Due to its lower levelised cost of electricity (LCOE), pumped hydro is likely to dominate in tenders, especially in those where longer durations of storage will be required, although IEEFA and JMK Research did not rule out cost declines for batteries turning that dynamic on its head. As longer durations become multi-day or seasonal, the authors saw green hydrogen become increasingly viable.

That said, there are various types of tender structure, and the key proponent leading efforts at national level is the Solar Energy Corporation of India (SECI), which the report’s authors pointed out has tried a variety of different models.

Beginning with tenders for solar-plus-storage plants, there have also been peak power supply tenders, round-the-clock (RTC) renewables tenders, tenders for standalone ESS, as well as a newer structure, firm and dispatchable renewable energy (FDRE) tenders.

Tenders appear to be working in their aim of lowering the cost of clean energy storage, with the report finding solar-plus-storage auction winning bid costs had fallen 23% from 2018 to 2022. SECI then-general manager Dr Bharath Reddy took part in a 2022 Energy-Storage.news webinar with consultancy Clean Horizon, discussing many of those early tender activities and their outcomes.

‘Ideal tender structure’: Firm and dispatchable renewable energy

IEEFA and JMK Research found FDRE to be the “ideal” tender design for India, one which can effectively drive coal and other fossil fuels off the energy system and “spark a boom in ESS investment and capacity additions this decade”.

“FDRE tenders, first issued in 2023, are demand profile-driven tenders to ensure firmness and dispatchability of renewable energy, and create a win-win scenario for power developers and offtakers,” Jyoti Gulia, JMK Research founder, said.

“With similar power quality and declining costs of renewable energy and ESS, FDRE can potentially replace thermal [generation], a situation electricity distribution companies (DISCOMs) are already exploring.”

Essentially, request for proposal (RFP) documents in FDRE tenders will specify the demand profile of energy the hosting agency or offtaker wishes to be supplied with. Whereas peak power supply tenders seek energy resources at times of peak demand, and RTC tenders seek 24-hour renewable energy, FDRE tenders are tailored to different types of demand profile.

That said, different tender structures will likely be suited for different circumstances, with RTC tenders returning lower cost tariffs than peak power supply due to their higher utilisation of the ESS resource, for example.

There is still a long road ahead for India to reach the 41.7GW/208.3GWh of battery storage and 18.9GW of PHES it needs by FY2029-2030, and revenues developers can earn from winning contracts in tenders will likely need to be part of a stack that includes other streams like energy trading on power markets.

The government is also directly supporting around 4GWh of standalone energy storage facilities to kick start the market with so-called viability gap funding, and IEEFA and JMK Research pointed out that ESS has been identified as a key component of India’s national transmission plan issued in December 2022 by the Ministry of Power. Meanwhile a tradeable Energy Storage Obligation (ESO) has been added to renewables purchase schemes.

The report’s authors noted that the challenges to overcome include the high Capex cost of ESS, long lead times for project development and transmission and distribution (T&D) infrastructure that is sub-optimal.

There is also a lack of domestic manufacturing capability, with India’s few ESS manufacturers assembling packs from imported battery cells. As with its dependency on imported solar PV products, the government is seeking to address this dynamic with its Production Linked Incentive (PLI) scheme for setting up 50GWh of advanced cell battery manufacturing in India.

“India aims to augment its variable renewable energy (VRE) installed capacity (solar and wind) from 117GW to more than 392GW by 2030. This surge in VRE penetration needs to be supported by a simultaneous growth in ESS capacity,” JMK Research’s Jyoti Gulia said.