Global energy storage system integrator Fluence increased its revenues for the first three months of 2022, its second quarter, by 249% to US$343 million.

Financial and operational highlights

The company, which has a fiscal year that runs to September 30, saw a net loss of US$61 million and negative adjusted EBITDA of US$53 million in the period, both of which increased in proportion with revenue. It has reaffirmed previous guidance of US$1.1-1.3 billion in revenue for fiscal year 2022.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

By March 31, total cash and cash equivalents grew around 6% to US$723 million and its total backlog reached US$2.2 billion worth of orders. US$1.8 billion of this is from energy storage products segment, with the remaining US$400 million from long-term energy storage services and Fluence IQ, its software platform.

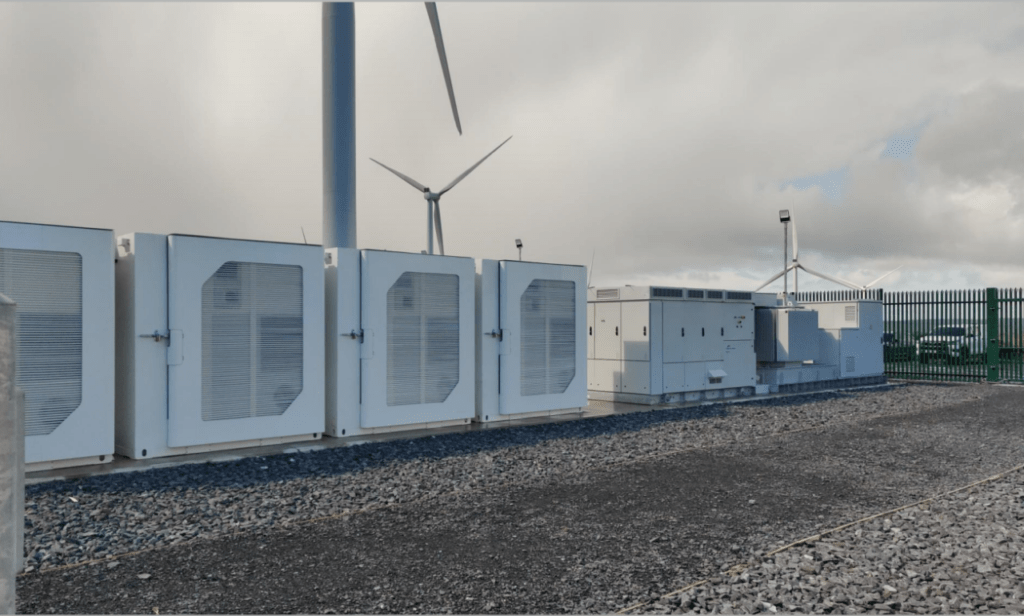

All three segments saw strong operational growth. Energy storage products deployed and contracted doubled (+94%) from the same period last year to 4,832MW. Energy services deployed and contracted tripled (+207%) to 3,283MW while deployed and contracted MW under its Fluence IQ platform was in between the two, growing 150%.

Fluence said US solar and storage greenfield projects have accounted for about 30% of total order intake in the first half of its 2022 fiscal year (October 2021 to March 2022). It added 582MW of new contracts in contracts for energy storage products in Q2 and made progress on contract manufacturing locations in EMEA and Americas, it said.

In the company’s Q1 (October-December) results presentation Fluence CEO Manuel Perez Dubuc revealed that future contracts would include pricing based on raw material indices (RMI) to minimise exposure to fluctuations which, along with inflationary pressure, were a “concern for many in our industry.”

In last week’s Q2 earnings call, he said Fluence had increased its prices on new contracts by 15-25%, related to its new RMI-based pricing, and that no cancellations had occurred after those price changes. “So far, we have seen a broad acceptance by our partners to engage in finding optimal and creative solutions for all parties,” he said.

Some 343MW of new contracts for energy services were added in the period while Fluence IQ grew its assets under contract by 2.8GW which excludes its acquisition of Nispera in April. It does include Fluence IQ’s first pumped hydro asset of 1.2GW.

In an update on the quarter-on-quarter development of its supply chain, Fluence cited disruptions like reduced battery production in China due to lockdowns and multiple Force Majeure declarations by manufacturers there. On the upside, shipping rates are stabilising, port congestions are moderating and raw material price volatility is improving, it said.

Although occurring after the period in question, Fluence recently tied-up with Amazon Web Services (AWS) for cloud computing services to support its hardware and software platforms.

‘Fluence well-positioned to capitalise on increased renewable deployments in Europe’

The company cited the EU’s REPowerEU initiative to increase the renewable energy transition and reduce reliance on Russian gas, by nearly doubling renewable asset deployments from 42GW to 78GW annually to 2030. While industry advocates have expressed concern that REPower EU excludes explicit mention of the role of energy storage in that endeavour, it appears Fluence believes the fundamental drivers for energy storage will be strong.

Dubuc said: “As you can imagine, this increase in renewable asset generation will create more grid reliability and stability issues, thus, necessitating additional energy storage. We have already seen increased interest from our customers in Europe from energy storage. As the market leader in Europe, Fluence is very well positioned to capitalise on this emerging need, enabling Europe to achieve its energy independency and security goals.”

He also highlighted the opportunity of data centres globally looking to replace existing traditional forms of carbon-emitting backup power systems with emission-free energy storage. Fluence completed a 2.75MW project for Google in its Belgium data centre during the period, and Dubuc said this sub-segment totals about 20GW globally.

Fluence’s chief digital officer Seyed Madaeni provided some colour on the Nispera acquisition mentioned earlier.

“The bidding app is currently Fluence IQ’s flagship application, we are in the process of developing a dispatch app, manage app and invest app, but we intend to utilise Nispera’s APM (asset performance management) as a foundation for our manage app, which we expect will accelerate the time to deploy this application to the market. Not only does Nispera provide us with a solid foundation for our manage app, but it also expands our digital portfolio’s geographic footprint,” he said.

Rebecca Boll, chief producer officer, added in response to an analyst’s question that the Fluence is on track to reduce its supply chain exposure to China to 70% by the end of the year through deals with other suppliers. By 2025, the company hopes it will be about 50% as Europe and North America-based manufacturers ramp up.