Energy storage investment tax credits (ITC) were priced more highly than any other clean energy type in transferability transactions in the US last year, according to a report from tax credit ecosystem Crux, which its CEO discussed with Energy-Storage.news.

The ability for clean energy project developers to sell tax credits to another company for monetisation was brought in as part of the Inflation Reduction Act (IRA), a measure aimed at increasing the amount of capital available for the sector by broadening the pool of investors able to utilise tax credits.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Crux CEO Alfred Johnson: “The Internal Revenue Service (IRS) saw that additional supply of capital would be needed for the clean energy sector and this was aimed at doing that.”

Although transferability became effective on 1 January, 2023, it was only after the IRS clarified how to use it in June 2023 that deals could happen, and the market took off between August and the end of the year, Johnson said.

The company estimates that there were between US$7-9 billion in tax credit transactions using transferability done by the end of the year across clean energy in the US, already one-third or even half of the size of the traditional tax equity market of US$20 billion.

Crux’ estimate covers investment tax credits (ITC) and production tax credits (PTC), the latter of which includes both the production of electricity from a renewable energy plant like solar or wind, and the output of a clean energy manufacturing plant like a lithium-ion gigafactory or PV module factory.

As we reported in an article earlier this week, Johnson said that the transferability market has taken off far quicker than anyone expected and had certainly broadened the pool of investors. The majority of deals were also under US$50 million, typically not a deal size that would have access to traditional tax equity investment.

Solar PV took the largest share of the deal pie followed by the 45x PTC for advanced manufacturing, a big chunk of which was a US$700 million deal struck by PV module manufacturer First Solar with finance tech firm Fiserv.

“That indicates that there is a broader market for more types of technologies at better prices than what was previously anticipated in the market,” Johnson said.

Energy storage priced the highest of all tax credit deals through transferability

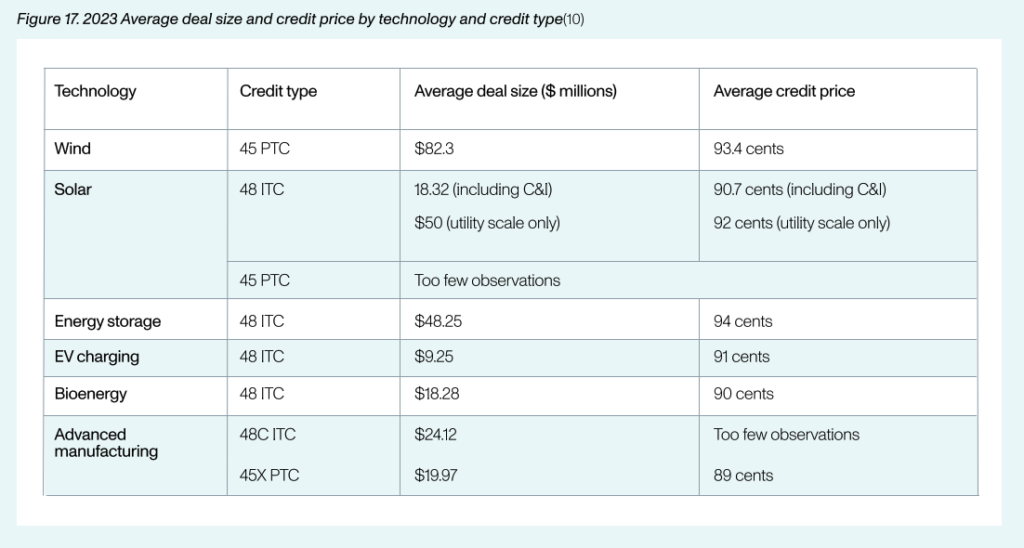

Through the firm’s marketplace, which provides deal intermediaries with information on transferability deals, Crux has been able to break down the transferability market to-date down to granular detail. This includes the differing prices tax credit buyers are paying for ITCs or PTCs depending on the technology type, shown in the table below.

The ITC for standalone energy storage was the highest priced of all types, at US$0.94 on the dollar versus US$0.89-93.4 for other types. That means buyers of standalone energy storage ITC paid more than any other type of ITC or PTC.

Johnson said this was primarily due to a larger average deal size for standalone energy storage projects at US$48.25 million than most technologies and the higher price that buyers would subsequently need to pay sellers.

However, utility-scale solar ITCs were priced at US$0.92 and wind PTCs were priced at US$0.934 despite both seeing larger average deal sizes (US$50 million and US$82.3 million respectively).

So storage could still be seen to have outperformed despite some industry sources saying last year that it might take some time for the tax equity community to get comfortable with standalone energy storage. One delegate at the Energy Storage Summit USA last year said they agreed to sell their project’s standalone ITC for just US$0.85. Note that this was prior to the IRS’ guidance on transferability.

“The storage projects where ITCs were transferred were larger projects being built by more established players. Storage was also often bundled with wind and solar in tax equity deals prior to transferability so it is not an asset that the market is unfamiliar with,” Johnson said.

A lack of wind ITC deals was primarily because most projects in the pipeline have already had their financing secured prior to transferability, meaning no need for additional deals needed to get them built.

See the Crux’s full report here.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.