The capabilities of lithium-ion battery storage in providing long-duration energy storage to global energy systems should not be overlooked, write Kotub Uddin and Sam Secher of Envision.

The energy transition requires the deployment of firm, reliable power, which wind and solar alone do not provide. Without long-duration electricity storage (LDES), grids must rely on inefficient and expensive fossil fuel backup, undermining both decarbonisation and economic stability.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Current grid stability mechanisms—including ramping gas turbines, coal reserves, and peaker plants—exist to compensate for the variability of renewables. However, this reliance on fossil assets introduces multiple challenges:

- Increased marginal emissions whenever fossil generation is used.

- Higher system costs due to inefficiencies and fuel price volatility.

- Structural bottlenecks that slow down the transition to a clean energy economy.

LDES is the critical missing piece. By decoupling generation from consumption, LDES captures excess renewable energy when it is abundant and discharges it when supply is low. Yet, despite its necessity, long-duration storage deployment remains far behind where it needs to be.

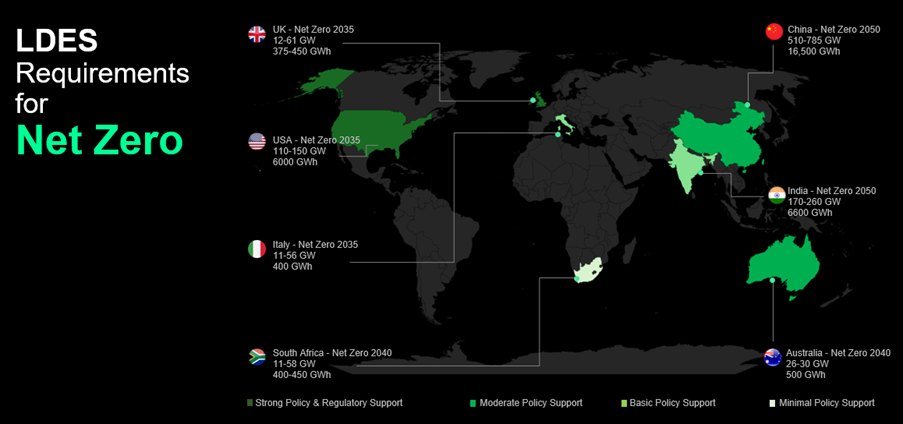

Trade association LDES Council reports 8 terawatts (TW) of LDES will be required globally by 2040, however today only 120 gigawatts (GW) exist, with another 120GW planned—bringing the total to just 240GW by 2035.

This massive shortfall risks slowing the clean energy transition and delaying global decarbonisation goals.

Governments worldwide are stepping in with policy incentives to accelerate LDES adoption:

- UK: Cap-and-floor mechanism provides revenue certainty, as the CfD scheme has done for renewables.

- Italy: MACSE auctions, which do not directly promote long-duration, are nevertheless driving interest in 6-hour+ storage, although rules remain unclear

- India: RTC tenders target 4-hour storage, with growing demand for 8-hour solutions.

- Australia: NSW aims for 28 GWh of LDES by 2034.

To meet global energy targets, LDES deployment must scale up 50x faster than current projections. Achieving this requires stronger incentives, strategic procurement, and collaborative investment between utilities, governments, and private sector players.

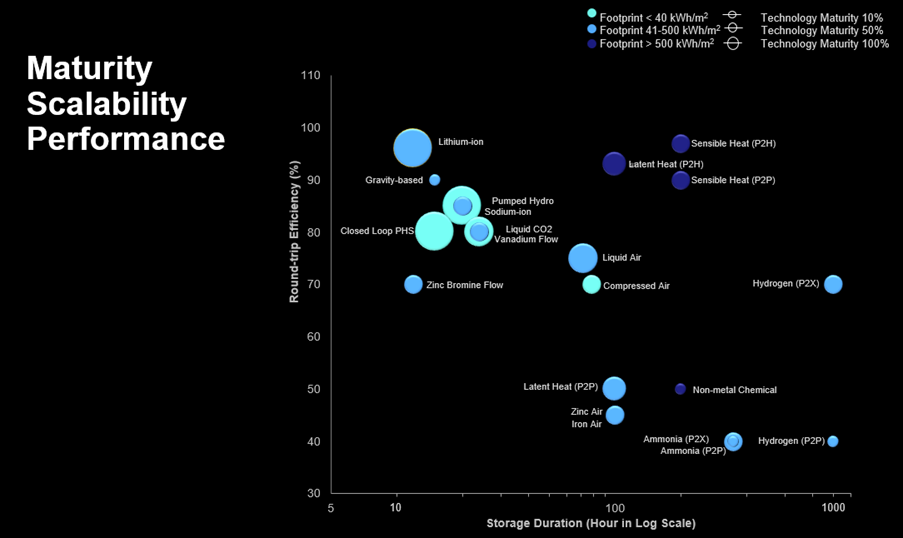

A variety of technologies are vying for dominance in the LDES space. However, evaluating their commercial viability requires focusing on key metrics: scalability, performance and bankability. These in-turn are related to:

- Round-Trip Efficiency (RTE): Determines operating costs and competitiveness in energy markets.

