Energy storage specialist Fluence and renewable energy market software and advisory firm Pexapark have entered into a long-term strategic partnership, confirming Fluence’s accelerated push into wider renewable energy and energy storage software services.

The partnership gives Fluence’s customers access to Pexapark’s suite of analytical tools and services through the Fluence IQ digital ecosystem. These include market intelligence about renewable energy power purchase agreements (PPAs) and energy portfolio risk management optimisation solutions.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

For Pexapark, combining with Fluence’s fleet of 3.6 GW of battery-based energy storage solutions will accelerate the incorporation of energy storage analytics into its software products, which are currently majority-focused on wind and solar. Pexapark says it has supported more than 20 GW of renewable power purchase agreement (PPA) transactions to-date.

As previously discussed on Energy-Storage.news, software is fast becoming a key differentiator for energy storage technology companies. Big growth in energy storage and renewables and increased volatility and regulatory changes are making data-driven market intelligence a must-have for electricity market participants, the companies say.

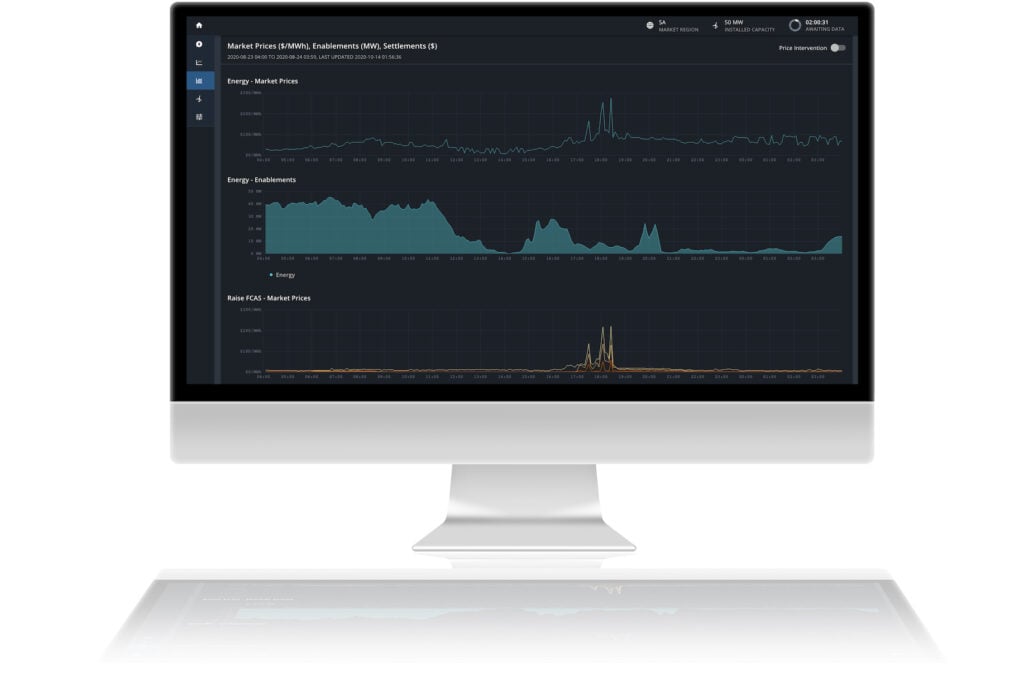

Software platforms can connect energy assets to energy markets by enabling optimisation and real-time bidding, which helps drive digitisation in the market.

In line with the trend, Fluence acquired energy storage software and AI pioneer Advanced Microgrid Solutions (AMS) in October 2020 and re-branded its offerings as Fluence Digital and Trading Platform. Fluence partnered with AMS to provide additional market functionality to its customers for over a year before acquiring AMS outright. Six months later it had its first customer in a 730MWh Lithium-ion battery storage plant in California.

AMS’ CEO-turned-Fluence chief digital officer Syed Madaeni has claimed that acquisition will help increase return on investment on energy storage assets from 10% to 30% for Fluence customers, albeit specifically in AMS’ Australian and US markets.

Longer-standing players in the renewable space have launched similar market intelligence products. Tesla has ‘Autobidder’ while Finnish group Wärtsilä, a rival to both Tesla and Fluence, has ‘Intellibidder’.

Fluence was founded as a JV between Siemens and AES in 2018 and IPOed on the NASDAQ late last year at a valuation of US$4.7bn.

In somewhat related news, our sister site PV Tech reported today that smart AI-driven energy storage provider Stem Inc’s acquistion of solar asset management platform and services company AlsoEnergy has closed.