European battery energy storage deployments are expected to plateau over 2024-27 due to lithium-ion scarcity, whilst the continent will need 200GW by 2030 to accommodate additional renewables.

Analysts from research and consulting company Delta-EE and EASE, the European Association for Storage of Energy, revealed the findings of the sixth edition of their European Market Monitor on Energy Storage (EMMES 6) report in a webinar yesterday (14 June).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Also under discussion in the webinar – ‘EMMES 6: Can Europe meet 2030 REPowerEU targets without a storage strategy?’ – was the EU’s recent energy policy strategy, which primarily aims to wean Europe off Russian oil and gas but fell short on energy storage as Energy-Storage.news reported.

Alongside missing its broader renewable energy targets, failing to deploy enough energy storage could leave Europe completely reliant on fossil fuel energy resources for grid balancing, according to Susan Taylor, energy storage analyst at EASE.

The challenge for energy storage in Europe

Taylor kicked things off by saying that Europe (including UK) will need 200GW of energy storage by 2030 to accommodate the high shares of renewable energy the continent is aiming for. By the end of this year, it should have a little over 10GW of cumulative battery energy storage capacity, of which slightly over one-third will be in Great Britain (UK excluding Northern Ireland).

That means ramping up from the roughly 1GW of annual deployments seen in 2019/20 to 14GW until the end of the decade.

“There’s clearly a significant mismatch between historic deployment rates and the actual energy system needs and it really highlights the urgent need to boost deployment today, especially as wind and solar installations continue to grow,” she said.

“In a case where we do not have enough energy storage in the system, we will not only fail to meet the RePowerEU targets but we’ll also be locked into fossil fuel flexibility, which will of course further jeopardise the EU security of supply.”

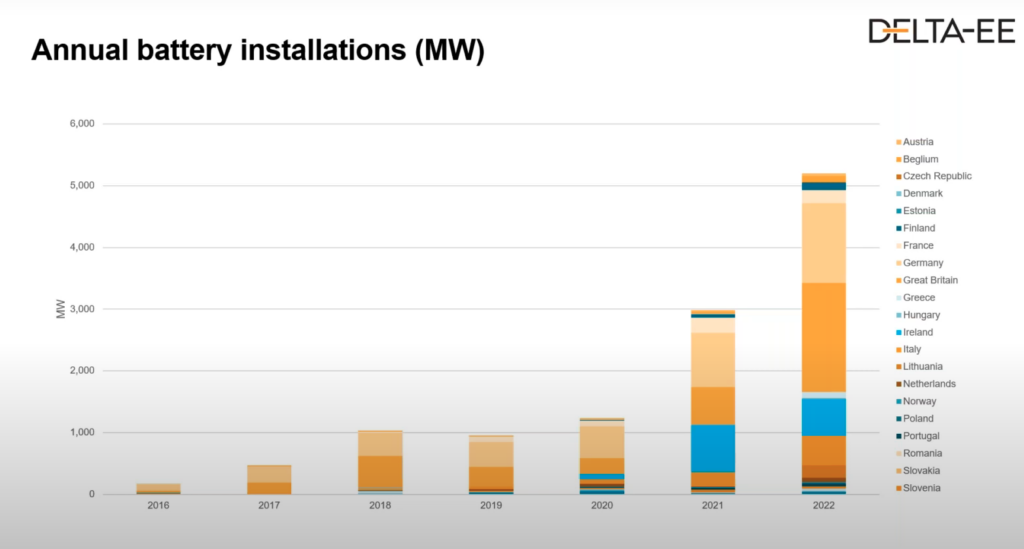

The direction of travel based on this year and last year is somewhat positive though still well off the 14GW figure. John Ferris, head of flexibility and storage, Delta-EE, said that there were 3GW of installations in Europe last year of which 1GW was residential.

In 2022, the company is forecasting over 5GW of battery energy storage installations meaning over 10GW of cumulative capacity. Battery projects are also getting bigger, with the number of 50MW-plus projects being delivered doubling from 16 last year to 33 this year.

