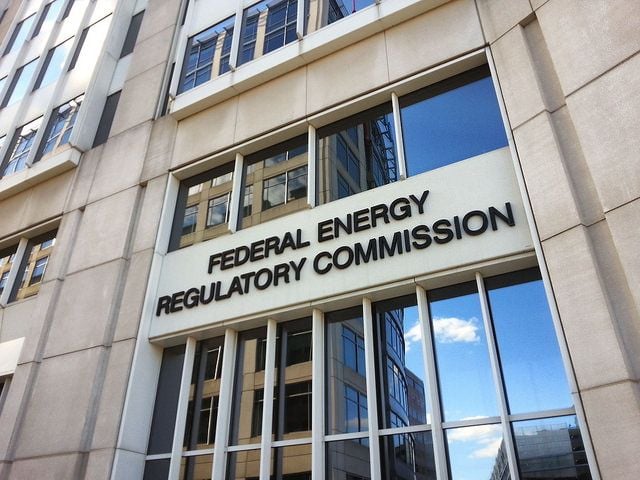

The US Federal Energy Regulatory Commission (FERC) has blocked a request to delay implementation of new market participation rules for energy storage made by the Mid-Continent Independent System Operator (MISO).

MISO delivers electricity across its grid network in 15 US states and Manitoba in Canada and also has responsibility for operating an energy market with more than US$20 billion of transactions made annually. As with the other RTOs and ISOs in the US which fall under FERC jurisdiction, MISO has been directed by the commission to reconfigure its wholesale market rules to enable distributed energy storage to participate.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The directive, FERC Order 841, had faced some hurdles since proceedings began to push it through in 2016, but a court ruling in July last year cleared the way for what then-FERC chairman Neil Chatterjee (still a commissioner) described as the “single most important act” the US could take in transitioning to a clean energy future.

Various clean energy industry insiders, experts and advocates also responded warmly to that ruling and various ISOs and RTOs have already put forward their compliance plans to implement 841, including the New York ISO (NYISO) and ISO New England, among others. Taking part in a session of the Energy Storage Summit USA hosted in March by our publisher Solar Media, ISO New England lead analyst of market development Hanhan Hammer said that her organisation already allows energy storage resources to participate in multiple market opportunities, giving it something of a head-start in adopting what Hammer described as the “enhanced” rules that Order 841 is facilitating, while NYISO's energy market design manager Zach Stines said his organisation had already adopted its 841 compliance regime but had yet to see energy storage developers step up to participate in those widened opportunities at that time.

MISO itself also filed a plan in 2019 that FERC accepted, which would see Order 841 implemented in its markets by 6 June 2022. MISO however in March asked for an extension until 2025. Then, in a letter to FERC from MISO CEO John R. Bear dated 10 May, said that it believed implementing the requirements would bring the grid operator into “an unenviable position of choosing a path between conflicting goals that could jeopardise our capability to operate our 15‐state wholesale grid reliably, efficiently and securely”.

MISO said implementing new software platform for balancing network to integrate renewables should take priority

The organisation said that its projections under a planned future scenario to 2040 would see its existing carbon emissions reduced by a minimum of 63% and a maximum 83%. Up to 50GW of new solar PV and 31GW of new wind could be added under that scenario, but the ISO predicted that only around 600MW of energy storage would be added to its networks.

This relatively low figure was based on the projections of its member organisations, which are mostly vertically-integrated utility companies, to meet the forecasted load, Bear wrote. However, MISO acknowledged that with growing shares of solar and wind coupled with increasing weather volatility there will be a need for more grid-balancing assets.

The organisation said its request for an extension hinged on the fact that it will be installing a new software platform, Market System Enhancement (MSE) to help meet growing complexity in meeting the demand for reliability electricity in a progressively less carbon-intense way. It basically requested more time to be able to align the goals of Order 841 with the deployment of this software platform.

MSE will be established in 2024, a year earlier than originally planned and MISO said the extension request would give it time to “align plans for building, testing and implementing” it. Battery storage already participates in some of the ISOs markets, the CEO wrote, and the requested extension would “further optimise the participation of those resources by 2026 in time to meet its projected growth”.

However, yesterday, FERC ruled to deny the request. Commissioners said in a filing that MISO had not shown a strong enough argument. MISO had “not demonstrated potential reliability impacts” to warrant the delay — specifically that the ISOs accelerated schedule for implementing the MSE platform would not be needed to maintain reliability.

This is partly because, FERC said, MISO does not expect wind and solar penetration on the grid to exceed a 30% threshold where reliability concerns become more acute, until after 2026. MISO had not shown enough evidence for why the accelerated MSE rollout was needed, nor of the potential threats to grid reliability, the commissioners said.

FERC also found that MISO’s existing market structures in which energy storage resources are already eligible to participate have “significant limitations” which participation in Order 841 compliance would address. The commission further said that while MISO claimed a precedent had been set by ISO New England’s request to delay some aspects of Order 841 compliance, ISO New England had only asked for a delay until the beginning of 2026 for state of charge and duration characteristics of storage in its day-ahead market and other compliance tariff revisions would come in line with the Order.

One FERC commissioner, Mark Christie, dissented with the ruling made by three others including chairman Richard Glick, while Neil Chatterjee did not participate in the process. Christie said that he agreed with MISO’s voiced concerns that it could not simultaneously prioritise Order 841 compliance as well as the implementation of the MSE platform.