Energy storage is among a number of key technologies which can bring much-needed flexibility to electricity networks and therefore to energy markets. With Europe at an unprecedented crossroads in its energy system planning, now is the time to factor in that critical flexibility, argue Julian Jansen and Lars Stephan of Fluence.

This is an extract of an article which appears in Vol.33 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Over the last 12 months, we have witnessed an unprecedented crisis in the European energy markets. This was caused, among others, by the war in Ukraine, the growing effects of climate change, and the unavailability of the French nuclear fleet. Europe’s response to those challenges is an even faster acceleration of renewable buildout in Europe.

As we rediscover the meaning of security of supply, it is time to better understand the value of flexibility as a critical enabler of the energy transition. European policy makers need to strengthen the role of flexibility technologies, including energy storage, in future Energy Market Design.

A perfect storm

The European energy crisis of 2022 is not only about gas shortages, but also about a persistent heat wave during the summer. High temperatures and droughts resulted in reduced production of conventional power plants, which were lacking cooling water, and decreasing water levels at hydro plants and reservoirs around Europe.

Several Covid-related delays of maintenance schedules at French nuclear plants and unexpected maintenance challenges at some reactors contributed to a historic low in electricity generated from the French nuclear fleet.

All of the above factors led to higher gas and electricity bills for households and businesses, bringing the social dimension of energy markets into the focus of European policy makers, and raising questions about the competitiveness of European industries and businesses.

Europe’s reaction to the energy crisis

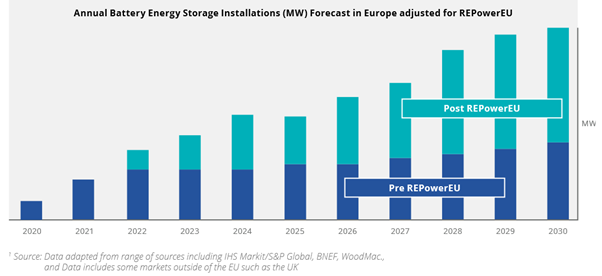

The REPowerEU Plan, published in May by the European Commission, aims to increase the target of energy generated from renewable sources to 45% by 2030, up from 40% compared to last year’s targets. This would bring Europe’s renewable energy generation to 1,236GW by 2030, including the installation of 320GW of new solar PV by 2025.

By the middle of the decade, this would result in cumulative solar capacity surpassing electricity demand in several European countries.

The REPowerEU plan is widely received as an important step by energy industry stakeholders, but it has also left some important questions unanswered. Discussed between energy experts, but largely invisible to the general public, is the need to upgrade power networks and interconnectivity between markets in Europe. While pivotal, it is not only a huge investment challenge, but also hindered by slow planning cycles and resistance against new infrastructure.

The other major question is how to safely integrate the increasing shares of fluctuating renewable energy into the European power system and market, and aligning it with the load profiles of industry and consumers. Energy storage, demand response and other flexible technologies are ready to address the needs, but the need and their value remain underestimated.

Despite having access to this ready-to-deploy and cost-effective technology, we continue to rely on high-emission natural gas-based generation for flexibility needs in European power markets, while the Europe-wide targets that would strategically scale up energy storage projects are yet to be developed and embedded in law.

The investment challenge for energy storage as clean peaking capacity

In Europe, industry experts see the REPowerEU Plan and the current higher energy prices as a major accelerator for energy storage.

Despite positive outlook, the business case of flexible assets has limitations for investors. They are fully merchant, and the investment case depends on forecasted wholesale market volatility. Without long-term revenue security, such assets are less bankable.