- Footprint & Scalability: Measures deployment feasibility and infrastructure requirements.

- Technology Maturity: Directly impacts financing risk and long-term investment returns.

Based on these factors, two technologies emerge as the leading contenders for LDES:

1. Battery energy storage systems (BESS)

- Highly scalable, modular, and flexible.

- Can be deployed almost anywhere.

- Majority of existing projects less than 4-hour duration but becoming increasingly viable for 6 to 10-hour duration.

2. Pumped hydro energy storage (PHES)

- Proven at scale with lower costs for longer-duration storage.

- Limited by geography, long construction times, and high upfront costs.

- Led the LDES market in 2023 with 185.5GW of global capacity, according to BloombergNEF (BNEF).

Current lithium-ion BESS technology has a baseline performance of:

- Energy density: 420 Wh/L at the cell level.

- Cycle life: 12,000 cycles with strong SOH retention.

- Round-trip efficiency: 88%.

In the coming years, further advancements will improve BESS viability:

- Energy density: Expected reduction in footprint by over 40%.

- Efficiency gains: More compact and efficient power electronics to increase RTE by 1%.

- Enhanced cycle life: Pre-lithiation technologies could boost lifetime energy throughput by 3% to end-of-life.

- Cost reductions: Economies of scale and process improvements will lower costs.

LDES investment case: BESS versus PHES

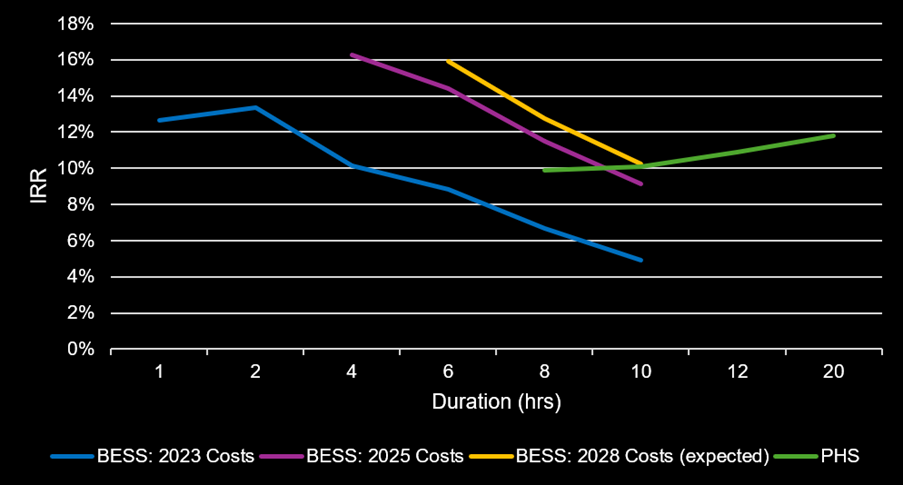

Unlevered internal rate of return (IRR) is a useful metric in evaluating the viability of a project. The below chart shows unlevered IRR calculated over the entire operational lifetime of BESS projects of duration ranging from 1-hour to 10-hours and PHES projects ranging in duration from 8-hours to 20-hours.

All projects are transmission-connected with the same nameplate connection capacity, and all begin commercial operation in 2028. BESS projects are decommissioned when cell state-of-health drops below 60%, and all PHES projects are assumed to operate for 50 years.

PHES cost and operating assumptions are drawn from the NREL Annual Technology Baseline 2024. The analysis uses revenue curves based on modelling from Modo Energy, though with a less optimistic view on energy storage revenue from the 2030s onwards.

Around two-thirds of total BESS project cost is assumed to be due to OEM equipment costs, with the remainder accounted for by EPC and connection costs. This is based on BNEF’s Energy Storage System Cost Survey 2024. OEM costs are largely driven by lithium iron phosphate (LFP) cell price, which are drawn from historical data published on Shanghai Metals Market (SMM).

Three IRR curves for BESS are shown. The first of these, BESS: 2023 Costs, has capital costs that include cell prices from mid-2023.

The second, BESS: 2025 Costs, has costs reduced by approximately 30% driven mainly by LFP cell price drops as well as improvements in RTE and degradation.

The last curve, BESS: 2028 Costs (expected), assumes cell price will drop very slightly in the next 2-3 years and includes some further improvements in efficiency.

