Grid-scale battery energy storage system (BESS) discharge has hit an all-time quarterly high in Australia’s National Electricity Market (NEM) for an average of 162MW in Q2 of 2025.

According to data in the Australian Energy Market Operator’s (AEMO) latest Quarterly Energy Dynamics report, this represents a 119% increase compared to the same period last year.

The surge in battery activity comes amid a substantial expansion of energy storage capacity across the NEM, which spans Australia’s eastern and southern coasts as well as the island state of Tasmania.

AEMO reports that 3,116MW/6,415MWh of new battery storage capacity has been added to the grid since the end of Q2 2024.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Violette Mouchaileh, executive general manager policy and corporate affairs at AEMO, said the continued investment in new wind and solar has also lifted renewables’ generation share from 32% to 38% year-on-year for the quarter.

“Average total demand rose 8.6% compared to Q2 2024, driven by economic activity, cooler temperatures and battery charging, which was partially offset by growing rooftop solar output,” Mouchaileh said.

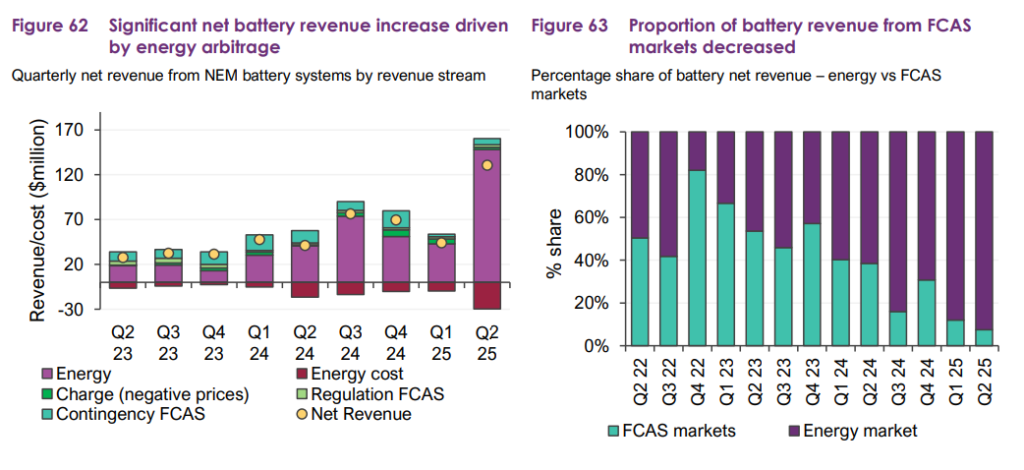

Energy arbitrage revenue rises 377% year-on-year whilst FCAS slides

The Q2 data reveals that BESS are increasingly participating in energy arbitrage opportunities. They charge during periods of low prices, which often coincide with high solar generation, and discharge during evening peaks when prices are higher.

The report notes that net revenue from energy arbitrage significantly increased, rising to AU$120.8 million (US$77.73 million) – an increase of AU$95.5 million, or 377%, compared to the previous year. This revenue constituted 93% of the total net revenue.

Additionally, estimated revenue from energy discharge reached AU$148.1 million, reflecting a year-on-year increase of AU$107.6 million, or 266%.

Conversely, energy costs associated with charging above AU$0 per MWh rose by AU$13.3 million, or 80%, bringing the total to AU$29.8 million. At the same time, revenue from charging at negative prices increased by AU$1.2 million, or 84%, totalling AU$2.6 million.

This pattern provides economic benefits for battery storage operators, helps smooth out price volatility and improves overall grid stability.

In contrast, revenue from frequency control ancillary services (FCAS) decreased to AU$9.8 million, a 39% decline from AU$15.9 million in Q2 2024. This reduction diminished its contribution to total net revenue from 39% in Q2 2024 to 7% this quarter.

Despite this decrease, AEMO states that FCAS remains a significant revenue stream for BESS operators. The fast response capabilities of BESS make them ideally suited for these services, which are critical for maintaining grid frequency within acceptable limits.

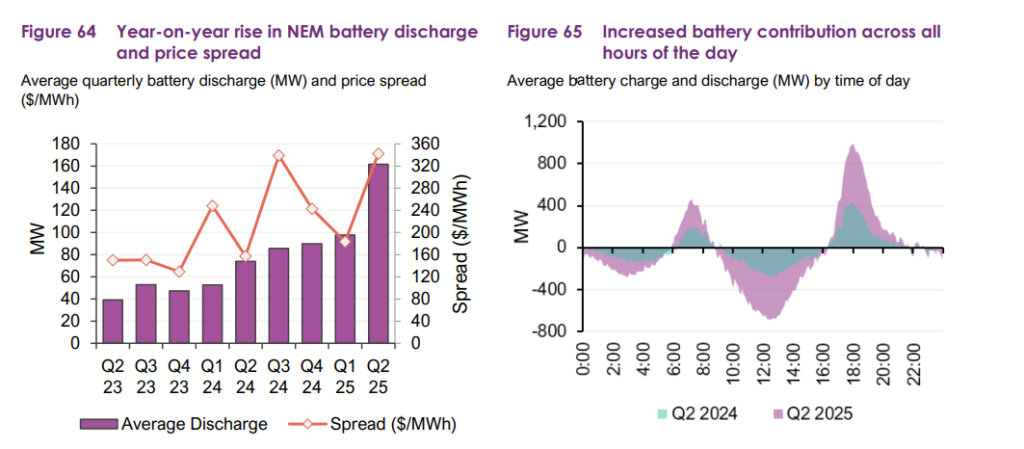

Average BESS discharge availability increases by 81%

AEMO’s report also highlights the changing operational patterns of batteries as the fleet expands. With more capacity available, batteries are increasingly able to sustain longer discharge periods, providing support during extended peak demand events.

For instance, in Q2 2025, the average quarterly BESS discharge availability increased by 801MW, or 81%, from 985MW in Q2 2024 to 1,786MW. The average battery discharge in the NEM also more than doubled, rising to 162MW compared to the 74MW average observed in Q2 2024.

Additionally, this quarter saw a new peak discharge record for battery storage systems, reaching 1,756MW during the half-hour ending at 18:00 on 12 June 2025. This marks a 60% increase from the previous record of 1,099MW set in Q1 2025.

BESS charging also reached a new high, with 1,221MW recorded in the half-hour ending at 13:00 on 20 June 2025.

The NEM-wide price spread for batteries increased to AU$342/MWh this quarter, up from AU$157/MWh in Q2 2024, reflecting greater price volatility year-on-year. Average battery discharge and charge increased throughout most hours of the day.

Notably, the average battery discharge during the evening peak period, from 16:00 to 20:00, increased by 300MW compared to Q2 2024, while average BESS charge during the daytime period, from 10:00 to 16:00, rose by 270MW year-on-year.

Our publisher, Solar Media, will host the Battery Asset Management Summit Australia 2025 on 26-27 August in Sydney. You can get 20% off your ticket using the code ESN20 at checkout.