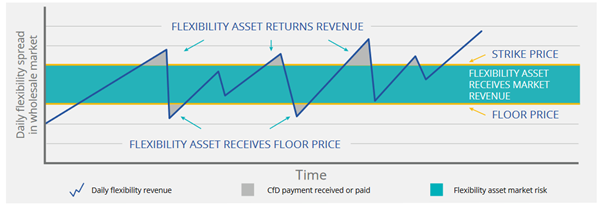

Reducing investment risk and, thereby, revenue risk for assets in our electricity system is not a new mechanism. Renewable generation assets benefit from feed-in-tariffs, renewable obligations or Contracts-for-Difference (CfD). Similarly, many European member states have Capacity Markets, remunerating the build-out of reliable capacity in power markets.

Creating Electricity Market Design fit for the energy transition

To integrate higher levels of renewable energy into energy markets, regulators are working on a proposal to restructure European Electricity Market Design. The European Commission aims to develop a merit-order mechanism, under which wholesale markets operate, ensuring the low cost of renewable electricity filters through to consumers.

Rethinking European Electricity Market Design also opens the opportunity to rethink the role of flexibility in electricity markets. Failing to prepare for the build-out of flexibility technologies and grid infrastructure to match the pace of the roll out of renewables will result in increased congestion on power grids, curtailment of renewable generation, continued CO2 emissions from the power sector, and higher costs to consumers.

At the same time, flexibility assets create opportunity to increase the efficiency of our power system, and ultimately lower cost to consumers. The question we need to answer now is: how to incentivise investment into flexible assets to enable this?

Decarbonising the Capacity Market

The Capacity Market or Capacity Mechanism (CM) is an integral part of European Electricity Market Design as a temporary measure to ensure the necessary means of resource adequacy in national electricity markets.

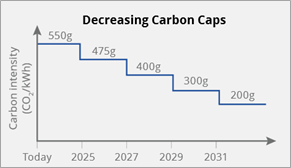

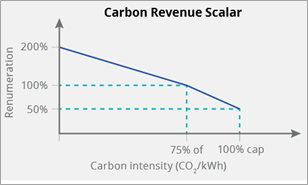

Security of supply has become a critical area of focus during the current energy crisis. As renewable penetration increases, CM design should prevent an unsustainable lock-in effect of carbon intensive thermal generation assets.

Otherwise, Europe will fail to meet emission reduction targets. We therefore propose three key changes to the CM: 1) Decreasing the existing carbon cap over time 2) Linking CM payments to carbon intensity 3) Providing longer contracts for new-build low-carbon assets The three proposed changes will provide a clear path to owners and operators of existing CM assets as well as clear investment signals for new-build capacity to accelerate the decarbonisation of CM across Europe.

Building flexible and low-carbon peaking capacity

We further propose two key changes to the Electricity Market Design that will enable flexibility options via a market mechanism to balance generation and demand on the grid, reducing curtailment of renewables and replacing peaking capacity with low-carbon peaking capacity. These options include: 1) Mandatory Renewable + Storage auctions 2) Contract for Difference (CfD) for flexibility and curtailment prevention.

European energy strategy needs to address flexibility

Europe today stands at a crossroad. Based on the unprecedented challenge in our energy markets, we decided to accelerate renewable build out, which in time will result in a lower-emission, more resilient, and more affordable energy system for European citizens.

Still, as we chart the course of a renewable based energy system, we need to pre-empt future challenges and already define solutions to the future challenges of our energy transition ahead of time. Defining the need for flexibility and creating market mechanisms for flexibility is a key part of Europe’s future renewable powered energy system.

This is an extract of an article which appears in Vol.33 of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry. Every edition includes ‘Storage & Smart Power,’ a dedicated section contributed by the team at Energy-Storage.news.

About the Authors

Julian Jansen is growth and market development director and Lars Stephan is policy and market development director for the EMEA region at Fluence, a global energy storage technology company

and products and services provider. Julian and Lars work to support growth in energy storage markets,

working in the policy and regulatory space as well as business development with stakeholders including transmission system operators.

Energy-Storage.news’ publisher Solar Media will host the 8th annual Energy Storage Summit EU in London, 22-23 February 2023. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.