In 2023, projects struggled to compete beyond 4-hour durations. This is because capital costs scale in proportion to installed capacity, whereas PHES costs, though high initially, only slowly increase with reservoir capacity (and hence duration). With BESS projects above 4-hour duration unable to exceed a 10% hurdle rate, pumped hydro was the default choice for longer-duration storage.

The turning points for BESS in 2025 and 2028

The BESS: 2025 curve shows that recent BESS project cost reductions have significantly improved the investment case for 6 to 8-hour systems, with 8-hour IRR approaching 11.5%. This surpasses pumped hydro, whose 8-hour IRR is 9.9%.

Anticipated additional efficiency improvements and a very small further decrease in costs are reflected in the BESS: 2028 Costs (expected) curve, which suggests that 10-hour BESS IRR will come into line with pumped hydro (10.3% vs. 10.1%). At that point, BESS will be the optimal solution for all durations up to 10-hour.

Impact of UK’s cap-and-floor mechanism

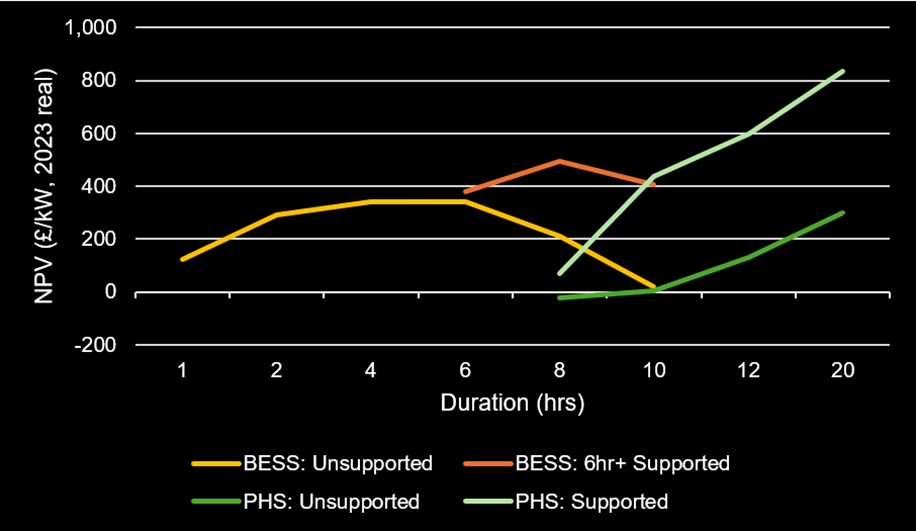

The introduction of a cap-and-floor mechanism in the UK aims to stabilise revenue streams for LDES projects, reducing financial risk. Though full details of the scheme’s implementation are not yet published, it is known that the floor level will be set to ensure developers can meet debt payments whilst the cap will ensure that profits above a certain level are returned to the consumer.

The minimum criteria for an energy storage system to qualify for the scheme are a power output of 50MW and a duration of 6 hours, though minimum duration may be raised to 8-hours or 10-hours.

The below chart shows the net present value (NPV) per kW nameplate capacity (in 2023 real terms) for BESS and PHS projects calculated over a 25-year period from commercial operations date, both with and without support under the cap-and-floor scheme.

Capital costs for BESS are consistent with the BESS: 2028 Costs (expected) curve described above.

The curves BESS: Unsupported and PHS: Unsupported have NPV calculated at a 10% hurdle rate. The curves BESS: 6hr+ Supported and PHS: Supported have NPV calculated at a 6.5% hurdle rate.

Without support, BESS NPV reaches a maximum between 4-hour to 6-hour duration then declines. With support, BESS NPV reaches a maximum at 8-hour duration, at which it significantly outperforms supported PHS, and remains on par with supported PHS up to 10-hour duration. This suggests that the reduction in hurdle rate does not shift the competitive landscape but rather improves the investment case for both BESS (6-hour duration and above) and PHS.

Conclusion

Beyond financials, BESS offers structural advantages over pumped hydro:

- Faster deployment: BESS projects can be operational within months.

- Geographic flexibility: No reliance on elevation or water reservoirs.

- Modular expansion: Scalable to match dynamic grid needs.

- Technology-driven cost reductions: BESS continues to benefit from rapid innovation, whereas pumped hydro is a mature technology, and costs are unlikely to change significantly.

These factors combined with declining BESS costs and improving technological maturity lead to the conclusion that BESS is ideally positioned to provide mid-to-long duration storage up to 10-hours before 2030, allowing rapid access to the full range of revenue streams.

About the Authors

Kotub Uddin, Ph.D., is chief engineer at Envision Energy, a provider of net zero solutions including wind turbines, energy storage systems and green hydrogen for global enterprises, governments and institutions. With 30+ published papers in the field, his expertise spans from pioneering developments in OVO’s VPP technology to driving innovation in Jaguar Land Rover’s electric vehicle programme.

Sam Secher is responsible for BESS system modelling at Envision Energy.