We catch up with the president of Canada-headquartered Hydrostor, Jon Norman, about the firm’s advanced compressed air energy storage (A-CAES) tech, current projects, future plans and being a developer versus system integrator.

Hydrostor: system integrator, not technology provider

Hydrostor is deploying projects in the US and Australia using advanced compressed air energy storage (A-CAES) technology utilising “off-the-shelf” components. Norman says the company is, therefore, more of a system integrator than a technology provider and, for now, is also a developer of its own projects.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It could have increased efficiency by redesigning parts of the system, but that would have reduced how proven the tech would be, and, subsequently, its bankability. Goldman Sachs Asset Management committed to investing US$250 million in the company in 2022, and Hydrostor is the investor’s “global LDES (long-duration energy storage) play”, Norman says.

The firm’s A-CAES system works on the basic level in the same way as ‘non-advanced’ CAES, by running electricity through a compressor which turns that into high-pressure air to be stored underground and then run back through a turbine to release the energy.

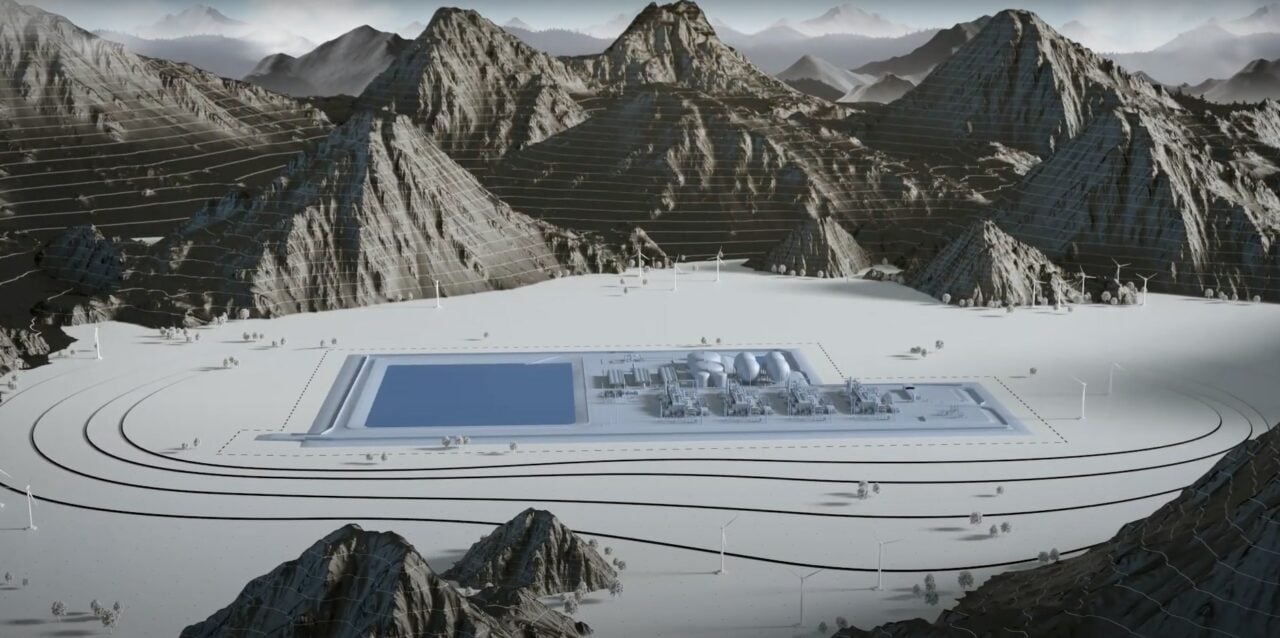

What makes it ‘advanced’ is that it takes the heat from the compressor and instead of releasing it it runs it through heat exchangers to store in pressurised water. That water is then held in a reservoir (seen in the render above) and pushed down into the cavern to push the air back up and out when discharging, and vice versa. The process is called hydrostatic compensation and is where the company’s name comes from.

The company’s A-CAES system uses ten times less space than conventional CAES and 20 times less water than pumped hydro energy storage (PHES), Norman claims.

Major projects: California and Australia

The firm has two, small-scale operational projects in Canada, the larger of which is a 2.2MW/10MWh commercial system in Goderich, Ontario, and is working on several large-scale initiatives elsewhere.

Its most advanced projects are the 200MW/1,600MWh Silver City project in Broken Hill, New South Wales, Australia and Willow Rock, a 500MW/4,000MWh undertaking in California.