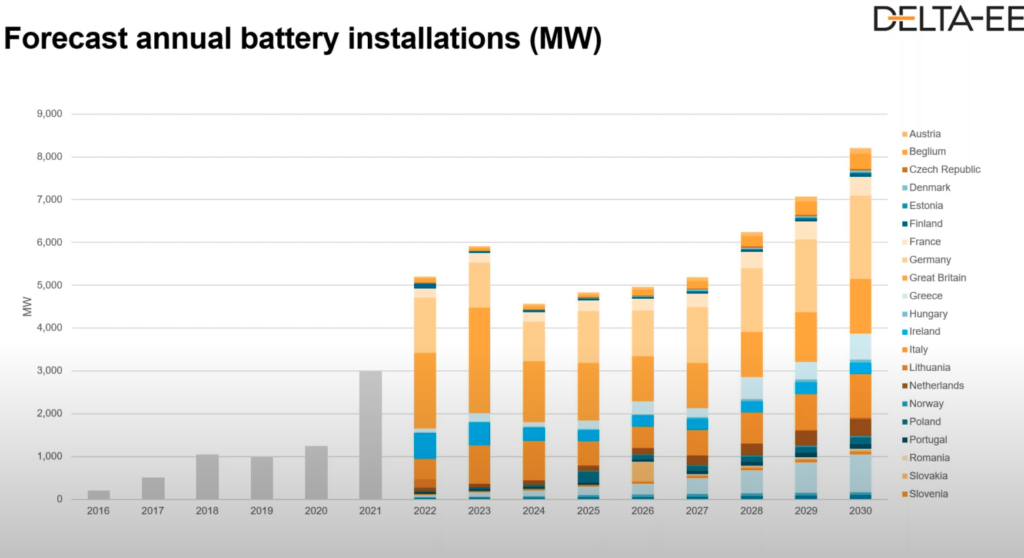

Its data implies that Europe is on course to hit around 60GW of battery storage by 2030, well below the 200GW target. Although its market forecast data does not cover technologies outside of electrochemical batteries, Ferris said Delta-EE expected new pumped hydro additions to total more than 50GW by that date, which again would still leave the continent well short of the EASE-suggested target.

Delta-EE’s European energy storage market forecasts

A few select national markets are driving the battery energy storage deployments for 2021 and 2022, namely Great Britain, Germany, Ireland and Italy, according to EMMES 6’s data. They will account for over three quarters of the 5GW-plus battery energy storage deployments this year, as shown in the graph below.

But, the mix is far more diversified for 2021/22 than previous years when Germany and Great Britain alone accounted for the bulk of deployments in the continent. And other countries will also start to account for larger and larger portions going forward, although those four will still account for more than half by 2030.

Going forward, Delta-EE expects deployments to increase again in 2023 to just under 6GW before plateauing for the next few years as shown in the picture below.

Ferris explained why: “We do see some headwinds at very least in the short term, particularly the lithium deficit, which is largely a reflection of the expected growth of EVs and that stationary storage is a small proportion of the total battery production capacity.”

He continued: “We do see significant volumes of projects already announced between 2023 and 2026 but not at the level that we want to see for continued growth. Our expectation is that there’s a likely plateau in battery installations over the next three to four years before growth returns towards the end of the decade.”

“This is reflecting either the new supplies of lithium being brought online to to address the deficit, or new (battery) chemistries achieving commercial viability and addressing the challenges in the batteries in storage market, whether competing with lithium-ion in short term or addressing the challenges for long duration storage.”

Energy storage deployment forecasts: country drill-down

As mentioned earlier, Great Britain is set to reach 3.6GW of installed battery capacity by the end of 2022, and 14.4GW by 2030 according to Delta-EE. It expects installations to jump to 1.7/1.8GW in 2022 and 2.45GW in 2023 before plateauing around 1-1.5GW for the following seven years.

New suites of ancillary services and wholesale trading have made it an attractive market but the projected slowdown may point to a saturation of the market, the company added.

Germany is expected to be slightly ahead of Great Britain on installations by the end of this year with 3.9GW installed, and 14.5GW by 2030. This has been and will continue to be driven by the residential market, although less so in future.

Pairing storage with home solar PV systems remains the main driver of the residential market while Energy-Storage.news will be publishing a special report on what is driving growth in the utility-scale segment in the next edition of PV Tech Power, Solar Media’s quarterly technical journal for the downstream solar industry.

The utility scale segment is expected to reach around 35% of annual storage deployments in Germany, from about 20% of this year’s 1.3GW.

The webinar also shone a light on the Italian market which will reach 900MW of battery capacity by the end of 2022, the vast majority residential, driven by the ‘superbonus’ payment by the government to those installing home systems.

However, the situation will totally reverse from 2023 onwards where front-of-meter utility-scale will be 80%-plus of installations. The country is set to reach 5,200MW of cumulative battery capacity by 2030.

France is a relatively small market but with the increasing unreliability of the nuclear fleet Delta-EE’s forecasts may be exceeded, Ferris said. It is expected to reach 3.2GW of installed battery capacity by 2030 from 670MW by the end of 2022.

“The interconnections that France has means that the flexibility needs from the TSO in particular, may be met through those market coupling mechanisms, reducing the domestic need for flexibility if it can be procured from outside the country,” Ferris said.

As shown in the graph above, Ireland is a significant contributor to the 2021 and 2022 deployment figures for Europe. But plans to interconnect with the French market mean Delta-EE is expecting a sharp decrease in annual deployments over 2022-24 to 300MW from a record 760MW installed in 2021, with 3.8GW installed by 2030.

Greece, which recently announced a 3GW 2030 storage target, could launch a storage auction in Q3 this year for 700MW. It has 16GW of approved projects in the pipeline and, while these are not all likely to be built, Delta-EE does expect it to exceed its 2030 target by 650MW.

REPowerEU

Jacopo Tosoni, policy officer, EASE, highlighted that although REPowerEU did not set a target for storage deployments, it will have ‘huge’ indirect positive impacts on storage. He cited increasing the headline 2030 target for renewables from 40% to 45%, increasing the binding energy efficiency target from 9% to 13%, doubling solar PV capacity by 2025 and improving permitting processes for renewables.

“At the same time, when we look precisely at the energy storage initiatives, there’s something missing. The market designs probably need to be changed as soon as possible to reward the services that energy storage provides which isn’t something at the moment that is really discussed. And also we don’t really have clear investment signals for investors,” he added.

“We see industrial members from the industry who maybe received mixed signals from time to time from the EU.”