Norman: “For the Broken Hill project, we are looking to reach financial close this year. We’re working with contractors and are well advanced in the permitting process. We’re the equity partner for the project and are working with a financial syndicate to secure traditional project financing for it, with an in-service date planned for 2027.”

The project will provide backup power to the city of Broken Hill as well as play into the energy market.

For Willow Rock, it emerged in June last year that the firm was choosing alternative sites for the initiative after ‘superior geological conditions for the compressed air cavern’ were discovered elsewhere, a spokesperson said at the time.

Norman disagrees with the characterisation of this as a project delay: “The media reported this as an unexpected site change. We had to file our permits before we could drill boreholes at the site, so we always had backup sites. We’re still targeting 2028/29 for a commercial operation date (COD) with the option to push that to 2030.”

“The new location is great, and the local authority is extremely supportive of the project. The date issue is more to do with development in California generally, which is one of the more challenging areas to develop in the world.”

Six months prior to that, Hydrostor entered into a long-term power purchase agreement (PPA) for 200MW/1,600MWh of Willow Rock’s capacity with Community Choice Aggregator (CCA) Central Coast Community Energy.

“This was one of the first types of LDES contracts in the world and one of the largest of its kind anywhere in the world for energy storage,” Norman claims.

Challenges of a rapid scale-up

Hydrostor is also working on earlier-stage projects in the UK and elsewhere: “We are keen on Europe, Chile, and India, though in these places [outside its core markets of North America and Australia], we would work with other development partners. We’re working with EDF on project development in the UK.”

Hydrostor has arguably skipped a step in project size scale-up by going from a 10MWh system to the multi-gigawatt-hour space, and that comes with challenges, though not on manufacturing as it might do for a BESS provider.

“I’d love to be able to do a 10MW project and then a 50MW project, as it would be much easier to find value propositions. But that’s not practical; the scale this works at is the multi-hundred-MW scale.”

“We obviously don’t have the manufacturing challenge that comes with that scale-up that a manufactured product has, nor do we have supply chain issues because our components are readily available.”

The main challenge that arises with scaling up for a firm like Hydrostor is around how you deliver and ‘wrap’ projects and demonstrating and warranting operational performance to secure traditional project financing.

“But these are well-known systems, so we have no problem getting major EPCs to tie it all together and wrap the solution, and that is really key,” Norman says.

On investment costs, the company tells Energy-storage.news: “A generic 500MW facility typically requires over US$1 billion in investment, though that all depends on a number of factors like whether or not we’re using an existing cavern (as we are in Silver City), existing transmission interconnection, etc.”

From developer to long-term operator?

As mentioned, for now, Hydrostor has done its own project development work, because of the scale of infrastructure that its projects represent, Norman said. CAES firm Corre Energy is doing something similar with Dutch utility Eneco for a 320MW project there, which has a 2027 target COD, though the latter is taking a 50% stake.

We ask Norman what the long-term goal is in terms of being a technology provider versus an owner and operator of projects, as well as what he thinks about bringing in other capabilities versus building those in-house (like optimisation).

“We are very open to selling these systems outright, but right now, we’ve focused on our own development in particular markets like North America and Australia, where we have excellent name recognition. We have a sophisticated development capability, commercial team and government regulatory function team,” he says.

“On a case-by-case basis, we’ll consider bringing in operating partners as someone else may be more suited to operating it. In Ontario, it’s a bit more straightforward, but in the UK, for example, we’d definitely want someone else to do the energy trading.”

LDES consultation in the UK

After the company commented briefly on it at the time, Norman expanded on this when asked about the UK’s LDES consultation launched last month.

“We’re very excited about it. At a high level, the UK government is taking a very good path, and it’s very important to set clear mandates around LDES. Note that we’ve seen a more technology-agnostic approach in other jurisdictions.”

“We like the cap and floor idea, though obviously the devil is in the detail. You need some long-term contracting mechanism; otherwise it’s short-term incentives, and, with that, you only get lithium-ion batteries.”

Two years ago, Energy-Storage.news interviewed the company’s CEO Curtis VanWalleghem, who discussed the regulatory changes needed to get LDES investment off the ground.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. . Visit the official site for more info. A month later, the 5th Energy Storage Summit USA will take place on 19-20 March 2024 in Austin, Texas. Then, Solar Media will will host the 1st Energy Storage Summit Australia, on 21-22 May 2024 in Sydney, NSW.